-

Posts

2251 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by Steve2UK

-

This pretty much matches my experience/practice for many years from 2006. For most of those years, I was a] receiving rental income from a property in the UK and b] annually supplying the property agent's rental statements to the (up-country) British Consulate - who duly (for a fat fee) gave me a consul-stamped affidavit showing 65K+ baht income for presentation to Immigration to facilitate retirement visa extensions (in person, natch). In all those years I never exited Thailand. No mention from anyone of tax return filing obligations. Eventually, the British Consulate ditched this 'service' and announced that all future such affidavits could only be issued from the Bangkok embassy - applied for by/supplied to me in person. As we Brits say "F**k that for a game of soldiers" - and I switched to the 800k baht on deposit route....and still no mention of tax returns from anyone. The years passed and I eventually sold the UK property - wiring the x baht millions of much of the sale proceeds to my Thai bank account and used some to buy a Thai property. Still no mention of filing a Thai tax return........from anyone. I doubt that my retirement experience is particularly exceptional. Granted - those from other countries (and likely still 'trading' stocks etc) may have different mileage.

-

For a couple of years a while back, my local Imm office was in the habit of using half A4 'backsides' of other people's photocopies on which to print my 90-day address report certification. Several times, the other side showed someone else's passport picture page. Fortunately, that practice eventually stopped - but it should never have started.

-

Mike, not wanting to argue, but it does read (as implied in the intro) like it's standard Central Bank monitoring of total flows by period and method & operator - with no identifying of individuals/amounts within those totals? - i.e. part of monitoring the overall flow/shape of the formal national economy?

-

Nope - if it came to the point, laws etc would be passed. OTOH Immigration are a division of RTP who are a potent force with a variety of levers to pull and pressure points to apply - not all of them in the open..... Given the notorious widespread Thai inter-departmental rivalries/turf wars - maybe not so hard to foresee ('your issue, not ours') resistance..... at least until they 'got something out of it'.

-

I've been here (retirement visa) since 2006, consider myself fairly well-informed (since before arriving) on Thai bureaucracy and the first I knew anything of farang being (much) the same as Thai citizens taxwise was when this latest Paw161/Paw162 hoo-ha started...... At very least RD could have provided immigration offices with leaflets stating that retiree farang 'tax residents' are obliged to file a tax return (including a link to RD's website?) - ready for the officer (or even just an intern?) dealing with the annual visa extension to slip into the returned passport (it's not like immigration are paper-averse ). Too logical/joined-up? Does make one wonder how readily immigration would cooperate with a new "No tax return = no visa extension" policy.......

-

Hard to argue with what you've said. That said, I remain persuaded that the Thai RD is really after the multi-millionaire/billionaire class of Thai citizens who have long played the 'high-roller' overseas game with stock-market/investment dealings and have repatriated their overseas profits (rather than mere salary) all according to volatile exchange rates generally and - more particularly - the hitherto very 'useful' (aka lucrative) 'previous year' tax loophole. On past form, I'm less persuaded that that class won't find/create ways to stay way ahead of any loophole-closing measures that Thai RD can come up with - and enforce.

-

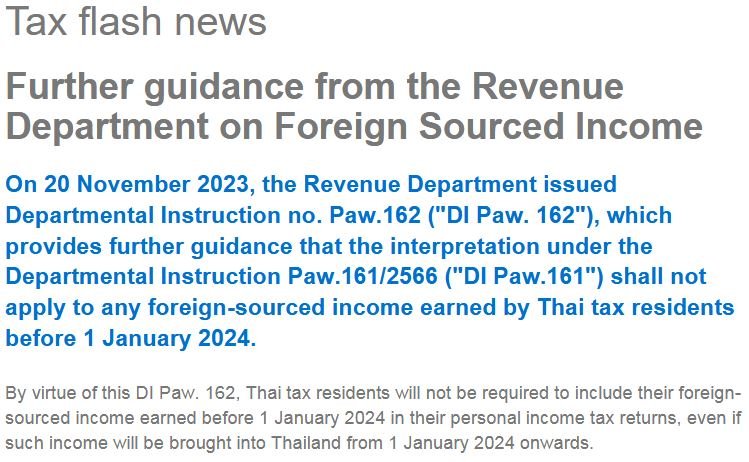

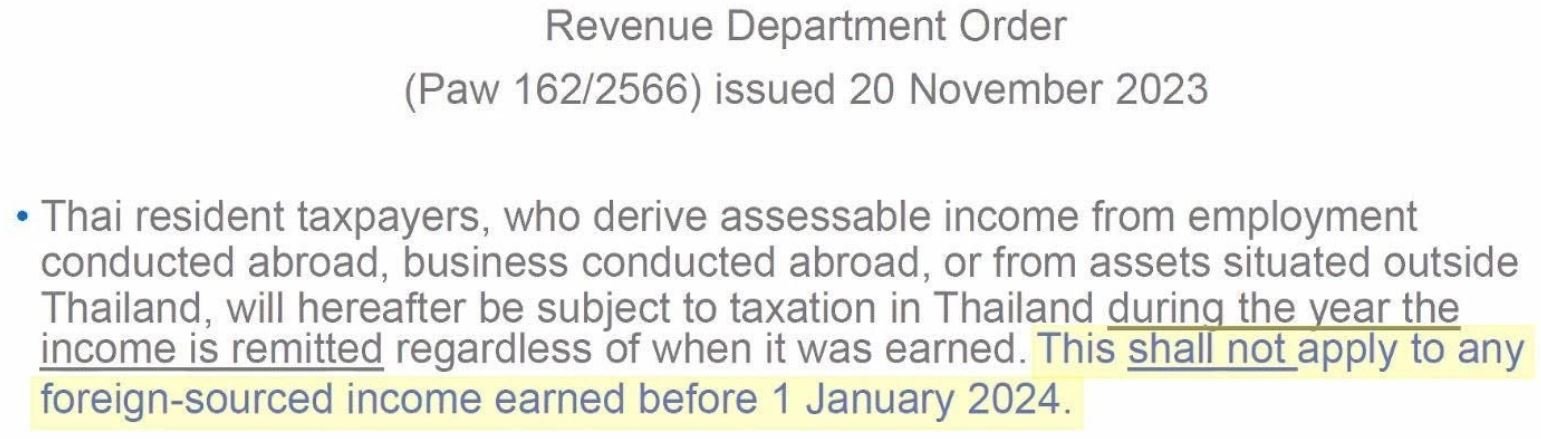

With the (beneficial for many) caveat/concession that RD's "Paw162" order (updating/clarifying "Paw161") treats separately funds demonstrably acquired outside Thailand before 1 January 2024 as not assessable for (Thai) tax when remitted to Thailand after 1 January 2024. See extract from Mazars' advisory below. BTW I've used the term "funds acquired" because I suspect that words like "earned" and "income" are potentially too tight/misleading for some cases - e.g. that inheritance from Aunt Mary's will and accumulated savings etc. Maybe "assets" is a safe(r) catch-all term? Maybe over-cautious on my part but..... better safe than sorry? It perhaps goes without saying that some credible form of evidence might be required to show that the remitted-to-Thailand funds were acquired pre-1 January 2024 - even if it's just a personal bank statement showing as much. And, before I get jumped on, I fully accept that some/many have complex/multi-faceted financial dealings that are/will be difficult to compartmentalise. "Funds acquired" after 1 January 2024? Yes - that (for now) remains a tangled potential nightmare.

-

That's near enough my* situation. Given that I received the sale proceeds into my UK bank account way earlier in 2023, I'm currently relying on the Paw 162 'clarification' (Mazar's version attached) that when remitting it to my Thai bank account even after January 1st 2024** it won't be taxable. Pure luck - if I sold in 2024, I'd be . My fingers are crossed that Paw 162 stays in place and gets applied. * Retired and Thailand tax resident year after year. ** Which I see as basically an RD amnesty 'concession'...... and very necessary for many.

-

Many thanks for the prompt response. Can't help but 100% agree with the "....but to require a statement also is so much overkill...." part but I've long since given up even wondering about the "why?" of such things. I just mentally file it under 'TiT' and move on. My MO here is just "Tell me WTF you want/need and I'll comply.....". Incidentally, in a previous year I inadvertently let the bank balance drop about 200 baht below the threshold for all of two days. Courtesy of my well-connected agent, that little episode cost me 15k (cough) 'penalty' to avoid my very longstanding visa being cancelled...... Still and all, I've seen crazier stuff dished out by the UK's tax authority (HMRC).........

-

That was also my experience when I did my retirement visa extension last September - except they (Immigration) wanted a bank statement covering the full year since my previous extension. Like you, I use the balance maintained at (at least) required level for required period route. I've long used an agent for the annual extensions and give them all the stuff they tell me to (same list as yours). IIRC they also made copies of all the pages in the bank book (or maybe just the last yearsworth?) - I certainly remember signing a vast number of them. Unlike you, I also use that one ('saver') Thai account for all my outgoings*. I do recall that the full year bank statements have been required for at least the last few extensions I've done. Incidentally, my bank balance at the time of that last September extension showed a bit over 18 million baht (remains of a personal property sale proceeds wired in from my UK account). Nothing was said about that during my last extension - but I can't help wondering whether I'll be grilled on "Why no TIN?" (been here since 2006 and never been asked/registered for one) come my September 2024 extension........ * I'm thinking about following your example and setting up a separate untouched deposit account for the 800k baht needed to cover that extension requirement. Does your local Imm office ask you for evidence (e.g. another bank account?) of what you're living on if you're not touching the deposit - or do (did?) they regard that as 'not their concern' providing you met their minimum balance/period maintained threshold? Same same next extension for you - or is the only realistic answer to that (for now) "Who TF knows?"....?

-

Your "$64K question" also gets me wondering if the 'new' Thai RD rule/interpretation means that from January 2024 every tax resident foreigner must by default obtain a tax number and submit annual tax returns. I'm a Brit retiree here full-time (i.e. 365 days a year) since 2006. During all those years I've never been asked to register with Thai RD and, of course, never volunteered to do so. In all that time, I've transfered from my UK bank to a Thai bank numerous sums to pay rent etc (certainly totaling well over 150,000 baht a year) and 3 years ago about 10 million baht to fund a house purchase. My last retirement visa extension was with over 10 million baht showing in my Thai bank account. Immigation merely satisfied themselves that I had the minimum balance of 800,000 baht in my account for the relevant period - and duly extended my visa. Should I be expecting them to ask for a tax (paid) certificate or somesuch come my 2024 extension?

-

Many thanks for the reply but........ Many thanks for the helpful reply. There's a potential wrinkle in this. I actually owned 2 flats (in the same converted house) - one in my own name as main residence (and I already transfered sale proceeds from that one to a Thai bank account 2 years ago). The other flat was legally speaking owned by my own one-man-band company (I'm sole director). To keep things clean from an HMRC (UK tax) perspective, those proceeds from that sale went into my company's account. I eventually moved the funds from my company account into my (UK) personal account - in December 2023. If I go for "remitting" them to Thailand at some point in 2024, I assume that just the transfer between the UK bank accounts should be solid enough proof that it's pre-2024 income. Conversely, if "remitting" them to Thailand this month (i.e. pre-1 January 2024) that 'proof' only argues that it's apparently 2023 income. My instinct as per the November PAW 162 Thai RD Mazars translation (attached) is that "remitting" into Thailand after 1 January is the way to go (as you suggest). My worry is that Thai RD might soon pull yet another switcheroo that mucks up my assumptions/actions based on PAW 162 staying in force and being applied as evenly/straightforwardly as the wording strongly implies (TiT etc). Incidentally, I have it in mind to transfer the new funds (about 16 million bahtsworth) into a separate Thai bank account - to keep it out of the one that I regularly use for extending my retirement visa; my last visa extension was September this year and my account details at that time showed a balance of about 18 million baht. No queries were raised by immigration about that - but I find myself wondering if immigration seeing a near doubling of the balance when it comes to next year's extension (and in the wake of the current tax fracas) might be a different matter (as in might they be minded to query it and/or decide to notify Thai RD? Worth saying again. as per my original post, that I am not registered with a Thai tax number and never have been since I first started living in Thailand full-time in 2006. Grateful for any further thoughts.

-

I've been doing my level best to grasp/decide what to do...... To keep this query simple: 1] I'm a longtime Thailand resident - since 2006 2] UK passport holder - retired long since (age 73 & counting) living in Thailand on retirement visa 3] Never involved in/registered for Thai tax 4] Rented out UK property & occasionally transfered proceeds to Thai bank account for living expenses etc 5] Since (2 years ago) sold UK property and now want to send sale proceeds to Thailand bank account for use here Query: Given proposed Thai RD changes, should I move the money into Thai bank account before/by 31 December 2023 - or wait till after 1 January 2024 (i.e. when Thai revenue changes dust may have settled and it's 'reportedly' [currently] pre-threshold income & [if so] thus not Thai-taxable)?