dayo202

Member-

Posts

231 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by dayo202

-

is any bank account good for proof of funds?

dayo202 replied to Pouatchee's topic in Thai Visas, Residency, and Work Permits

Do the account need a passbook for immigration ? -

I send you a personalised message to the link

-

Thanks for the feedback.. I seen a used 2023 model with less then 500km on the clock for 99k, I'm very tempted saving of over 30k.

-

Just returned from this year's motor show in Bangkok. I quite fancied the royal enfield hunter 350cc. At 134,000฿ looked good value for money. My question is have anyone got any knowledge or feedback on royal Enfield brand, pros and cons etc...

-

The next soi over, much more quiet and cheaper also.

-

Does anyone bank with NatWest in the UK?

dayo202 replied to WhiteHatPhil's topic in UK & Europe Topics and Events

You probably need VPN, as you IP address here in Thailand is blocked by NatWest. -

Will she be living in ?, if so around the 10/12k mark.

-

Where to buy a laptop in Bangkok?

dayo202 replied to StayinThailand2much's topic in IT and Computers

Good deal, did you buy direct from the HP online ?. -

How many millions of baht does one need to retire in Pattaya?

dayo202 replied to advancebooking's topic in Pattaya

Mostly ISAs, bonds. Money's in the UK not here -

How many millions of baht does one need to retire in Pattaya?

dayo202 replied to advancebooking's topic in Pattaya

I moved out here 6 years ago with equivalent of 15M baht at 51 year's of age. My pension will kick in when I'm 67, the return on my 15M keep me going until my pension. -

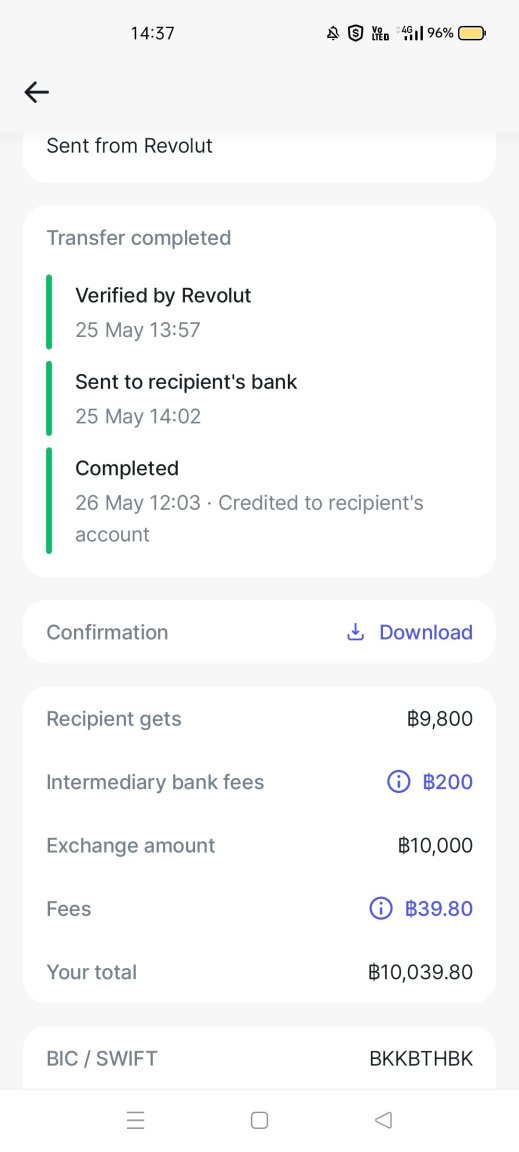

I'm from the UK, age 57 I been living in Thailand for 6 years I'm also married to a Thai. My question is I do a monthly transfer from my UK bank account into my Thai bank of 25,000฿. The money I transfer from the UK is saving that I accumulated over my lifetime and sale of my house in UK ( which I made no capital gains on the sale ). Would i need to pay tax on my 25,000฿ ( annually 300,000฿ ) and if so how much please ?🙏