-

Posts

2,563 -

Joined

-

Last visited

Recent Profile Visitors

13,449 profile views

SooKee's Achievements

-

It seems that even what customers see on their portals is different! "Guide to your insurance cover" downloads a completely different document to General Conditions a document that, for some customers, is very elusive!!

-

By way of a final update, and given the time constraints, I plan to renew my April policy for 2024/25 as a stop-gap with an increased deductible then take a more leisurely approach to finding a new provider with my new broker, AOC. At the moment New Health International are looking favourite but AOC will also start handling policies from AXA later in the year, that's another option too, there may be others. Having asked AA World to get a specific answer from April about the reason for my premium increase if, as they said, that the zone change is NOT affecting renewals (the exact opposite of AOC), they eventually sent me an April one page flyer (a typical insurance company blah blah blah document) about all the things that MIGHT influence premium increases. Nobody seems able (more likely willing) to provide a specific answer to a very specific question. For the industry standard 10% or so increase the pamphlet would probably cut it but for a 30% hike I'd expect a better and more detailed explanation. The region change is not mentioned anywhere at all! It does seem that region change is a topic that April seem keen to avoid, at least insofar providing customers with any information about it. Thailand is however listed as being in region 2 in the 2024 General conditions and there's a specific example given in another document, a help sheet for choosing zones of cover, both of which were supplied by a broker that I wasn't even with at the time. Neither of these documents had been supplied to me by April or anyone else and were part of a bundle of 4 documents that AOC advised me should be supplied by a broker along with the renewal notice under the European Distribution Directive. Doing the bare minimum seems to be the order of the day in some cases and even April didn't send me the documents when they emailed my renewal notice directly, nor did they make any reference to their existence! IMO it's definitely worth discussing with a reputable broker, one able and willing to provide more than superficial replies, in order to get the full low down on the current situation with April and, for instance, exactly how the costs of the region change (in total about 40% I'm told) for Thailand will be recouped.

-

I just sent you a DM.

-

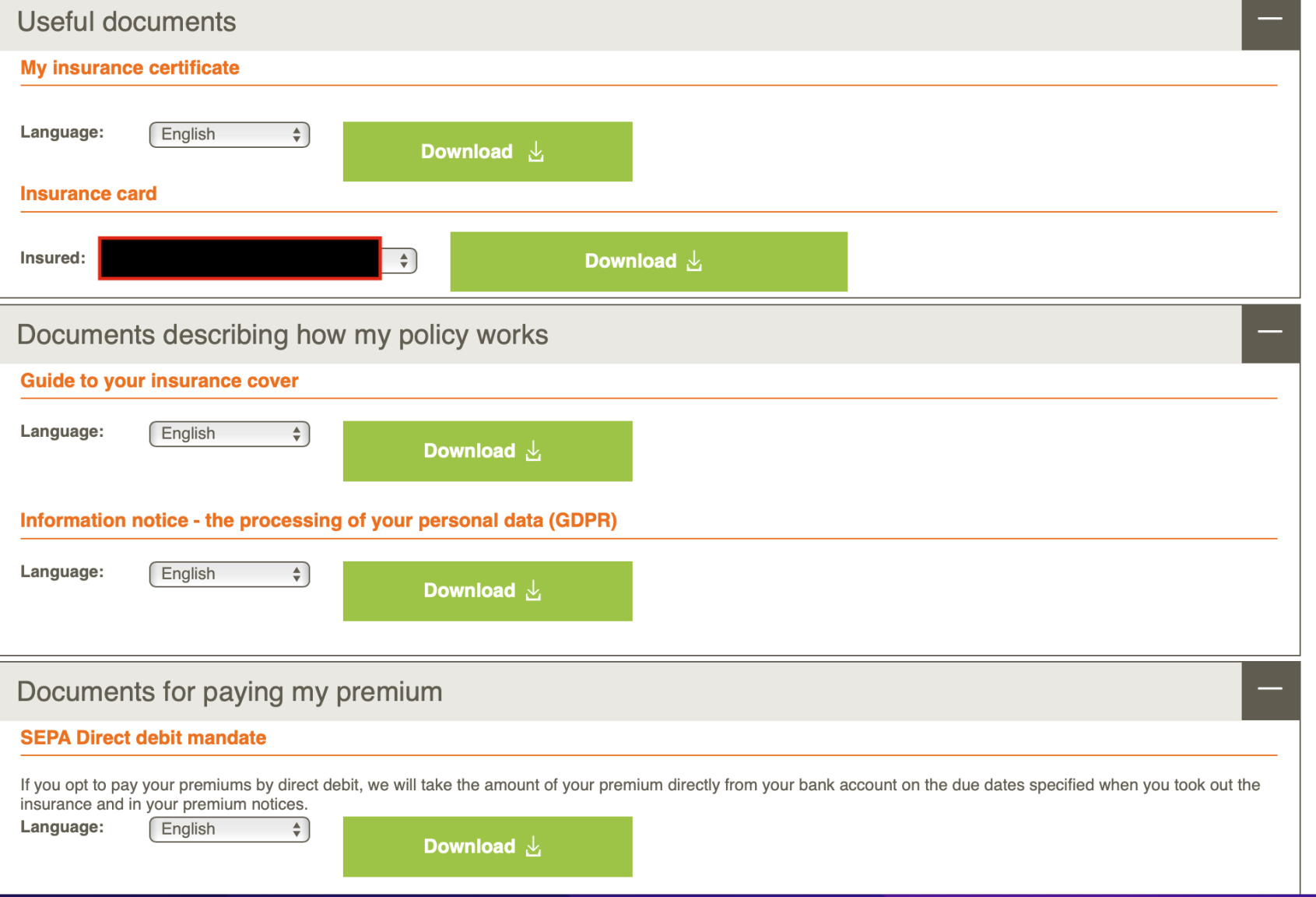

As I said, for me it's not (probably why I posted that it wasn't in the first place), I say again the ONLY documents showing for me under My Documents are: My Insurance Certificate Insurance Card Guide to your insurance cover (this is not general conditions) Information notice - the processing of your personal data (GDPR) SEPA Direct Debit Mandate It may be that what you see under My Documents is not the same, it wouldn't surprise me given the shambles that is April administration.

-

I expected it would too, however while you can access some documents from the April customer portal, your certificate and "Guide to your insurance cover" along with a direct debit mandate and some blurb about data protection, the document you actually want, "My Health International - General Conditions 2024", isn't one of them, in fact, I couldn't find it on their site at all (that said, I didn't spend much time trying to find it, better things to do). Your broker SHOULD provide this document along with some others, with your renewal notice, needless to say, my current broker (now ex-broker) didn't! They provided JUST the renewal notice and vert little else after. Bare minimum is probably being generous!

-

It's a big document so probably not. There is an awful lot of information in addition to just that too, way too much to post. I would suggest the best thing is to contact a broker yourself who can provide you with all the information one might wish to consider I can give you the email address of the broker I am discussing with at AOC if you wish (contact me by direct message if you need it). As I say there is a lot of information, much of it not good. As an aside, changing broker is easy, signature on form, copy of a utility bill and copy of passport. I have found AOC very helpful and very thorough in terms of the information they provide, reasons for premium adjustments (both now and in the future!) and their overall helpfulness.

-

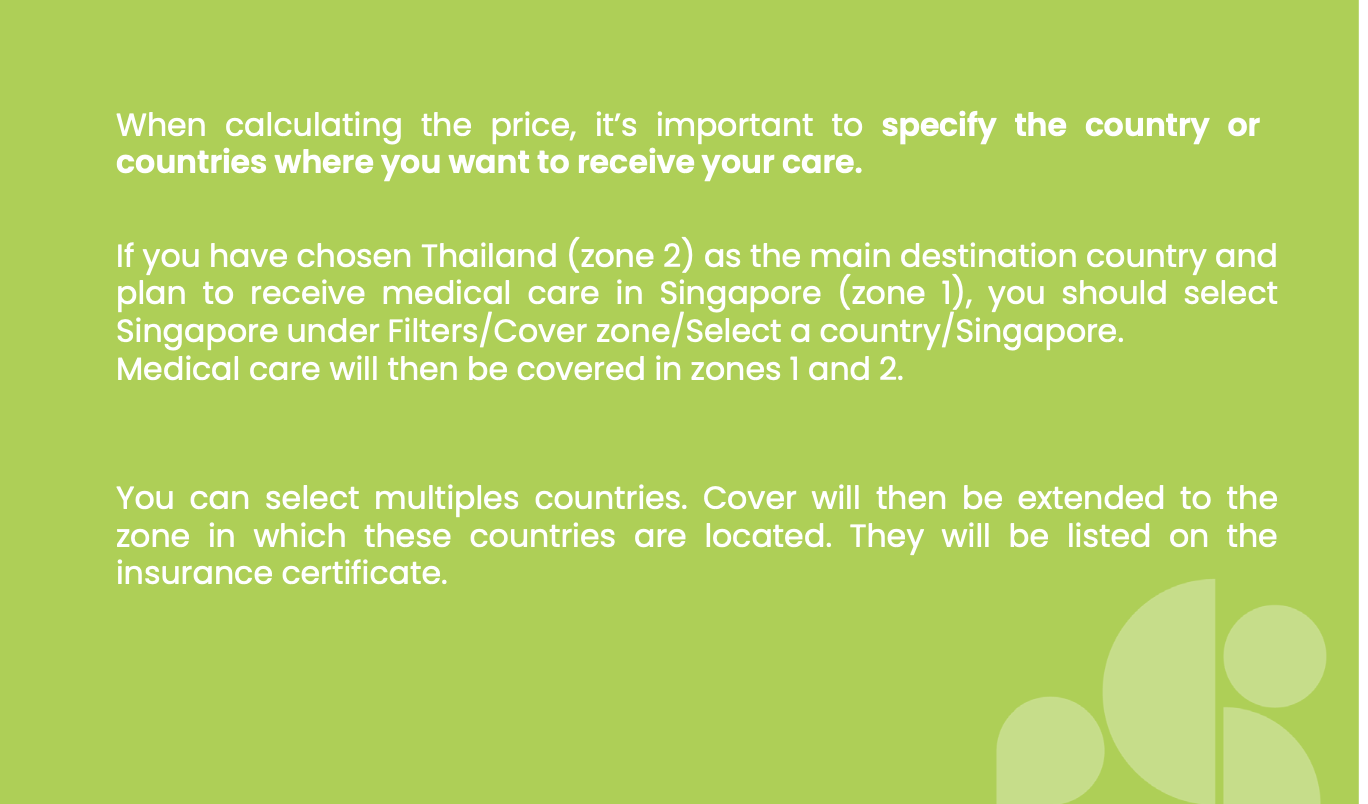

This will likely be the last post before I come up with some kind of plan as this is becoming really exhausting but I post it for for others who may encounter similar issues with April this year. Essentially two completely different stories from two different brokers and one of them not providing complete answers to both questions that I explicitly asked (e.g. a) is the region 2 change only for new business and, if so, b) what is the precise reason FROM APRIL (not broker hypothecation) for the 30% hike in premium this year). Question b) seems to be the one that one broker is avoiding answering at all costs, I have a sneaking suspicion as to why. AOC have said that the region 2 change most definitely applies to ALL policies from 1 April, not just renewals. He said that April made this clear to ALL brokers, providing them with the 2024 policy terms and conditions (the document along with the policy that they will refer to if making a claim). To quote the email: "The general terms and conditions of 2024 (Attached again page 6), which is an annual update of the My Health International policies, is very clear and doesn't allow any doubt. Furthermore, all the brokers received this information in an email from April International about the change of zone for Thailand and other countries." That document clearly states: "For medical expenses and basic repatriation assistance: Cover is provided on a year-round basis in the Country of destination/expatriation listed on your Membership certificate. Cover also applies in the Cover zone listed on your Membership certificate and in the lower zones. 6 zones of cover are available: Zone 0: Bahamas (Islands), Puerto Rico, the United States and countries in zones 1, 2, 3, 4 and 5 Zone 1: China, Hong Kong, Japan, Singapore and countries in zones 2, 3, 4 and 5 Zone 2: Brazil, Chile, Costa Rica, Mexico, Saint Barthélémy, Saint Martin, Switzerland, the United Kingdom, Taiwan, Thailand, the United Arab Emirates and countries in zones 3, 4 and 5 etc etc etc" Thus, the zone is determined solely by "the Country of destination/expatriation listed on your Membership certificate" NOT by whatever region is indicated on the renewal notice! When I asked exactly what the reason was for the discrepancy he said "commercial reasons". Basically it was clear the change was not going to go down well and could lead to a loss of custom. His explanation was much longer, but that is the gist. AA World however said the exact opposite: "We have checked this with April International and I can confirm again in writing that Thailand switched to zone 2 in 2024 but it is only applied for new Business." The second part of the email they have not so far answered, despite repeated attempts to get an answer. It makes me wonder what question they asked April and how. Maybe April is extending the muddying of the waters around this issue for customers by splitting hairs over wording. Whatever they say though does not change the general terms and conditions in that "Cover is provided on a year-round basis in the Country of destination/expatriation listed on your Membership certificate." From what I can see, as far as April are concerned your cover will depend on the country listed on you certificate and that is Thailand, thus region 2, regardless of what play on words anyone is giving with regard to the region change. That I suspect is the reason for the 30% price hike this year and the renewal notice "admin error" merely makes the change less obvious, "It's been a bad year for medical costs" isn't going to cut it.

-

1) Other provider: New Health International 2) A possibility for sure. I don't particularly trust brokers if I'm honest. The company they suggest switching too is actually MORE expensive than April but, they feel, will be more stable and less costly in the years to come. Funny, contact them to query switching brokers and beyond industry norm price rises and bingo. Here's an even more expensive policy that we think will be better for you. They did ask me what my current renewal premium was. I always get suspicious when that happens, fishing for what level they can pitch alternatives at, just give me some quotes, why do you need to know what I'm paying now? 3) I have not switched yet. I will decide once I can fathom which one is able to provide me with the more accurate information. So far, they are both telling me exact opposite stories. If your renewal is due imminently, has your premium increased significantly or is it still within the 6-10% band?

-

So, to add to the confusion, AOC Brokers have said that the change of Thailand to region 2 will affect all policies, not just renewals, and that, along with inflation, is the reason for my increase, increases that they say will gradually level out to 40% across the board over the next 2 years as other policies are renewed / issued. If that is the case I suggested that they contact April so that they can issue me with a new premium notice (and subsequent policy documentation) that is 100% accurate BEFORE I renew! I stressed that I certainly do not intend to pay for region 2 pricing, while my documentation from April (the first place they will look in the event of a claim) reflects region 3, just because some admin muppet forgot to update the documents, or because they are just plain incompetent. There is no way I would want to be arguing following a claim say, while in the UK, that it's region 2 and should be covered while April tell me the only documents I have from them still say my coverage is for region 3! Having asked AA World if they have any update they have indicated they are still waiting for a response from April. It'll be interesting to see what transpires there. What a complete and utter shambles. April don't seem to have enough skills to run an ice cream cart at the moment let alone a multi-national health insurance company.

-

I was out of time to edit the above post but, FWIW, what I am intent on doing is establishing the EXACT reason for the significant jump of 30% / $800 in premium costs this year from April, not broker based guesses and assumptions (probably this, could be that too, maybe this blah blah blah). It is proving to be way harder than it should be to get a proper and precise answer from either April or the broker about this. At the very least I will definitely change broker this year and I have asked the (most likely) new one to try and get an explanation from April. Getting an answer to anything from April I find is extremely difficult, their communication is crap!

-

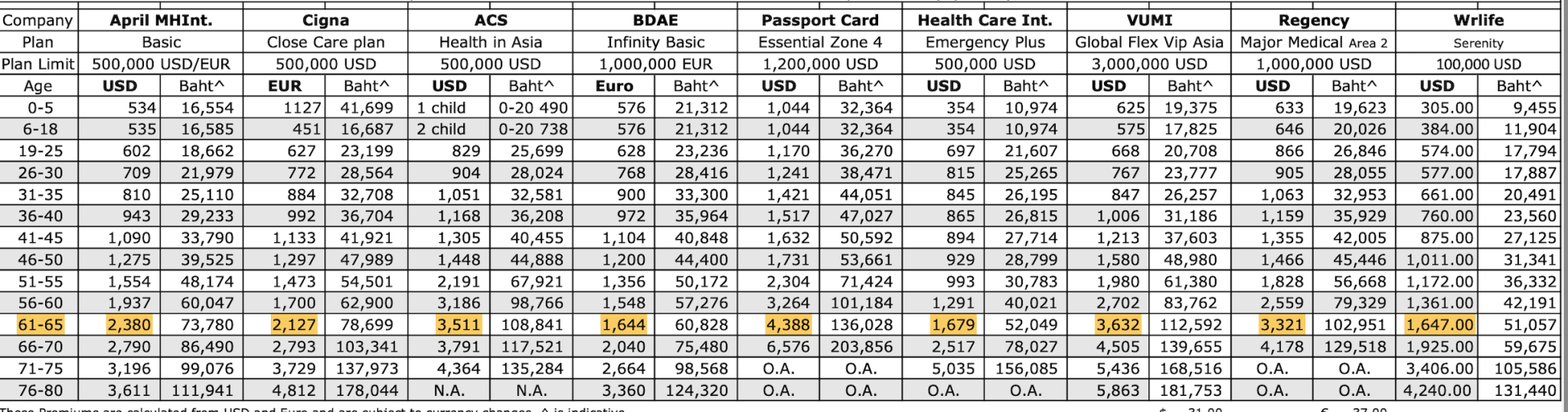

This was from the broker and for the basic $500 plan as they call it. I have only ever got forecasts from brokers, with the insurance companies I have experience of, they have never provided such estimates. The broker that I am thinking of switching to provided me with a lot of very worrying information about April which I intend to study in depth over the weekend. Also, apparently they no longer accept new business for applicants over 60 and, over the years, they have moved Thailand from Zone 4, to 3 to 2 with all the costs that go with it. The broker is of the view that April premiums could well increase by 37-40% over the next two years plus medical inflation. It's got to the point with April that for me, I think it's time to cut and run to another provider. Things change over time of course but I'm now being advised to move my business to the next 'all music, singing and dancing' company, of course April was supposedly that company 4 years ago! Circumstances will be different for everyone though and folks should definitely make their own decisions after availing themselves of all the relevant information from a respected broker. Personally, I'm not that sold on the idea that brokers are solely concerned with looking after my interests, never have been really, they make commission from sales, I just think that some are perhaps more strictly regulated than others.

-

That's just an assumption. It depends on where the age brackets come from. Sorry, and I don't wish to sound blunt, but there's no 'usually' about it, what one may have encountered with other providers / brokers historically doesn't equate to 'usually', despite the fact that it may be the case in some instances. As an example, see the below, provided by a well known and previously highly regarded broker in 2022. 61-65, 66-70 etc etc. AOC also provided the following information regarding another provider: + The insurance premium is calculated in 5-year age brackets - age 66/70 and then age 71 to 75 + There is a wide choice of annual deductibles, including $1 000, $2 500, $5,000, $10,000 and even $15,000. + The insurer increases these premiums by 5 to 7% a year for our client in South-East Asia + Private room are full refund + Rehabilitation is up to 30 days per medical conditions These premium forecasts though have proved to be not only inaccurate but wildly inaccurate, so much so that they are not worth the virtual paper they are written on IMO. YMMV. It also depends on who exactly is providing the bracket related information, a broker (grouping them approximately for the purposes of providing overview charts) or an insurer that may operate their bracket ranges differently to what we may think or have encountered before. There is also the issue as to whether the provider works on the basis of brackets at all. Twice now I have been told by two different brokers that April does not and that they operate on a year by year basis. Nobody but the insurer can say why my premiums have risen by 30% and to date they haven't replied and neither have the brokers. Very transparent (not!).

-

This is the odd thing, in two ways. Firstly I've not moved to the next age bracket which I always though was 66, my renewal date is 1st April and I do not reach the next age bracket until after that. AA World Insure though (I'm still in contact with them and will be until I change) have said that April do not use age bands? It's all very strange and there definitely seems to be a 'smoke and mirrors' thing going on! AA World have gone quiet since I contacted them asking whether the reason for the increase was the change of region, to which they replied as I said above, apparently not. Given that's not the reason, I asked them to ascertain precisely what the reason is, beyond the normal inflation line that they trot out. Of course I accept inflation will play a part, but 30%? Heard nothing since. Still waiting to hear from AOC. I've mailed April a couple of times to ask too but, of course, I've had no reply from them either. That I don't find at all surprising given I think their communication is garbage, always has been for me.

-

Just by way of an update for those with April France, or thinking of going with them, having asked AA World directly, they tell me that Thailand moving to region 2 from region 3 is only for new business, not renewals. If that's the case, a 30% / $800 premium hike is alarming to say the least! Or maybe April have, on paper, left Thailand in region 3 for renewals but have just hiked the price of the premium anyway. Given that premium increases over the previous 3 years have been 8%, 6% and 10%, the 30% being asked for now will need some explaining. I'll update again if any more meaningful information comes to light about the increase or about alternative providers that I'm looking at. It will be interesting to see if others with policies from April France get such a large premium increase if renewing this year, assuming of course they are members here and post about it.

-

Yes, AOC told me about the change too, as you say, 1 April. My renewal is due 1 April so I suspect (hope) that my notice is based on the new region 2 and that it's just an admin error that it's been left as region 3 at the foot of the document. If that's not the case it may not bode well as that would mean there would need to be another reason for the 30% / $800 price rise in premium plus of course the double-whammy to come for the region change. My guess though is that my renewal, falling as it does on 1 April, has been switched to the new region 2 price structure. I have never claimed and have no existing conditions so a change of insurer may not be too problematic and, in light of what AOC have told me, may actually be a good idea. He made the following points to me about April (France): "Note that April's Basic plan is limited compared to plans in the same category. Few examples: Annual limit $500,000 Semi-private room only and no private room (Important point in Thailand) Rehabilitation up to 20 days compare to the market 30 days per medical conditions" Changing while I still can may seem prudent! Of course, I have yet to establish what's available from other providers and what the premiums will be but April is looking less attractive at the moment.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)