MartinBangkok

-

Posts

321 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by MartinBangkok

-

-

On 4/23/2024 at 12:46 PM, transam said:

The last time I had a hotel holiday in Phuket was in 2009, they charged 250bht for a beer and 350bht for a glass of red wine....

And you're worried about a 300bht levy that lasts the length of a holiday in 2024...😁

Transam, since you are ridiculing this, may I suggest to the TAT that they introduce a special tax for you and your likeminded of 3000 Baht per entry? It's like only 8.5 glasses of red wine. Ridicilous to care about, right?

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

On 4/3/2024 at 6:50 PM, SingAPorn said:At the end of the day nobody seems to have a concise and reliable answer to all the doubts of taxing the retirees in Thailand and their pensions.

Many retirees in Thailand could start selling their property and perhaps are looking to relocate in other countries in the region that are more foreigner and tax friendly.

My personal income qualifies for the LTR visa, but not my employer's, only the parent company of my employer qualifies.

So this means: A select few farangs (westernes) employed directly by very big companies with huge salaries will get to enjoy Thailand without having to pay any tax (congratulations Thailand, awsome tax policy).

For me, earning a mere 3,4 million Baht a year, this is basically Thailand telling me to .... off. Which I will. In fact, on Sunday.

All I can say to the Thailand mafia elite who run things here, keep enjoying your more than 4 million immigrants (slaves) from neighbouring countries, out of which 3,5 million are illegal.

Good luck Thailand (probably not so much for the people of Thailand)

-

2

2

-

1

1

-

2

2

-

3 hours ago, Letseng said:

My husband recently needed a new ATM card. BKK Bank asked for his Thai TIN.

Tell the freaking bank you are looking for a bank, not a tax office, and leave!

-

2 hours ago, jayboy said:

"work permits invariably pay Thai tax anyway"

You are dead wrong here.

-

6 hours ago, Ben Zioner said:

Not. Have you calculated the amount of tax @MartinBangkok would pay to Thailand, for nothing in return? I have calculated what I would have paid over the past year and came up with a figure of 25%. If I didn't have LTR I'd be gone.

For me 27%

-

2

2

-

-

15 minutes ago, Neeranam said:

As I thought, it's not the risk of paying tax that has got your goat.

It was the defining last straw.

-

2

2

-

-

- Popular Post

- Popular Post

40 minutes ago, Neeranam said:Rather over the top. There must be other reasons you are not happy here.

The course I play in Hua Hin only give 100 baht discount to me for being a Thai, hardly going to break the bank,

Btw, I was charged 5,000 baht more than my pal at Royal Melbourne Golf club for being a foreigner.

Does a Farang in Thailand need any more reasons than those I outlined?

I can continue since you are not satisfied:

How about been treated as a criminal, having to report to the police in two different provinces every time you leave your home (habitat province) for more than 24 hours, how about reporting to immigration officers every 90 days (more than a criminal on parole in my country), how about getting charged double, or up to 10 times the amount of a Thai just because you have white skin (Farang), how about local people regularly speaking bad about you behind your back thinking you don't understand Thai, how about having to produce an annual criminal record from your home country (work permit), even if you haven't lived there for 15 years (you've been living in Thailand!), how about having to produce a medical record annually (for work permit) confirming you don't have 7 different sexual diseases (are Thais (and immigration officials) allowed to live in Thailand with any of these diseases)?, how about being appallingly discriminated on the property market?, how about having to pay exorbitant prices for quality goods from Farang-land because Thailand and Thais are unable to produce quality goods?, how about living in a country where local food, environment and air quality is a direct threat to your health due to mismanagement and an insane level of corruption?

Do you want me to continue?

-

1

1

-

1

1

-

3

3

-

- Popular Post

- Popular Post

15 hours ago, Sigmund said:Make arrangements and stay only for 178 days each year. Then do the remaining months in a country next door. Issue solved, But agree that it's difficult if one has been around for some time.

I'm running. Moving to another SE-Asian country first week of April. This after 15 years living in Thailand, spending approximately 2.1 million Baht a year (about 70% of my foreign income) in this country (multiple BMWs, Ducatis, Hondas, not to mention local girls, restaurants, nightlife, golf!)

After the new tax rules were announced last year I have completely stopped spending money in this country. For golf I now only go to the local navy driving range and pay 20 Baht for a tray of 40 balls instead of thousands to pay courses where Thais get to play for a fraction of the price, not kidding, it's the hidden truth.

There is zero chance I will ever pay the equivalent of 1 Baht tax to a country which gives me zero in return and where the only thing it gives me is a shocking amount of discrimination as a Farang. A month ago I was sent to Malaysia by my company for a 1 week assignment. What a wake up call. The people there (including government officials and police) so genuinly sincere and friendly. Another stratosphere compared to Thailand.

Bye Thailand (I recommend those of you reading this carefully consider if Thailand is still worth it)

-

1

1

-

1

1

-

1

1

-

1

1

-

1

1

-

1

1

-

Xenophobic and brainwashed Thais awash. This country has steadily grown less appealing for Farangs the last 15 years.

I can understand the Thais a bit. It must be extremely frustrating to see and witness the Farangs who live here, most with a good and secure economy far outreaching most Thais. Not to mention seeing a Thai girl/woman wiht a Farang.Jealousy, brainwashed attitude (we have never been colonized!! :-0) towards westernes combined, makes you wonder if Thailand really is an attractive place to live as an expat.

-

Safety of all people in Thailand? So if a Thai man kills a policeman (Red bull-case), what happens?

And if a Thai person (should be plural) beats a farang, are there any other consequences than a 500 Baht fine?-

1

1

-

-

Thais will do anything to make a Baht.

-

- Popular Post

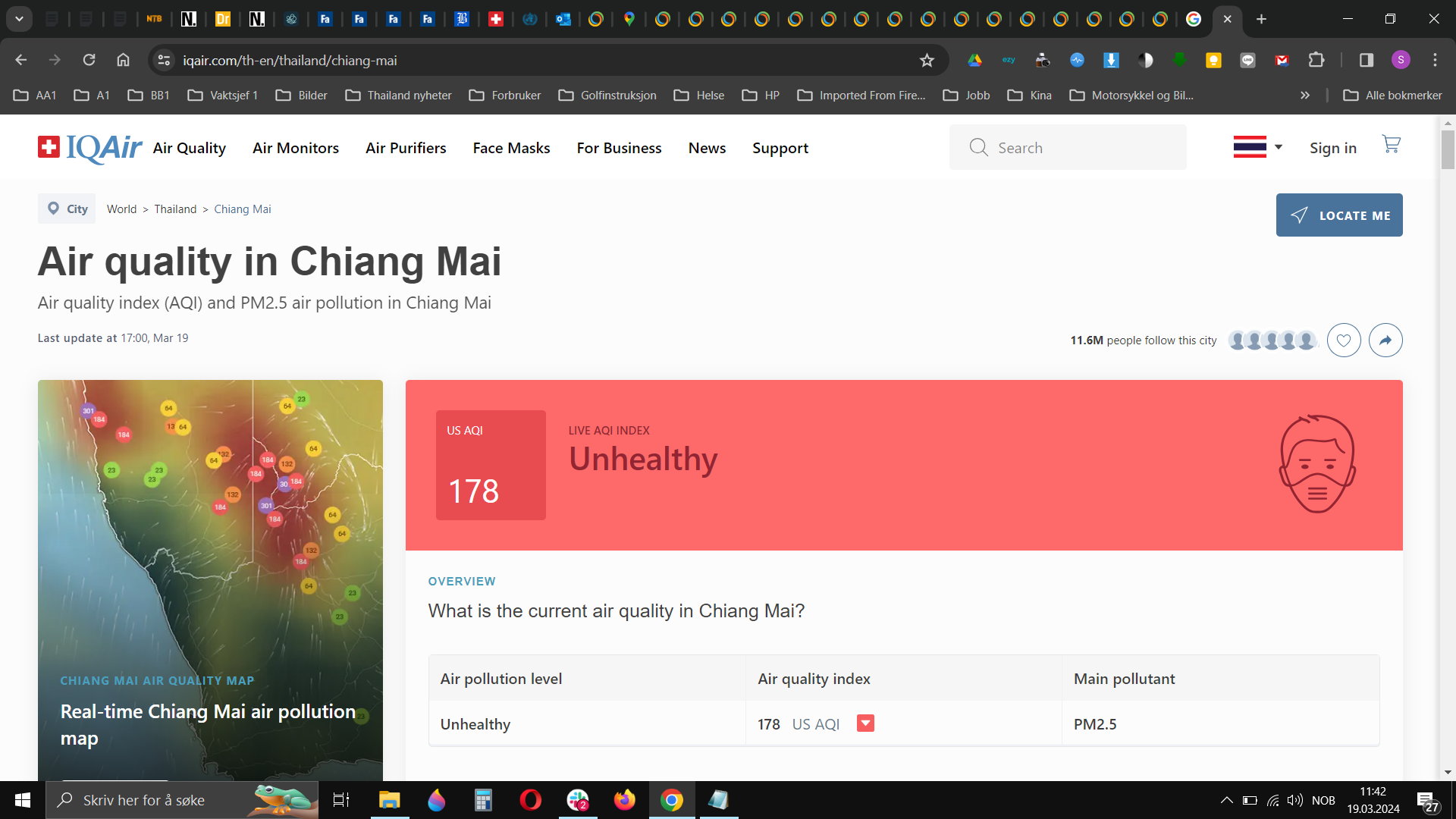

No need, here is the truth: Tuesday 5.42pm: (Or the Thai prime minister could order the air force to get rid of the dangerous air by dropping a few liters of water from the sky (sarcasm)

-

3

3

-

1

1

-

1

1

-

1

1

-

- Popular Post

Thailand attending a democracy-event? Aprils fools day already?

-

2

2

-

1

1

-

1

1

-

4

4

-

Should have an 100% tax on Thai fish - due to the fact it´s full of contaminants.

-

- Popular Post

- Popular Post

On 2/1/2024 at 1:08 PM, TroubleandGrumpy said:Everything that is written in the Thai RD Tax Code is written specifically for salary earners and recipients of income in Thailand, who are tax residents. It has been and still is my belief that unless a person has to pay income taxes, then they do not have to lodge a tax return in Thailand. The vast majority of Thai citrizens do not lodge tax returns - a google search indicates that only 6-9 million people lodge a tax return out of a population of over 50 million over the age of 18. Unlike other countries, the Thai RD does not want everyone to lodge a tax return.

The application of everytghing in the Thai RD Revenue Code is not automatic, as some people think - otherwise every single person leaving Thailand would be fined 1000 Baht for not getting a tax clearance. When it comes to application of the Code, it is not automatic that it will be against all money received/earned overseas by Expats and remitted into Thailand. DTAs have a big impact on those forms of income, as does the application of the Thai RD Tax Code in each and every single situation (and as directed by the Thai Govt). So does the application of the tax laws in Thailand against Expats (which have not been tested in a Court - yet). No part of this 'new rule' ramifications have been 'tested' in a legal manner (Court), and the Thai RD often loses Court challenges. Depending on how they implement this new rule change, they are going to get a lot of new 'challenges' by Thai citizens for changing a system used for 30 years, with 3 months notice.

I am not keen to lodge a tax return in Thailand - ever. I do not believe Thailand has the legal or moral right to force retired or married Expats to do so - unless they are using their Visas to avoid taxes overseas, or are earning money in Thailand. That viewpoint is based upon how Thailand legally treats retired/married Expats. Legally and technically, all Expats staying in Thailand long term are doing so as a tourist - we are not here as an immigrant - the 90 day reporting and annual renewals is due to the Visa being an extended tourist Visa - that is why we have the same 'legal rights' as a tourist. Thailand does not and cannot legally tax tourists, unless they are earning income while they are in Thailand. There are Visas that actually give legal rights (such as the LTR), but the standard Visa that most Expats used when entering Thailand, is an extended tourist Visa - we are all tourists (visitors). But I am not going to take that legal 'argument' further and get it tested in the Thai RD Tribunal or Court - only because that would be extremely expensive.

I will also point out that there is SFA arrangements in place at the Thai RD for the lodgement of a tax return in Thailand under which the terms and conditions of a DTA can be utlised. Both the written and online versions of the Thai RD tax lodgement do not cater for that situation. Therefore, should any Expats wish to lodge a tax return and claim that certain money is not taxable under a DTA with their country, it will be an expensive exercise if we use a tax expert - and it could be very expensive if it goes to a Tribunal. Plus I am certain that the Thai RD does not have the time and resources available to manage that anyway, should every Expat who receives over 120K Baht from a Pension lodge a tax return claiming they owe no taxes (or a very small amount) due to their interpretation of a DTA. Who the hell at the Thai RD is going to be able to deal with exemptions claimed under the DTAs that Thailand has with over 60 different countries.

Unless I am working/earning income in Thailand (legally available only with a work permit), then I see no legal reason for a retired or married Expat to pay income taxes. My calculations are that they get zero from myself anyway, but it is the principle of the matter. When a Thai Court has ruled that Expats can be legally charged a much higher rate in a State hospital, because they are not Thai citizens and have more money, that clearly states we dont have the same legal rights as a Thai citizen. And there are so many other situations (like dual pricing, courts, etc.) where it is very clear what our/my legal status is in Thailand. Implicit in that is that we dont have to pay income taxes

Thailand will find out soon enough that if they start applying income taxes against many Expats (especially their Pensions) then they will not stay living here in Thailand full-time. Obviously some Expats have no choice and cannot easily move out, but many Expats can and will either just visit Thailand (<180 days), or they will take up other options. It is no coincidence that the Taxation Minister in Malaysia, who introduced this same new rule in 2022, has stated that they have no intention of taxing the money of retired/married Expats that they bring into the country. As she said that is wrong because that is all 'new money' being broguht into the country, and it would be a massive disincentive for Expats to bring money into Malaysia if it is going to be taxed. The implementation of this new tax rule is about removing the loophole that allowed citizens and companies to invest their money (earned in their country) overseas and to then bring that money back and not pay taxes on the earnings made on that investment overseas. The associated 'global taxation' system that is now being employed in many countries, is about stopping people living in one country for long periods, just so that they can avoid income taxation in another (and money laundering).

I couldn't agree more with everything in this post from @TroubleandGrumpy

-

1

1

-

3

3

-

17 minutes ago, Liverpool Lou said:

Tourism is not Thailand's main industry!

Bull<deleted>, over 50% of Thailand's economy is black. Most of that is tourism related.

-

- Popular Post

As we all know, the men in brown's racket of extorting people by jailing them without support in the law, is an integral part of their fabric. This hot air announcement is worth zilch.

-

13

13

-

3

3

-

2

2

-

- Popular Post

- Popular Post

The corruption in this country is nauseating..

-

1

1

-

2

2

-

1

1

-

What else can Thai people do to make a descent living?

-

3

3

-

1

1

-

1

1

-

-

5 hours ago, ravip said:

Does it mean that the entire world should agree 100% with the West and reject ALL that the West has rejected?

Is the West doing the best for ALL the human race?

Yes. The west is superior. Freedom of speech, true democracies, independent and non corrupt judiciary, checks and balances of all state powers including the media, free press, advanced healt care and education (the best in the world, and free), the world's best welfare systems, leading the world in aid for less fortunate countries, equal rights for all (no matter religion, nationality, sex or wealth) Shall I go on RavidP?

-

1

1

-

1

1

-

-

- Popular Post

- Popular Post

6 minutes ago, hotandsticky said:Do you normally panic over everything?

Do you actually think about what you write?

The Thai authorities couldn't put together a system for all foreigners to complete a tax return. Do you have ANY idea how many foreigners are in Thailand?

I can guarantee that I will never need to complete a tax return in Thailand - nor will I ever pay a Satang in income tax, nor will I consider leaving on the whim of some idiot who thinks this will happen.

Thanks for calling me an idiot..

-

1

1

-

2

2

-

2 hours ago, Jenkins9039 said:

I actually phoned the revenue office (bangkok).

Money earned overseas, and or as a business owner overseas regardless of tax overseas or not, is tax free unless remitted and then taxed, this includes companies which say are overseas in tax havens, and say don't have substance in the overseas location (otherwise hire someone on Fiverr on a permanent contract and use their home as the office).

Money from property (rent / sale) overseas will be treated as Income when remitted (this will <deleted> a few people).

Money in the form of 'not in the bank account' - say cash or even stablecoins (thankfully public) whereby savings and remitted, is tax free *IF* it was earned before and/or tax was collected, having said that any funds earned in 2023 and remitted will be taxed as Income, evidence to support it is savings is a must, for pre-2023.

Money extracted from stock market activities, principle is tax free, ROI is treated as Income if remitted to Thailand.

Elite Visa holders 'reportedly' spend around 30,000$ a year (such a low number and I am one of them so not sure where they are getting that from) anyway they will be taxed as Income like everyone else.

Pensioners are in for a whammy though... State Pension is tax free as the State will have dealt with that, your private pensions on the other hand will be treated as Income and taxed, note some countries charge tax anyway, the terms of some of the treaties outline that Thailand will provide a credit for the tax paid, what you need to recognise is that is specifically on the $ (equivalent) amount 'earned' and 'remitted' meaning in some countries (say the UK) there is something like a tax exemption of 13/14,000 GBP, whereas in Thailand there is a tax exemption of 150,000 THB + (60,000 THB - needs verification), so from the 150,000 THB onwards you'd be taxed at the standard Thai rates.

Note the Government is pushing through higher income for Thais, with luck they also increase the Tax levels upwards... also note 96%+ of Thais don't pay tax (and earn enough just they do not declare it or feel they should not be productive members of society) - the Government has commenced populistic politics which is what specifically has led to the downfall of our own countries (deficit spending and populistic appeal) - in this latest move we are the ones, alongside the productive members of Thai society paying for the populistic policies such as a free 10,000 THB bribe etc.

This appears to be the start of the road our own Governments went down, and will need to be factored in before individual property appraisals and tax there etc.

Likewise I am somewhat surprised no one has complained that for example, in the time i've been in Thailand, i've seen not one but two exit taxes created, and not one but three entry taxes created under the promise of this or that and then folded into the flight ticket.

Somewhere the Thai Government has some major economic hurdles that haven't revealed themselves as of yet, and they are appearing to consolidate into causing more long-term hardship (like our own debasing currencies) by compounding what ever the issue is with populistic vote buying.

This confirms a previous post of mine, where I put forward the notion that they might, already next year, in 2024, demand a tax return for the year 2023 from everybody. So for many this will mean get out of Thailand before 1st. January 2024 (2,5 month's from now) or before your Visa expires in 2024, or before tax return is due in Thailand in the spring 2024. Difficult to say which alternative is best, as in worst case scenario they won't let you leave after 1st January without a tax return for 2023.

-

1

1

-

1

1

-

-

-

- Popular Post

- Popular Post

35 minutes ago, transam said:I think perhaps you will "looses".........

If you planned to live in LOS, and now are stamping your feet over something that at the mo is in the wind, perhaps you are better off following your money protection thing, but where the ........dot's.......... seem to be lining up wherever you go, in our modern high-tech world..........????

There are/will be countries that appreciate the economic benefits of attracting people who contribute to the economy.

-

1

1

-

2

2

Foreigners and their overseas income: what next?

in Thailand News

Posted

LivinLOS, are you in a state of denial or have you been asleep the last 10 months.

This is exactly what has happened already!