-

Posts

1642 -

Joined

-

Last visited

Previous Fields

-

Location

Bangkok

Recent Profile Visitors

7205 profile views

Misty's Achievements

-

Citibank Transfer of Accounts to UOB

Misty replied to Etaoin Shrdlu's topic in Jobs, Economy, Banking, Business, Investments

Glad to hear you got it sorted. Tried calling UOB again this morning, and unfortunately no progress. Looks like I'll need to go to my nearest branch today. Hope it's also a relatively easy fix. -

1. Yes, I think you're supposed to make an appointment at the BOI within 60 days of receiving the approval letter. You may be able to get this extended if you request it. 2. As of Dec 2023 they were still accepting cash for the LTR visa itself. If you get a digital work permit, however, it's a different cashier and they would only accept credit card or phone app bank transfer. 3. If you choose the e-visa in the US, you'll get a pdf of the visa and there's no 60 day limit for entry. Just a note on e-visas: if you later want to switch to another type of visa these can be problematic. The LTR e-visa is good for 10 years (rather than the standard 90 days for most visa types). So you'd have to get the e-visa cancelled by the Thai embassy or consulate that issued it. It can be done, but the process is complicated and long. I had an LTR e-visa initially, but when I became eligible for an LTR visa with a lower income tax rate, it was financially worthwhile to switch. Eventually I was able to do so, but had I not gone the LTR e-visa route initially and instead gotten my LTR visa issues in Bangkok, the LTR unit in Bangkok could have handled cancelling the old visa, and the switch would have been much easier.

-

Citibank Transfer of Accounts to UOB

Misty replied to Etaoin Shrdlu's topic in Jobs, Economy, Banking, Business, Investments

Hope the local UOB branch can help. Phone calls (when I can get through) just result in being told that someone will call me back in 15 min. So far no one has called, and I conclude they are overwhelmed. No time to go to a branch today, but will do so tomorrow if this remains unresolved. It's good you're getting notifications of transactions, so at least you can see if there's card misuse. I'm not getting those types of messages, although one UOB person was able to to confirm my phone number. Hopefully the risks are low, but if data was compromised this period would be ideal for fraudsters. -

Interesting to see the differences between the 2022 data of actual travel, and a 2024 poll that @BurmaBill posted in this thread previously. Florida could be too expensive, but at least in the poll NYC made it into the top 10 travel planned destinations: https://business.yougov.com/content/48404-what-are-britons-top-travel-destinations-for-2024

-

Citibank Transfer of Accounts to UOB

Misty replied to Etaoin Shrdlu's topic in Jobs, Economy, Banking, Business, Investments

You're a step ahead of me. I had a CC credit card and have tried to register for a UOB online account a couple of times since last night. Not receiving the OTP. The system appears to have my correct information and phone number, Separately, now also not receiving OTPs from payment systems that used to be run by Citi and now say UOB. Have called UOB, and they are looking into the issues. Long phone wait times, they may be a bit overwhelmed. -

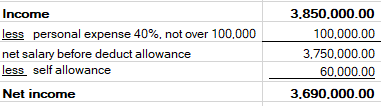

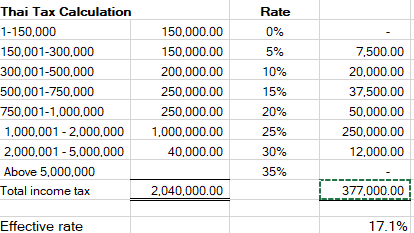

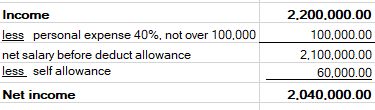

For foreign remittances to be taxed at an effective rate above 17%, based on the current progressive tax schedule and using standard deductions and without an LTR visa, I figure you'd need to bring in about Bt8.5m each year (c.$236k) - without any foreign tax credits to offset it. Of course, a moot point if you have one of the LTR visas (except LTR HSP).

-

You may misunderstand the LTR visa's tax benefits. I currently have the LTR HSP visa but am not "legally tax-free." I will pay a substantial amount of Thai income tax on my salary, albeit at a flat rate of 17%. Previously on a different LTR visa at progressive rates I paid up to the top 35% marginal rate, or effectively a total of c30% including RMF deductions.

-

The tax issue is definitely something big spenders (wealthy/rich) expats consider when looking to move to a new country. If they don't, frankly they are hugely remiss. Prior to last September's changes to how the tax code would be interpreted, these types of expats liked the fact that Thailand did not tax them on passive income earned outside of Thailand. And now that Thailand has changed the tax code interpretation, big spenders will certainly consider the LTR visa over other visas that don't address this tax issue.

-

Having had to annually extend a NonB/work permit every year for decades, with the mounds of annual paperwork and ever growing requirements, the LTR visa + digital work permit is a huge improvement. To start with, the LTR unit is professional, courteous and even friendly. Such a breath of fresh air! Given the amount of Thai income tax I've paid over the decades, the LTR unit's attitude is so welcome and in stark contrast to the attitude of the offices overseeing NonB visa/work permit extensions. Not to mention there's no annual renewals with the mountains of required paperwork and wasted time, no 90 day reporting, no requirement for re-entry permit, no Thai employee requirement, no minimum salary, no need to be in country every year (like with PR), no harassment of annual syphilis blood tests. There are some nice tax benefits. And using the fast track at the airport is further icing on the cake. At the very least, I can only guess @Gottfrid has never had a NonB / work permit or at least not recently, and has no idea what a corrupted mess that process has become.

-

Advice on best visa route

Misty replied to Swall101's topic in Thai Visas, Residency, and Work Permits

Definitely suggest checking out the WP LTR visa. It's a 10 year visa and there are many advantages if you qualify, including up to 4 related visas for spouse and children.