Mangotango

-

Posts

12 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Mangotango

-

-

8 minutes ago, Lorry said:

You are right about the 60000, retiree said that a couple of posts before yours (and he mentioned that for employees it's 120000).

What got me exasperated is when people say "assessable = taxable".

You haven't understood the taxonomy of the Thai PIT.

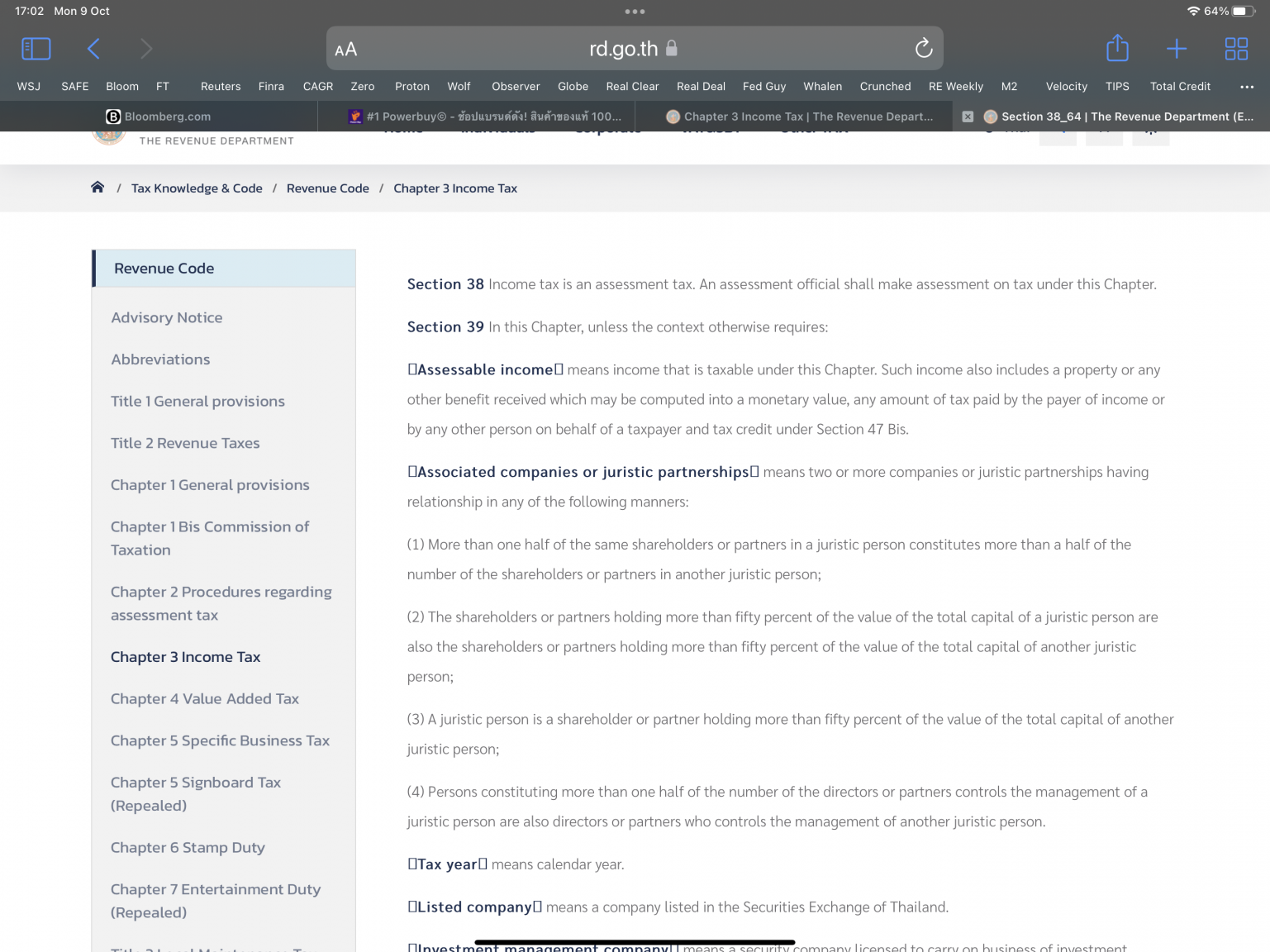

From your screenshot: "Assessable income means income that is taxable under this chapter" - the last 3 words are the important ones.

The logic of Thai PIT goes like this:

Assessable income is not any income, but only certain kinds of income specifically listed in the law. Other kinds of income, that are not in this list, cannot be assessed for PIT.

Taxable income is assessable income minus allowances and deductions.

The taxable income is then multiplied with the tax rate, and you get the payable tax.

For many purposes the difference doesn't matter.

Where it matters, for example, is the calculation of those 60000 you mentioned.

60000 is assessable income, see your screenshot.

60000 is NOT taxable income.

If your assessable income from the income sources listed in the tax code is 10m, but you (think you) have deductions of 9,950,000, your taxable income is 50,000 and you don't have to pay any tax. But you have to file a tax return.

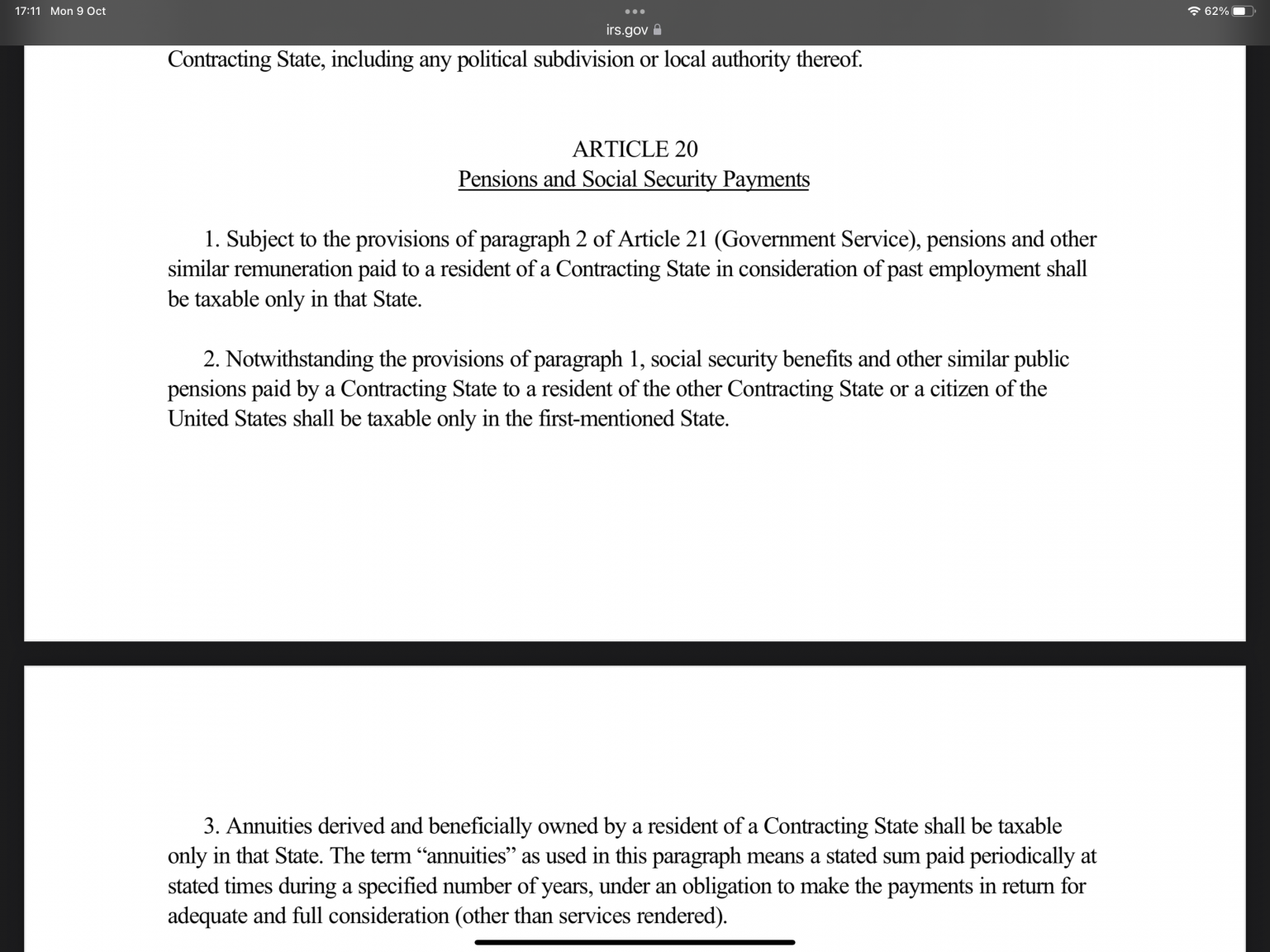

The same applies for tax credits based on a DTA. (it may be different if the DTA says something is not taxable in Thailand but in the other country - I am not sure about this)

Agree with everything you said. The interesting question is going to be assume you have more than 60,000 baht of assessable but foreign-tax-creditable foreign remitted income, taxable income of 1000 baht but a dta tax credit of more than 1000 baht. Do you have to file?

-

Of course this is Thailand and up to now, and maybe forever, they will say mai pen rai no need to file if you actually owe no tax. They can do anything they want. And as I said, they are quite reasonable so why make anybody file if they do not owe? Somewhere in their tax code you will actually see a provision that says rd “will” waive any payment of 5 baht or less. I just saw it but cannot find it again to post. So, remember this is Thailand, which is actually a GREAT place.

-

1

1

-

1

1

-

-

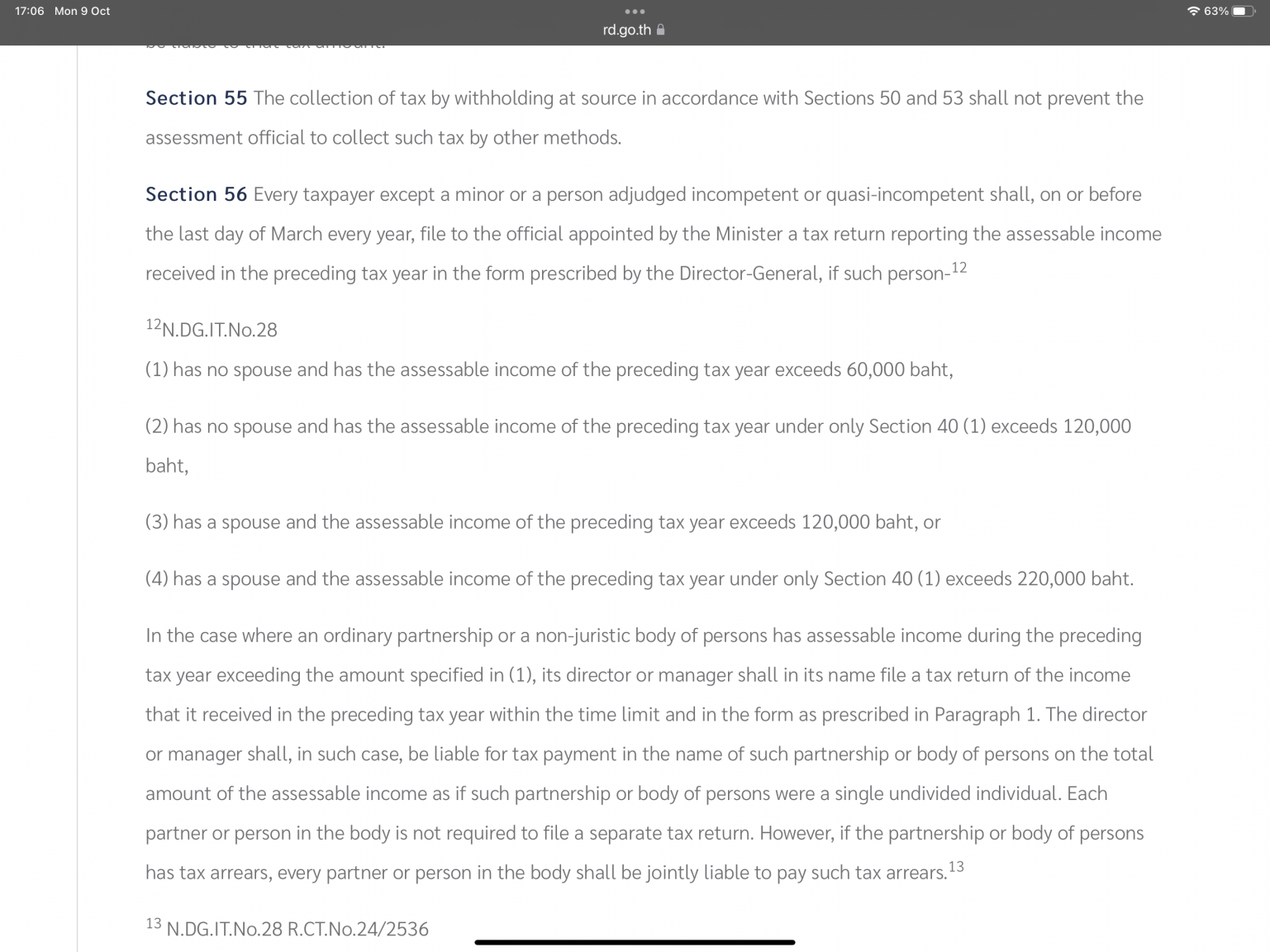

Lorry… you are wrong I believe. You forgot to read the whole statute. The actual rule right from the horse’s mouth is above. Assessable income more than 60,000, you must file.

-

-

-

-

Mike Lister…..I agree. For example, USA social security brought in (not taxable by dta, so not assessable) plus no more than 60,000 baht more, no need for return is a very resonable position to take. Despite what everyone says on here, in my opinion the Thais are quite reasonable and will take this position as well. Also much easier for them administratively. But no guarantees unfortunately.

-

1

1

-

1

1

-

-

For all you people arguing about who has to file a tax return, anybody with assessable income of more than 60,000 baht has to file a tax return. Assessable income is defined as taxable income.

-

I do not know how to do that. See the following 2 topics

“social security direct deposit, change from Bangkok bank to another bank”

and

”us social security directly deposited into Thailand bangkok bank fees”

-

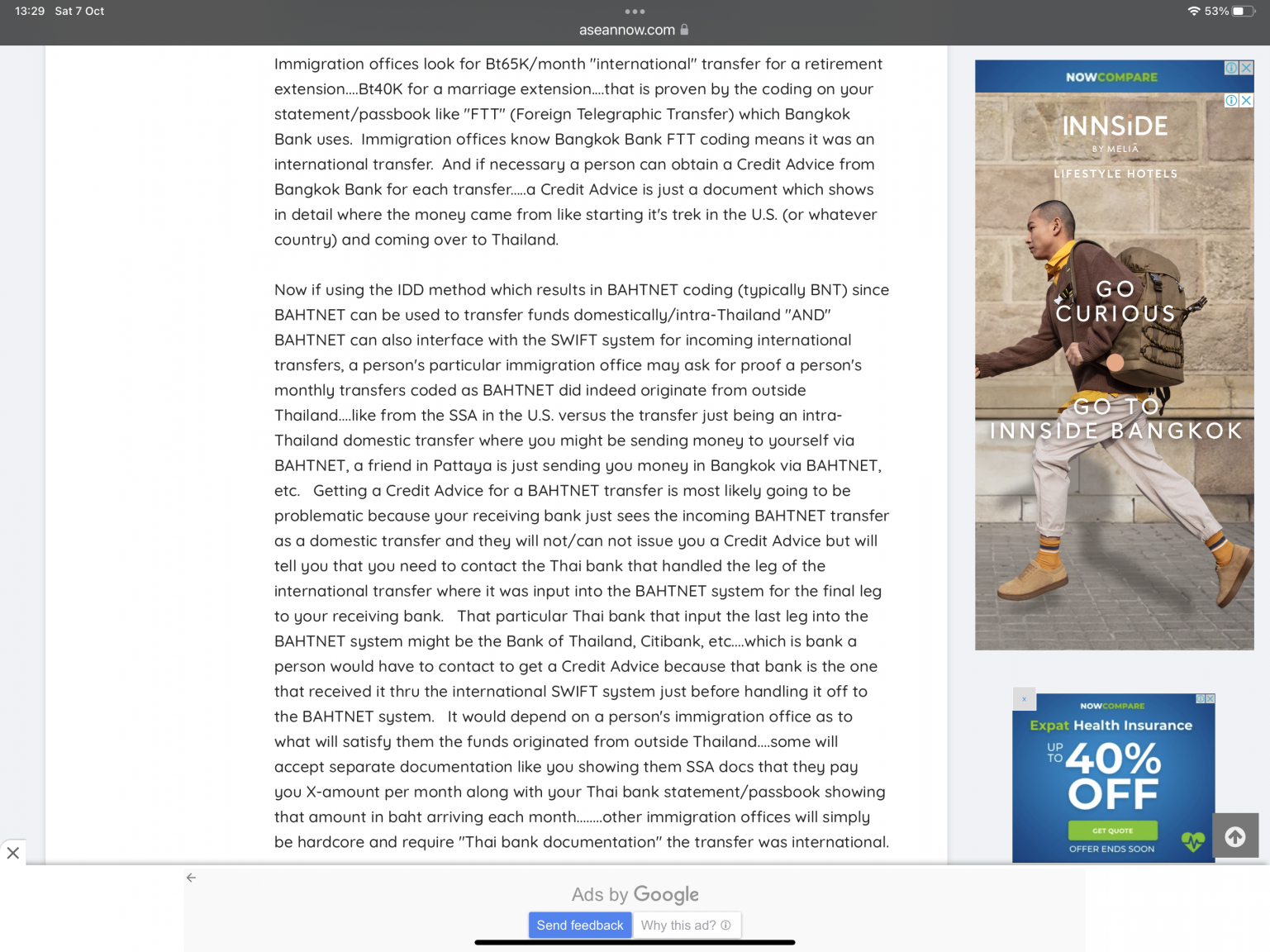

Thanks for all replies! Is everybody sure that if you do not use Bangkok bank and the old ACH system, but rather use the new IDD system, that the credit advices for the transfers will satisfy immigration that they are indeed foreign? The attached recent post from another thread seems to indicate otherwise…..

Thx again!

-

If US social security is directly deposited to a Thai Bank, do the credit advices for these transfers indicate the transfer is from a foreign source for purposes of the retirement visa extension? I am referring to the new direct deposit program to any Thai bank instituted around 2019.

Thanks!

Thai government to tax all income from abroad for tax residents starting 2024

in Thailand News

Posted

Yes unfortunately 2026 sounds about right.