h3ith

Member-

Posts

48 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

h3ith's Achievements

-

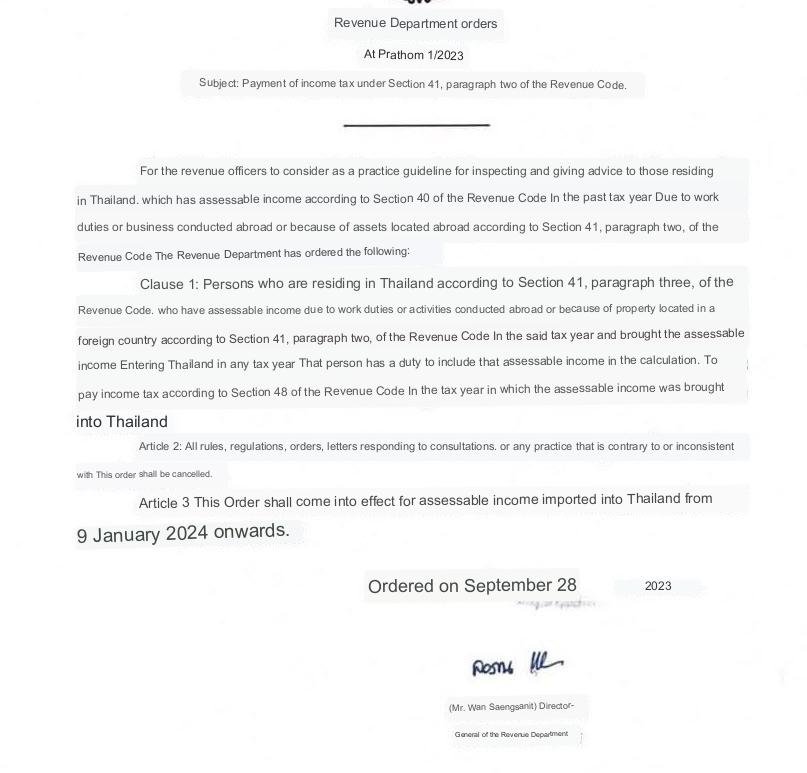

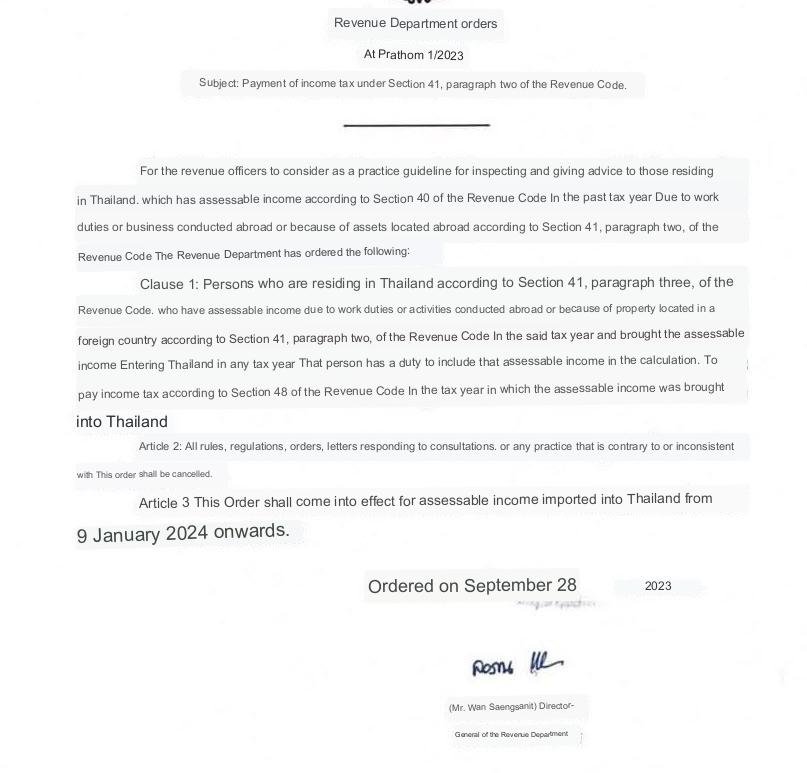

Could be worse: Assume you purchased Apple or Amazon stock 10 or 20 years ago. If you sell them and transfer cash to TH to buy a condo, 90% of the amount would be old capital gains. Would TH revenue office calculate the capital gain starting with the stock price on 31 Dec 2023? Or the original stock purchase price of 10 years ago? Or if your original savings of 100,000 came from your after-tax salary, 10 or 20 years ago, how do you prove to the TH tax office that this original capital should not be taxed as Thai income because the money had already been taxed by the home country?

-

Current law: not taxable if you remit it to TH in the next calendar year: remittance principle. The text of this new order does not clearly separate financial income from employment and business income. Foreign employment income is always taxable, whether or not the amount is transferred to TH. If they want to cancel the remittance principle for financial income, I'd imagine that the parliament would have to change the tax law. But this order just cites the current law.

-

It's a decree or order. I'm not a Thai lawyer, but this order does not change the tax law, which should require an act of parliament. "Any tax year" may refer to employment income and business profit, to which the remittance principle ("next calendar year") never applied. The order text just did not bother to separate work and business income from financial income.

-

"Any year" could be a translation flaw. Imagine accumulating capital gains, interest or dividends for 20 years, and then transferring 5% of it to TH? How could anyone sort out how much of the incoming amount was based on financial income over the previous 20 years as opposed to original savings? I imagine the revenue office may demand evidence that the incoming amount was not work or business income. And that it was not financial income earned in the current year. Which would be burdensome enough. But "any year" for 10 or 20 past years, for all incoming bank transfers, would be absurd.

-

This decree cites the current tax law, Section 41, almost verbatim. "A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax in accordance with the provisions of this Part." Since it does not differ from the current law, it does not seem to invalidate the remittance principle (calendar year seasoning). It seems to be an enforcement decree instead of a change of the law. Employment and business income from abroad are always be taxable, irrespective of the year. But perhaps they will force tax residents to prove that all incoming amounts did not comprise any current-year financial income (dividends, interest, capital gains), which would be a bureaucratic nightmare.

-

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/507424/uk-thailand-dtc180281_-_in_force.pdf This is the double taxation treaty. 1) "Interest ... may be taxed in that other state", i.e. Thailand. That's the case for most European countries. 2) But if you season your interest income in your UK bank acount and transfer it in the next calendar year, it would not be taxable in TH. https://taxsummaries.pwc.com/thailand/individual/taxes-on-personal-income The new decree may mean that the TH revenue office will try to verify that you have not transferred current-year interest but only past-year interest income.

-

But Sections 40 and 41 of the revenue code refer to assessable income. That's interest, dividends, capital gains. But not the capital stock that generates this financial income. If any cash that is transferred into TH would be subject to income tax (30% for 2 - 5mil THB, 20% for 1mil), the real estate market would collapse because that would be a wealth tax. No country imposes a 20% wealth tax on incoming payments. And this decree does not change the current tax law. Currently, only foreign income (as opposed to foreign capital) that is transferred into TH in the same calendar year when it was earned is subject to TH income tax. That's not new, it was just not much enforced. But from 2024, TH will get data from foreign bank accounts that are held by people who registered their Thai address with a foreign bank: Automatic Exchange of Information. So the TH revenue office probably plans to comb through these data and look for incoming payments from foreign businesses. "You live in TH all year long. How do you earn so much from a foreign business?"

-

The Google translation refers to (A) "income due to work duties or business conducted abroad" or (B) "because of property". A) Section 40 of the revenue code: A1) Any of us is a tax resident of TH if we stay more than 180 days. Tax residency has nothing to do with the immigration status or the type of extension. A2) "Income derived from employment, whether in the form of salary, wage, per diem, bonus, bounty, gratuity, pension, house rent allowance, monetary value of rent-free residence provided by an employer, ..." "Pension" among all these types of income seems to refer to private pensions paid by an employer, (perhaps) not government pensions. The double-tax treaty between your country and TH regulates where government pensions and private pensions are taxable. In previous years, many retirees could not even get a Thai Tax ID even when they asked for one. B) Section 41 paragraph 2: capital gains, interest, dividends. "A resident of Thailand who in the previous tax year derived assessable income under Section 40 from an employment or from business carried on abroad or from a property situated abroad shall, upon bringing such assessable income into Thailand, pay tax." This decree does not change the current tax law, which only imposes tax on financial income if you transfer it into TH in the same calendar year when it was earned. Employment income is different - it's always taxable in TH if you earn it while you are in TH, even if you receive it from a foreign employer and park it in a foreign bank account. (C) Income tax on capital, i.e. on the savings you transfer from your foreign savings account to TH: No, cannot happen. If you transfer 5mil THB of savings to buy a condo and TH were to impose 25% income tax on the incoming 5mil, then the real estate market would implode. This decree does not change the tax law, which only taxes income but not the substance or capital. In the worst case, the revenue office may demand proof of how much financial income was included in the 5mil, e.g. 200,000 interest income in the months before it was transferred. Then they could impose a 5% tax on the 50,000 of interest that exceeds 150,000. That's not a new tax law. It was just not enforced. (D) TH has signed up for the Automatic Exchange of Information with most other countries. So if an account owner is registered with a TH residence address with his bank in the EU, ANZ or UK, then the TH revenue department will receive data about incoming payments the next year. In 2025, a foreigner who received a 2024 stream of payments from some Western business in his Western bank account may be asked to explain the source: "We've got these data from your foreign bank. Did you earn foreign business or employment income while you lived (and apparently worked) in TH?"

-

Starting this year, Thailand participates in the Automatic Information Exchange of bank data with almost all other countries. The foreign bank in which you receive your earnings will report your bank data to their national tax office in 2024, which will report it to the Thai tax office. At some point, TH will start to analyze these data and may ask how you generated this income while you spent 365 days in TH. If you work online from Thailand, even if all your customers are located offshore, you generate income that is taxable in TH.

-

The import permit is free, unlike the process at the airport. You just send the filled PDF form by email to the Department of Live Stock and get the reply email with the Notification for Import 1-3 days later. It's the easiest step of the process. Even if someone claims it is not required for a pet on the same flight (which I haven't read in any English-language guidance), you should send the email.

-

These are Thai regulations, not airline requirements. The airlines just check if your dog's documents are complete to avoid import problems at the destination.

-

times 4, that might be the tariff