Thomas J

-

Posts

2848 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Thomas J

-

-

23 minutes ago, Yellowtail said:

For whatever reason, you seem to think that when a single asset is sold, the corporation has to be liquidated.

1. Did you even read the original post. It say and I repeat "When a company is dissolved" It does not say "it has to be dissolved"

2. Now the purpose of these companies is to provide a foreigner with a methodology for purchasing a home that they can not do directly.

3. Now if the "sole" asset in the company is the home, and the home is theoretically an investment or is being rented and that sole asset is sold. The company no longer has any "legitimate business purpose"

4. Now the foreign owner could purchase a different home, or condo, or commercial building and continue to operate the business. However, in the overwhelming number of instances the foreign owner has no real interest in operating any business, he/she was just using the corporate ownership to obtain the single family home to live in and perhaps rent when they are not using it. Once disposed of the foreigner has no interest or intention of maintaining the company and would dissolve it.

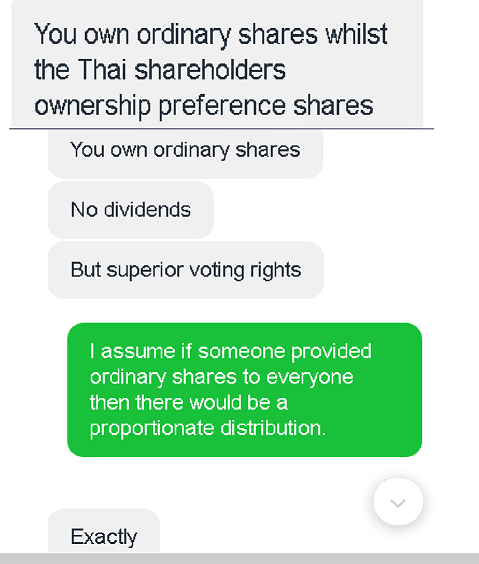

The original post asked how that could be accomplished without having to share the proceeds. I now know how. If sold only the stock is sold and the new foreigner takes the position of the old one and the company continues. Or, the home is sold to a Thai. The minority shareholders hold only a share class that does not entitle them to any return of invested capital. In the USA I have seen many times different share classes to skew the control of companies. Typically a small privately held company going public keeps A shares with lets say 100 votes for every share but sells B shares to the public with only 1 vote for every share. The family selling the shares keeps operating control

In Thailand the Thai shareholders get only preference "preferred shares" That is the mechanism used that when the capital in a corporation is distributed allows the foreigner to recoup their invested capital without having to share it.

It is under Thai business laws not mandatory that equal rights and privileges are attached to all shares of a limited company. Some may be preferential either as to capital or as to dividend, or as to both, or may have privileges in the matter of voting. A Thai limited company structure with preference shares is a popular form of business entity among foreign investors in Thailand. The majority Thai owned company is under the current Foreign Business Act (section 4 (number of shareholding) and section 36 (nominee shareholder punishment)) considered Thai and the foreign investor as a minority shareholder is able to control the company through a preference share structure and circumvent foreign ownership or foreign business restrictions through the Thai limited company. However there is a discussion in the Thai government and Ministry of Commerce to amend the Foreign Business Act and include foreign voting rights and foreign management as a criterion in defining a company foreign or Thai. Such changes could affect existing companies.

-

2 hours ago, Yellowtail said:

Do you really believe insulting people and bragging about yourself and how smart you are strengthens your position?

I was correct. No matter how simple I tried to make it, I knew you just would not comprehend it.

-

1 minute ago, Yellowtail said:

You would have to understand it to explain it. Again, if a corporation has no real value at the time of liquidation, what do the shareholder have coming to them?

Ok this should be simple enough for even someone with the expertise of a shoe shine man to understand but I have my doubts.

I have a Thai company. I place 5 million baht into the company to capitalize it. So on the books it shows a bank balance of 5 million baht. I use those proceeds to have "the company" buy a home for rental and some personal use by me. Now 3 years go by and I find I want to sell the home and dissolve the company. I now sell the home, the proceeds are cash, that asset belongs to the company so the money legally has to be placed in the corporate account. Now I vote to dissolve the company and liquidate its assets. I write myself a check from the company for the amount of money in the company account, and file the papers to have the company cease operations as a going concern.

Now I realize I am only a person with a 30 year career as an executive officer at major banks including Bank of America, have my MBA in Finance, and have owned 4 companies personally including 1 C corporation, 2 LLC's and 1 sub chapter S company and that pails in comparison to the knowledge you have via owning a shoeshine and lawn moving business. But you even asking this question is pretty evident you are absolutely clueless as to corporate structure, accounting, or share classes. -

7 minutes ago, snoop1130 said:

Shares of the hospital group rose as much 13.45%

No this is just plain stupid. Reportedly the Thonburi group has a market cap of approximately 25 billion baht. That would mean its value would have gone up, by 366 million baht. I realize that they will be making some money from the sale of the vaccine but how many injections would you have to give in order to justify that increase in value. This is particularly true since unlike ongoing operations, the vaccines if effective are not something that would generate the same level of injections each and every year.

-

2

2

-

1

1

-

-

2 minutes ago, Yellowtail said:

I understand how complex this must seem to you, but if a corporation has no real value at the time of liquidation, what do the shareholder have coming to them?

I could explain it to you but I think I would need some crayons for a person with your IQ.

If the home is in the company it has value. If you sell the home while the business is ongoing the proceeds go into the corporate bank account. That has value. It is only when you "liquidate" a company that all assets are distributed.

The only reason the Thai owners get nothing, is because their share class entitles them to dividends only but that share class is entitled to dividends which the foreign owner is not. Is it a way to circumvent the intent of no foreign ownership yes. But your assertion that the company has zero value shows how absent you are of any corporate structure or accounting. I suggest you stick to shining shoes and cutting lawns. You appear to be well suited for it.-

1

1

-

-

6 hours ago, Yellowtail said:

Shareholders are NOT partners in the business

There is an old adage about you can keep quiet and people may think you know nothing, or you can open it and confirm it.

You have obviously done the latter. Your responses show you do not know the difference between a dissolvement based on bankruptcy versus one based on liquidation of an ongoing concern.

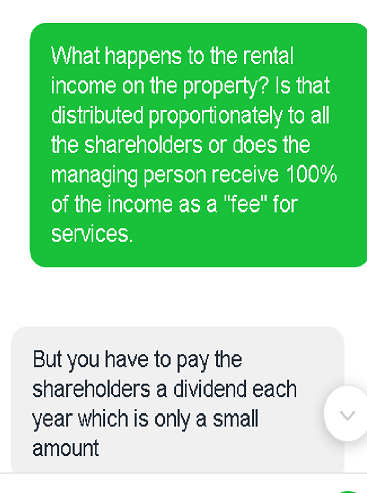

You seem to be of the opinion that shareholders are just names on a piece of paper and that minority shareholders have no rights. You say if the assets are impacted by their disposal shows your lack of any accounting knowledge. If an asset is sold, it is taken off the asset list, but the cash received replaces it. The impact is neutral. According to my source, dividends are "required" to be paid each year to the minority shareholders although a nominal amount. You say they are not "partners" no they are "shareholders" and their ownership rights dictated by the class of shares they own.

The very fact you would think the Thai government would go through the process of establishing a law to protect minority shareholders rights and then believe that somehow a company owning a home here in Thailand would be required to have Thai shareholders but any rights to them could be stripped or ignored by the foreign owner is testimony to why you have all the business acumen to run a shoe shine and landscaping business.

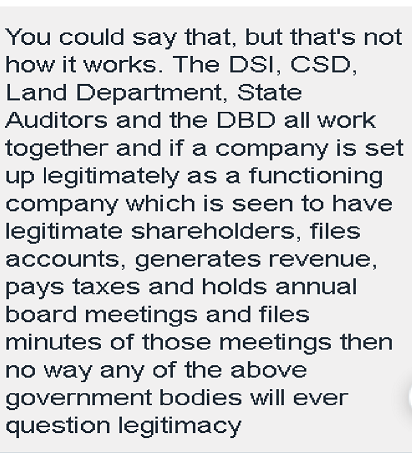

I went to the step of inquiring with a property management company who deals with the sale of homes to foreigners. The Thai company foreign owner is limited to a 49% ownership of the company. They recommended a minimum of 3 Thai’s as additional shareholders. Included is a copy of the conversation as to the operating and legal requirements.

As I suspected, the Thai lawyers have determined a way to maintain all of the value of the company with the foreign owner. If only ordinary shares were issued, ALL SHAREHOLDERS would be required to get their proportionate share of the assets in the company upon dissolution.

However, Thai law permits the Thai owners to get “preference” shares and the foreign owner ordinary shares. The ordinary shares have superior voting, and ownership of the assets of the company with the Thai preference owners have rights to dividends which must be paid to them annually.

Bottom line, all shareholders of the same class of shares are treated identically and have the same rights. But Thai law allows foreigners to own companies being formed with Thai shareholders with shares with diminished rights. I knew that the answer of well just vote to sell the property and to heck with the Thai shareholders was not correct. That is not to say that some might just do that. If done correctly and legally, the foreign owner can control the company, and wanting to sell the home, can either sign over the Chanote to the new Thai owner or as I suggested sell their shares in the company to the new foreign owner which saves them the expense of forming a new company.

Selected comments from company that sells property to foreigners and establishes thai based companies.

-

1

1

-

-

This reminds me of my days in corporate America. I would press some of the support areas as to when their projects were going to be complete. They would go into lengthy dissertations about how the committees being formed, resources being marshalled, the process being flowcharted etc.

I would always reply, so in other words you have done nothing, and have no clue as to when they will be completed.

Same here, no specifics on who it has been ordered from, and when it is scheduled to arrive.-

1

1

-

-

What, no free healthcare for illegals, free college for everyone. How does Thailand ever expect to become a world leader like the USA without fulling embracing the everything is free agenda.

-

4

4

-

2

2

-

-

21 hours ago, Yellowtail said:

Were this true, a second year law student could go through the public records, find all these people and recover all of this money.

https://lorenz-partners.com/rights-and-protection-of-minority-shareholders-in-thailand/-

1

1

-

-

8 hours ago, webfact said:

"Are we scared of the virus? No. We're scared that we have no money to live."

You may catch the virus - a possibility. You may die from the virus - a possibility. Your business is closed and you have no money to live - a certainty

Thai people prefer betting on a possibility rather than a certainty.-

2

2

-

-

2 hours ago, Guderian said:

Yes I read this article this morning. Well it was 17:00 and they were stopping everyone, not just select vehicles. My license was viewed by not less than three police officers as I made my way through the line.

I guess if they were stopping only the vehicles carrying what appeared to be migrant workers I could understand. They certainly were not checking to see if your trip was essential. One way or another, it created quite a traffic snarl and there were many Thai police and police vehicles off to the side of the barricades who were just standing and conversing with each other. So perhaps the only reason was to screen for migrant workers. -

- Popular Post

2 hours ago, webfact said:The authorities responded quickly with strict measures, including months of lockdown, in a bid to bring the deadly outbreak under control. By late May 2020, not a single local transmission was detected, winning Thailand much praise for its timely and effective action.

This reminds me of the story of the person studying flies. He pulled the legs off the fly and slapped his hands and the fly flew away. He then pulled the wings off the fly slapped his hands and of course the fly remained. He concluded that pulling the legs off had no effect on the flies hearing but pulling the wings off made the fly completely deaf.

The reality is that all of SE Asia had extremely low covid infection rates in the beginning. I find it too hard a stretch to believe that Thailand, Cambodia, Vietnam, Burma and Laos all had the foresight and took the exact correct actions to stem the virus but now all are simultaneously doing the wrong things.

SE Asia had a low rate of infection, for reasons that we may never be able to completely know. And now it has a higher rate of infection. Perhaps it is just SE Asia's turn in the barrel. Not every country in Europe or state in the USA had identical experiences. The statistics on the effectiveness of covid prevention measure are just not clear. Two areas doing the exact same thing have markedly different results. The one thing that all countries including Thailand could have and should have done is to order as much proven vaccine as possible, and get the population vaccinated. The rest is just a Kabuki dance, strictly for show.-

5

5

-

3

3

-

When I hear people say "listen to the experts"

I believe in the beginning it was two weeks to "Flatten The Curve"

-

1

1

-

-

9 hours ago, donx said:

t is my understanding that the mechanism that facilitates the minority shareholder getting nothing is the use of a board of directors meeting where the decision is made to sell the property and distribute all proceeds to the managing director.

I would not think that could be the case. Otherwise any company with the majority vote could just vote to only give proceeds to a select group of shareholders. I read the Thai law and it does say that minority shareholders are entitled to their proportionate share of any dividends.

Money is distributed to shareholders in two ways. 1. a dividend or 2. a return of capital. In either case shareholders get a proportionate amount. If there are 1000 shares and I have 500 I get 50% of whatever dividend or return of capital is distributed. If that were true companies like Siam Cement which are publicly traded could just have a vote where the majority shareholders voted to sell the company and distribute the money only to them.

I can see legally only one way and that is to not sell the home which is an asset of the company but rather the managing director sells the shares it owns. The new owner really just steps in and replaces the existing owner and the company continues. That is not to say that some company owners just don't sell the home, pocket the money and move back to their home country. After all what would the minority shareholders do. They probably don't even know the home that is the asset let alone that it has been sold. While that gets the money back to the foreigner it "technically" would not be legal. But legal and having any true negative consequences are two different things.

-

1

1

-

-

I over two years in Thailand I have only been stopped for ID once and that was when there was a quarantine/lock down in effect. This afternoon at about 17:00 I was traveling south on Sukhumvit and there was a large contingent of police. They had set up a covering large long enough that about 5 vehicles could be under it and it was 4 lanes wide. The police just asked for your drivers license, looked at it and then let you go.

Anyone's guess on this? Maybe looking to see if the drivers license showed a local address?-

1

1

-

1

1

-

-

Have some very significant financial handling and reporting infractions in village juristic entity. Does anyone know a good "aggressive" attorney who is skilled at Juristic Entity law and is a skilled litigator.

-

2 hours ago, snoop1130 said:

Thailand’s Department of Rail Transport (DRT) has requested that passengers no longer talk on trains in order to help prevent the spread of COVID-19.

Several of the Department of Rail Transport members voted for a much tougher measure no breathing on train but they opted to try the less restrictive measure first.

-

1 hour ago, Yellowtail said:

It seems to be your position that you are smarter than every attorney in Thailand and the you and you alone have discovered that hundreds of thousands of minority shareholders are being cheated out of what is rightfully theirs.

I did not say that. What I did say is that the Thai attorneys must have included a mechanism in these companies that facilitates the minority shareholder getting nothing. That was the question in the original post.

As to a second year law student ask them if you own shares in a company and the company declares a dividend or cash distribution of capital whether you are entitled to it.

If minority shareholders in any company were not entitled to any ownership rights you would not have any publicly owned companies in Thailand. And there is no difference between the ownership right of closely held versus publicly offered stock

-

15 minutes ago, Yellowtail said:

The three Thais in your example would be on the board and would likely not vote for this , BUT in the event did want vot to give away their money they could.

A board vote is different from a shareholder vote.

It is obvious you are clueless as to how corporations work. So there is absolutely no sense in trying to explain anything to you. Somehow you believe that because they are minority shareholders they are entitled to nothing. Now I know why your was a lawnmowing and shoeshine business.

-

- Popular Post

1 hour ago, Catoni said:Difficult to believe that some people actually admire the Chinese Communist Party after all the misery it’s caused,

Well it is hardly fair to single out the Chinese. I would point in history to the Romans, how about Spain and its conquest of Mexico, Central America, and much of South America. England was hardly devoid of misery in its occupation of numerous countries during its colonialist period. Then in modern times Russia and Germany have hardly been without their atrocities. Lets not forget my home country the USA. What it did to Vietnam was atrocious and I suspect if you asked anyone from Afghanistan, or Iraq if they suffered any misery under the U.S. wars there they would hardly give them a free pass.

-

4

4

-

8 minutes ago, Yellowtail said:

I'll take that as a none, that your companies had no shareholders, much like my lawncare and shoeshine businesses.

No by law each corporation had to have shareholders. I had one C corporation that was required to have two shareholders. I had three. I suspect your businesses were Sub Chapter S which means you did not have to have other shareholders.

That is not the case in Thailand. Minimum 3 shareholders and foreigner can not own more than 49%.

-

1 minute ago, Yellowtail said:

Except in a case such as this, where the assets have all been disposed of and the funds all distributed prior to the dissolution of the company.

Again sure the foreigner could sell the home and just send the money to himself. If any monies are distributed from a company as part of a liquidation/dissolution they legally are suppose to go to the shareholders pro-rata. That is not to say that the foreigner could not just sell the home, and pocket the money. That however does not make it legal.

Using the example of three Thai's forming a company to buy a home and rent it. One has a 49% ownership share and the other two the remaining 51%. Are you suggesting the shareholder that controls the vote can just "legally' sell the home pocket the proceeds and give the minority shareholders nothing. No different if Thai owners or foreign owner. Corporations are corporations. -

10 minutes ago, jacko45k said:

China told them to say that, as other opinions are impacting Sinovac sales.

As I read it the WHO was saying to avoid any mixing. Supposedly the best combination is one of Astra Zeneca and either Pfizer or Moderna. But who really knows. The world is really just a human Petri dish where we are being injected with vaccines to prevent Covid that we won't know for years any long term side effects and it will be months before we see how effective the vaccines really are.

-

1

1

-

-

6 minutes ago, Yellowtail said:

How many shareholders did your companies have?

You seem to be of the opinion that minority shareholders are merely there for decoration.

When a corporation is formed shares of stock are issued. Normally those shares are sold and the proceeds becomes the capital of the business. In privately held companies shares are typically awarded. That would be the case of the ruse used to allow a foreigner to own property here in Thailand. Lets say it is 100 shares. The foreign owner gets 49% and is the managing owner. The other 51% are divided between the two or more Thai owners.

Now somehow "capital" is injected into the company. Perhaps the company takes out a loan between the company and the foreign owner. The cash becomes an asset, and the loan a liability. The company then uses that cash to buy the home and the home replaces the cash as an asset on the books.

Now perhaps, everyone just forgets the legal aspect of this, the home is sold the foreign owner pockets the cash and goes back to his/her home country and the company is never dissolved and the foreign shareholders are left with nothing which is fine with them since they put nothing in and got some baht to put their names on a piece of paper that they didn't have a clue what they were signing.

That however is not proper. If properly done the home would be sold, the proceeds deposited into the corporate bank account, and the board would vote to dissolve the company, file the required forms with the Thai government and distribute the proceeds. Absent any other methodology that distribution should be made pro-rata with the foreign owner getting 49% of the proceeds and the Thai owners 51%.

I am sure that is not the case. Perhaps company owned "homes" are never sold. When the foreign owner wishes to sell, they sell their shares in the company and the home of course comes with it.

But you are totally and completely wrong about how corporations are suppose to work and you can have a completely solvent company who decides to go out of business. If that company is set up as a corporation the proceeds go to the shareholders pro-rata. Even in a bankruptcy the shareholders get whatever is left over after all creditors have been satisfied.

Opinion: Government’s misplaced priorities has Thailand firmly back in the third world

in Thailand News

Posted

Government’s misplaced priorities

They use the term misplaced priorities. Other than arresting old retirees secretly going to bars, trying to permanently kill all the tourist infrastructure, and banning alcohol sales, I am not saying there priorities are misplaced, they are just missing having any priorities.