Thailand J

Advanced Member-

Posts

1447 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by Thailand J

-

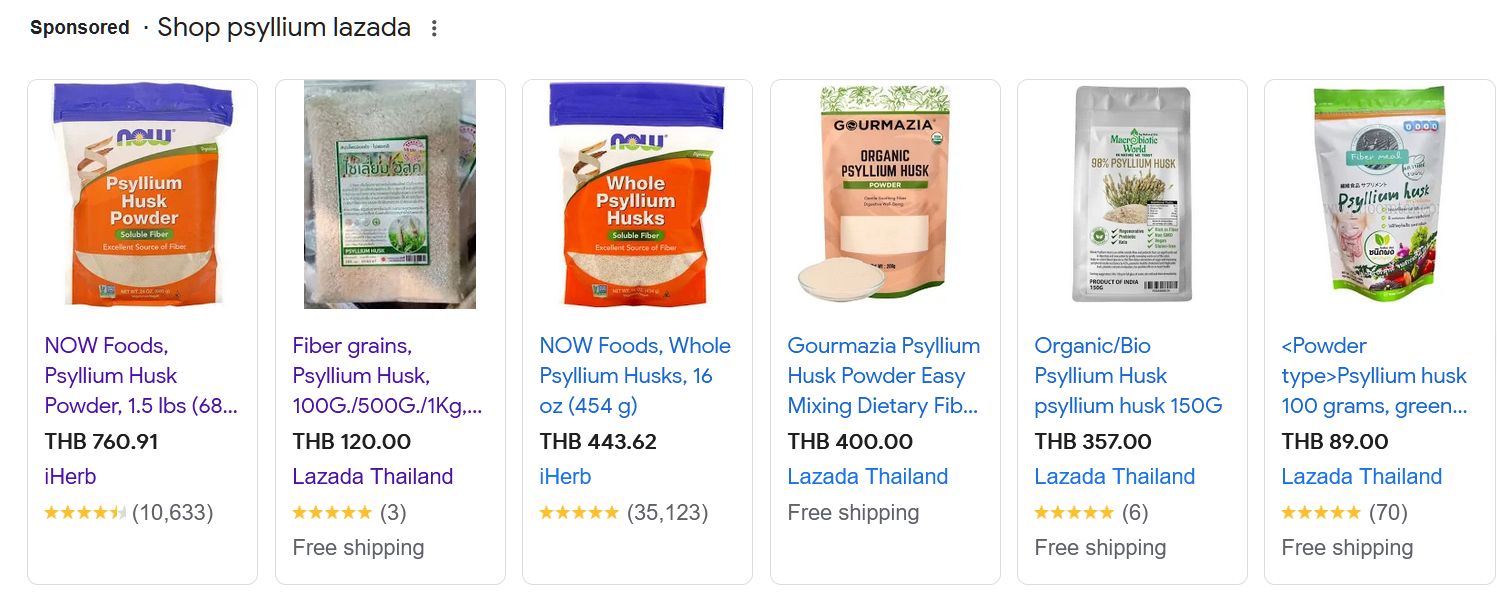

I am happy with the brand. May be they have changed the content? Try another brand. There are many to chose from online, used to be only two or three sellers.

-

From my experience in Nov 2023, it took 6 days from Step 4 to Step 8. The day after the status changed to " Consideration by Gov Agencies" (step 4) I was requested to submit insurance certification. Almost immediately after I had submitted that, I receive a request to submit insurance policy. 4 days after that I was able to make an appointment online to get the visa.

-

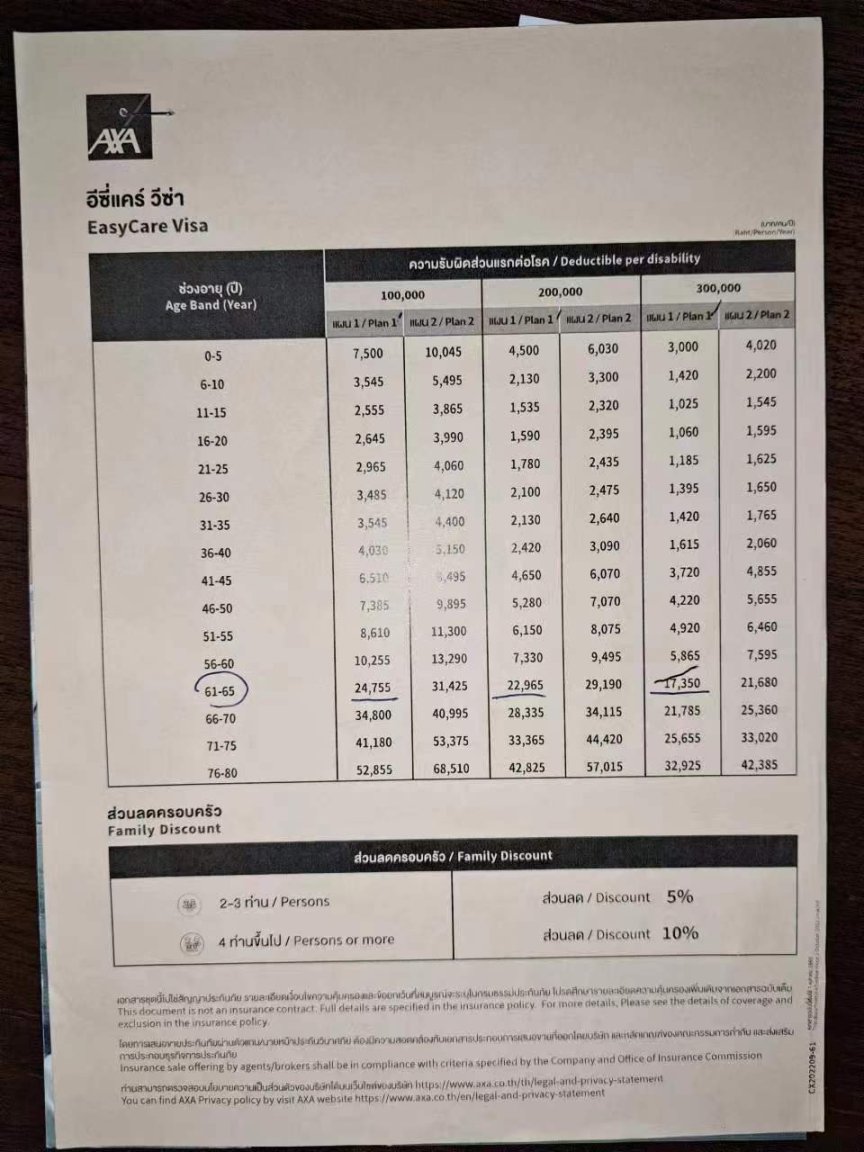

I didn't shop around. I bought health insurance for LTR visa from AXA, the only company I called. The premium depends on the insurer's age and the deductible. In the picture below , Plan 1 with 2M maximum benefit is good enough for LTR visas. I needed at least 10 months left on the policy at the time of visa approval, so I started the application without health insurance, and bought the policy when BOI asked for it.

-

Pattaya’s Newest Beachfront Market Prepares for Splashy Debut

Thailand J replied to webfact's topic in Pattaya News

Near Twin Palm Resort here: https://maps.app.goo.gl/SaMcRNNcVSrAGwLd6 -

Hong Hong Dog Cafe is on Pattaya Nua. https://maps.app.goo.gl/CGHrSScEq6UcAdyX7

-

You need to deal directly with NT, make and appointment to install fiber optic cable and the condo front desk will charge you 2500B for hooking up to their meter room cable. Go to their office across the street if you have problem with the front desk new staff.

-

There is a utility room or meter room on every floor next to the elevators. TOT tech ran fiber optic cable above the ceiling along the hallway from that room to my condo. 2500B was paid to the front desk, receipt issued by VT. The fee is the same no matter which floor you are on. I've just checked my record , it was in August 2020 when I was remodeling my condo. My crew worked with TOT tech to have the fiber optic cable run into my unit , and have the cable in the wall (not on the wall) of my living room. I have double units at the corner.

-

Don't know about VT2A, my condo is in VT5D. I paid 2500B to run fiber optic cable from the utility room to my unit in 2021. TOT, which is now NT is the only choice. Once you have fiber optic cable connected to your unit, you can pay yearly for the service.

-

Costco's new idea; Investing in Gold and Silver?

Thailand J replied to GypsyT's topic in US & Canada Topics and Events

This is interesting. https://www.livemint.com/money/personal-finance/if-you-buy-gold-etfs-you-can-get-physical-delivery-of-gold-11587013567895.html -

Costco's new idea; Investing in Gold and Silver?

Thailand J replied to GypsyT's topic in US & Canada Topics and Events

right. Instead of gold EFT, you should buy solid gold, have your elephant haul it back to your cave. -

Costco's new idea; Investing in Gold and Silver?

Thailand J replied to GypsyT's topic in US & Canada Topics and Events

You don't have to buy barrels of oil to invest in oil. You don't have to hide gold bars to invest in gold. https://etfdb.com/etfs/commodity/gold/ -

Your SS benefits will continue after you've renounced US citizenship. You don't have to sell US stocks, properties or any US investments. You may have to pay tax on a " pretend sales" of your US properties. See IRS form 8854. You can only renounce US citizenship outside of US by showing a valid passport or citizenship of another country.

-

I filed last month still waiting for the refund. Yesterday went to Jomtein Revenue Office 4th floor confirmed I can no longer use e-money card to receive refunds. I was claiming tax withheld at Bangkok Bank, I asked if I can get refund deposited in Bangkok Bank the answer was yes. I'll take the refund check to Bangkok Bank to try my luck once I got it in the mail.

-

Colonoscopy Tests Costs In Thailand

Thailand J replied to Mitkof Island's topic in Health and Medicine

The Red Cross Queen Vadhana Memorial hospital in Sriracha has to be the most beautiful hospital in Thailand. https://maps.app.goo.gl/a39SWip4wvgNKTYc9 They offer selected services in the evenings at higher fees. I was there on Feb 9. Registration was 50B, 4pm doctor consultation plus NIFLEC 1350B. EGD ( EsophagoGastroDuodenoscopy) plus colonoscopy on Feb 14 was 20392B, of which 350B was for removing one benign polyp. -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

You are right, it can be nerve wrecking when the market is down. The biggest danger is panic selling , which has not happened to me yet 55. -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments

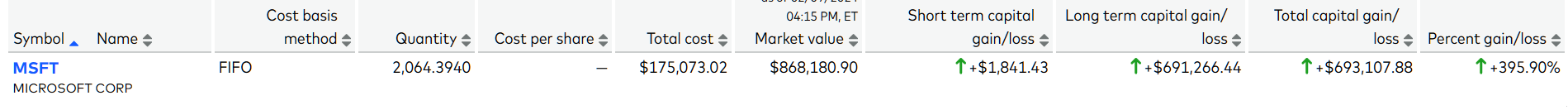

Learn to invest with the patience of a tiger. identify the mother lode, buy a few index funds, hold for years. NOt like a curious cat, distracted by anything shinny all over the world. That's was how I manage accounts but NVIDIA is too "shinny". -

The Investing Year Ahead

Thailand J replied to Mike Lister's topic in Jobs, Economy, Banking, Business, Investments