samtam

-

Posts

3107 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by samtam

-

-

- Popular Post

22 minutes ago, snoop1130 said:“We have done our best, and the PM2.5 fine dust level fell by four to five times.”

Oh well, that was easy. Problem solved then! Just like Thaksin with Bangkok's traffic. And just like that...

-

6

6

-

1

1

-

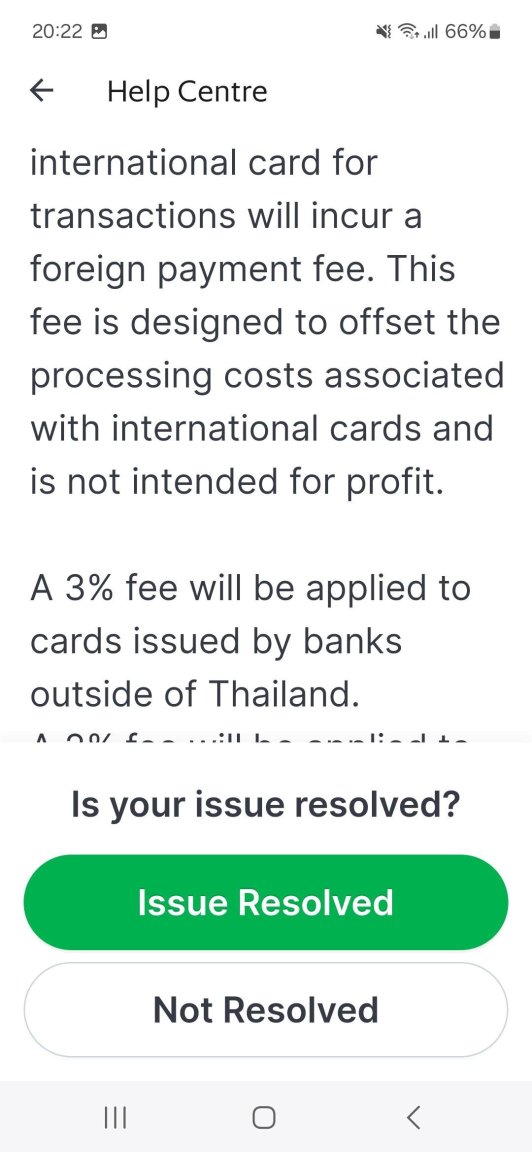

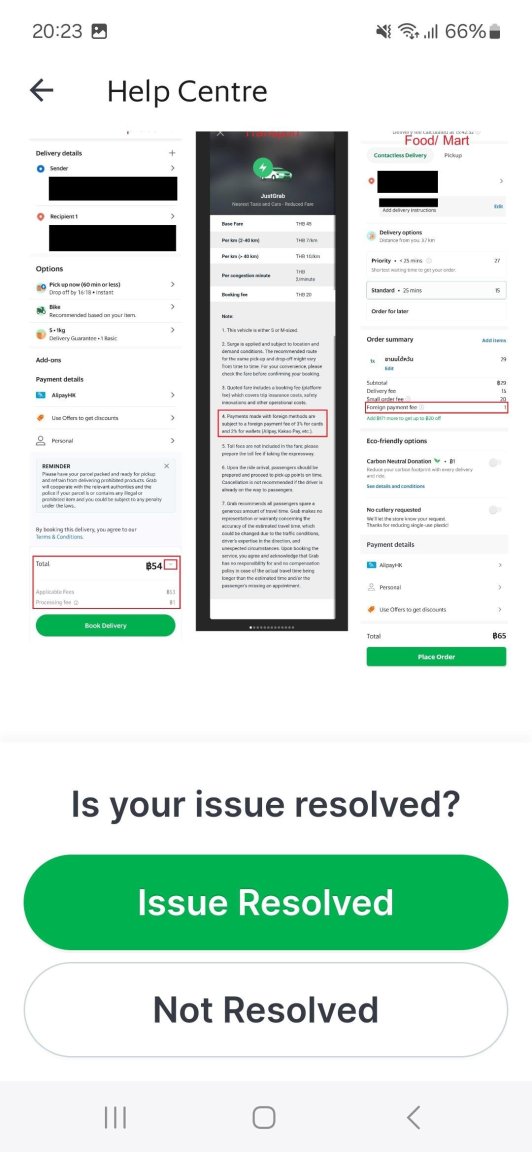

"....this fee is designed to offset the processing costs associated with international cards and is not intended for profit..."

I'm sure credit card companies like VISA and MasterCard will be delighted to have their business.

Presumably there are no processing costs for locally issued credit cards.

-

16 minutes ago, treetops said:

When did this happen or can anyone else confirm it? Are you sure it's not a fee from your bank?

I'm an infrequent Grab user but have my overseas credit card linked to my account and have never noticed any 3% surcharge.

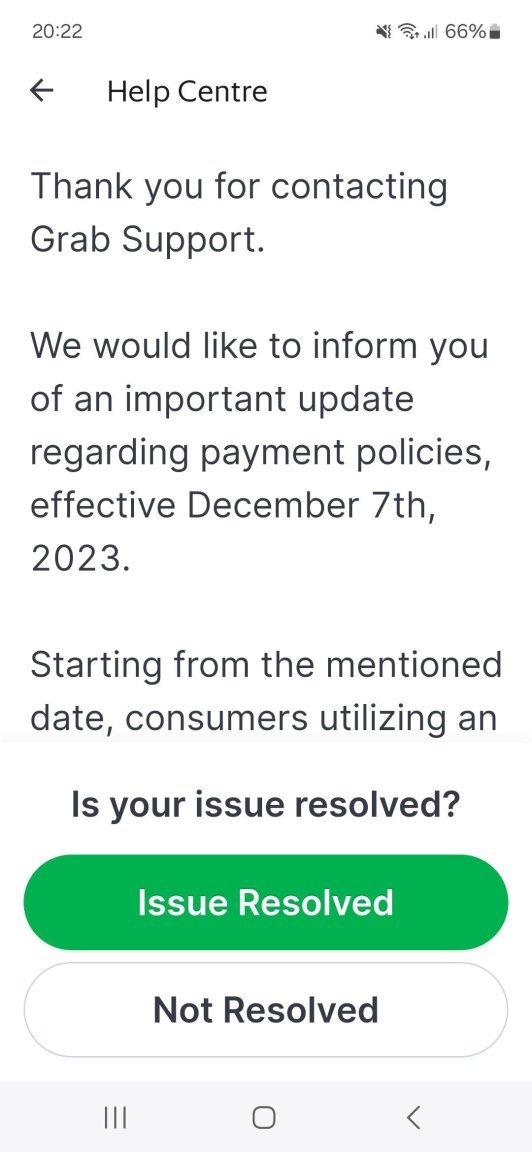

Per Grab's response to me today:

We would like to inform you of an important update regarding payment policies effective December 7th 2023.

Starting from the mentioned date, consumers utilizing an international card for transactions will incur....

-

1

1

-

-

37 minutes ago, Gaccha said:

The initial low prices were to grab (pun intended) market share. They were clearly not sustainable. And even with the current prices they are not earning a profit.

But it is fantastic that Grab exists since it breaks the local motorbike/car cartels, forces better behaviour of drivers, and gives more options to us.

Obviously not great news for drivers. It means low wages for them and they must achieve higher standards. I can only welcome them to the new world of neoliberalism!

When it's good, it's very good. When it's mediocre, it's a rip off. Unfortunately Grab do not seem to take criticism of their less than 5 star ratings with any degree of seriousness, despite their auto-generated blurb.

But I agree that it is nicer to avoid some of the truly awful taxis. But in their defence, the low flag fall is only ever going to produce sub par service, or worse. That too is by no means universal. Sometimes I've had better service from a taxi than from a Grab Premium ride, (the difference in car notwithstanding).

-

6 minutes ago, retarius said:

What did you expect exactly? Reduced competition is unlikely to bring down prices.

Thailand's business model. OK for the very big boys. Suffocate potentially good business.

-

1

1

-

1

1

-

-

1 hour ago, Pouatchee said:

i truly enjoy watching tv. but over the years i have found that the actors/actresses are more and more difficult to understand. they slur more, mumble with low voices and many actors arent even native english speakers. now i am watching true detective season 3 (as example) and i gotta have the subs on all the time. season 2 was just as bad with woody harelson and Matthew McConaughey drawling in texas accents. same goes for british tv... even more so cos much of what is being said on brit tv is colloquial and particular to england. any others struggling with this new generation of actors?

Yes, agree! No enunciation. As others have said, when regional English accents are used, the audience must be very limited. I'm British, but I have to put on subtitles to understand what is being said. Also dialogue very often includes very local phrases. In an attempt to be authentic, they have lost a large audience. But I dare say the same is true when you are in UK, the variation of accents is difficult to comprehend. American English has similar issues. It's subtitles for everything for me now, which proves some of the jargon, (when you see it written) is very specific to a very limited group of people.

-

2

2

-

-

Ever since Grab took over Uber it has dramatically increased its prices and in the case of Grab car, removed the points (unless you pay), added in a new 3% "foreign payment" fee, (a charge when the card you have registered is not issued in Thailand).

It seems obvious to me that the Grab car sector of their business is not really of interest to them, having demolished the competition. The usual business model, I suppose.

What I find objectionable is that changes only manifest themselves when you spot a change in billing or activity, through a plethora of information. All rather sneeky. Sometimes the quality of the car (in Premium) is so dire, it's just not worth it. They ask you to rate, but "this is certainly not the Grab experience we want you to have!" when you provide the reason for not giving 5 stars, I'm sure it goes straight into the file marked "bin".

Such a pity. Businesses thrive on a good reputation, but cynical loyalty programmes are a complete con.

Rant of the day.

-

4 hours ago, soi3eddie said:

This is more of a worry for those of us that have middle names. I can't remember ever using middle names on a flight ticket booking. Yet, of course my passport and Thai DL/ID have my middle names. If ticket is only first & last name, will they start denying boarding as with middle names missing it will considered a "mismatch"?

I have three "Christian" names as they used to be called, "first" names now. Back in the day I used to buy tickets with the name I am called by which is the second of my 3 Christian names + surname (or "family" name in today's parlance). All my airline memberships were also in this one name + surname. But now I have changed everything to my 3 Christian names + surname (as shown in my passport), with some difficulties with airlines making the change. It makes for some silly reproduction of the passenger name on tickets either self-print from online booking or boarding pass, so that the three Christian names are combined into 1, (no capitals), plus the surname. I imagine it must be a similar issue with long names, like Thais have, or Middle Easterners.

-

1

1

-

-

- Popular Post

1 hour ago, Thailand said:Dust!

Can someone please send this to the outlets that will shame the Thai government into actually doing something effective?

Top of this list for Thai government policy is "how will it affect tourism?". Bottom of the list is "how will it impact on the ordinary people who inhabit this once and sometimes beautiful land?".

-

3

3

-

1

1

-

3

3

-

On 9/21/2023 at 11:57 AM, K2938 said:

This does NOT confirm that foreign income REMITTED to Thailand will NOT be taxed which is the crucial question. Moreover, in the same fb thread further below the LTR people also repeatedly refused to answer what the situation will be concerning REMITTED foreign earnings. So they probably either do not want to clarify because the answer is bad or they just do not know.

Yes, too many uncertainties to make applying for LTR wealthy pensioner visa, not given definitive approval by RD to all the BOI / LTR responses.

On 9/22/2023 at 6:42 PM, K2938 said:On this fb thread the BOI now appears to have confirmed that for LTR visa holders foreign earnings regardless of their remittance stay tax-free:

Question: "????????????, ???????????? ???????????????? ???????????????????? ???????????????????????????? ???????????????????????? ???????????????????????????? ???????????????? ????????????????????????????????? That is really what is supposed to be taxed based on the new tax law changes, regardless of the time it is brought into Thailand. Please kindly also comment on this for LTR visa holders."

Answer BOI: "We would like to address that for the LTR tax benefits: the revenue department has already announced a royal decree to exempt the LTR- Wealthy Global/ Wealthy Pension/ Work from Thailand from paying the income tax derived from oversea business/ work and assets."

So if this is true, then this would be good news.As above. Need RD definitive comment.

On 10/7/2023 at 10:01 PM, Misty said:For LTR visas, the BoI has clarified that these three categories allow tax free transfers: GWC, P, WP. But the LTR Highly Skilled Professionals does not. Conversely, only one LTR visa has income tax capped at 17% - the LTR HSP. The other LTR visas all have the normal progressive income tax rates up to 35%.

As above. Need RD definitive comment.

On 1/9/2024 at 7:46 AM, SHA 2 BKK said:I really don't know.

But as I have the Wealthy Pensioner LTV and my only income comes from outside Thailand, I bring this in the year after it us earned, and according to Royal Decree 743 that income is Tax Exempt - my thinking is no. I doubt the Thai RD want a return where no tax is due (and I doubt there is a form to return as such).

No assessable income - no Thai Income Tax Return. And that seems to be the gist on the other tax threads where other Visa holders have asked similar.

I have asked the BOI but was told that the RD will clarify matters - that was some months ago.

Highly Skilled LTR Visa holders will have to lodge to claim their 17% - but that is income in Thailand and there is a special lodgement form for that.

As above. Need RD definitive comment.

As with others who have inquired directly to BOI about tax, I received this reply, (obviously translated from Classic Greek). Mangling the English so badly made me have to re-read this several times:

QuoteGreeting from LTR Visa Unit.While holding LTR Visa, all foreign income that transfer into Thailand will be exempted from tax.Please be informed that normally, your overseas income will be subject to Thai personal income tax only when you are a tax resident (staying in Thailand 180 days or more in a tax year) and have brought such overseas income into Thailand in the same tax year that you are a tax resident and have received such overseas income. Please refer to Section 41 of the Revenue Code. If the aforementioned conditions aren’t all met, your overseas income won’t be subject to Thai personal income tax and you won’t need personal income tax exemption under Royal Decree No. 743.

If those conditions are all met and you have been granted a Long-Term Resident Visa for Wealthy Global Citizens, Wealthy Pensioners, or Work-from-Thailand Professionals, you will receive personal income tax exemption on your overseas income under such Royal Decree even if you have brought overseas income into Thailand in the same tax year.

Under your category, The Department of revenue exempted assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad and brought into Thailand. (Foreign-sourced income will be tax exempted)

Royal Decree No.427 Link (Thai): https://www.rd.go.th/fileadmin/user_upload/kormor/newlaw/dg427KA.pdf

No.427 (English)

https://ltr.boi.go.th/documents/Notification-427.pdf

Royal Decree No.743 Link (Thai):

https://www.rd.go.th/fileadmin/user_upload/kormor/newlaw/dc743.pdf

No. 743 (English)

https://ltr.boi.go.th/documents/Royal-Decree-743.pdf

Kind regards,

LTR Visa Unityour overseas income will be subject to Thai personal income tax only when you are a tax resident (staying in Thailand 180 days or more in a tax year) and have brought such overseas income into Thailand in the same tax year that you are a tax resident and have received such overseas income.

Is that then contradicted by the following in the next paragraph:

If those conditions are all met and you have been granted a Long-Term Resident Visa for Wealthy Global Citizens, Wealthy Pensioners, or Work-from-Thailand Professionals, you will receive personal income tax exemption on your overseas income under such Royal Decree even if you have brought overseas income into Thailand in the same tax year.

Or does the second paragraph say that if you have an LTR for Wealthy Pensioner, then the old tax interpretation (pre September's announcement in 2023 from RD) will apply?

I'm just struggling with the way it's written in English, and also that BOI/LTR are giving their interpretation. I would rather wait until RD gives a definitive ruling.

I have read all the posts from page 75 (RD's announcement of their change in interpretation) to the latest, and was in the process of making an LTR application. But the uncertainties make this move seem premature. I can see the benefits of LTR for Wealthy Pensioners, but without definitive clarity on the RD position, I am reluctant to make the switch, (from Extension of Stay based on Retirement).

-

18 hours ago, KhunLA said:

Agree. I'd give a watch (simply for TH), but I can't stand one of the leads, Jennifer Coolidge. Doesn't even start till 2025

Spoiler alert....re Jennifer Coolidge.

-

- Popular Post

- Popular Post

21 minutes ago, snoop1130 said:HBO‘s The White Lotus announced yet another stunning A-list cast for its highly anticipated third season set in Thailand.

Parker Posey, Jason Isaacs, Leslie Bibb, Michelle Monaghan, Dom Hetrakul, and Tayme Thapthimthong are set to join the gripping comedy-drama, promising an explosive mix of talent and intrigue.

Season one’s Natasha Rothwell is making a comeback, reprising her Emmy-nominated role as the beleaguered luxury hotel masseuse Belinda. But that’s not all – buckle up as the new season, set to start production in Koh Samui, Phuket, and Bangkok next month, taking viewers on a satirical and humorous journey into death, eastern religion, and spirituality.

Parker Posey and Jason Isaacs are the latest additions to The White Lotus universe, joining Iron Man star Leslie Bibb, True Detective’s Michelle Monaghan, and Thai actors Dom Hetrakul and Tayme Thapthimthong. This powerhouse ensemble promises to elevate the already acclaimed series to new heights.

While exact plot details are being kept under wraps, creator and director Mike White hinted at a departure from the previous themes.

“The first season highlighted money, and the second season is all about sex.

“I think the third season will be a satirical and funny exploration of death, eastern religion, and spirituality.”

By Puntid Tantivangphaisal

Caption: Photo courtesy of Bangkok Post

Full story: The Thaiger 2024-01-09

- Cigna offers a range of visa-compliant plans that meet the minimum requirement of medical treatment, including COVID-19, up to THB 3m. For more information on all expat health insurance plans click here.

Get our Daily Newsletter - Click HERE to subscribe

Let's hope they can use CGI to pretend the sky is clear.

-

1

1

-

1

1

-

1

1

-

1

1

-

57 minutes ago, positivevibes said:

No big deal. If you can't hack it then go live in Canada or some other hellhole.

Yes, stay here and get a hacking cough!

-

1

1

-

-

32 minutes ago, sungod said:

I live over near Wongamat and Lovell school is my nearest station so look at it quite frequently. Not convinced the meter at Lovell school is working properly as it went offline over Christmas/new year, offline now (just checked) and when online the readings dont seem to alter. It was red the other day when the rest of Pattaya was yellow.

The AQI organisation data is frequently not working properly. Had similar issues with their reportings in November. I reported the inaccuracies (on the website). They shut off the ones that were completely out of whack. Typically, none of these things work properly, unless they are professionally monitored.

-

1

1

-

-

23 hours ago, Emdog said:

"The EOC’s objective is to collaborate with other agencies to keep a close watch on environmental conditions and health repercussions." As we all know, simply looking at a problem is enough to solve it.... not!

"Dr Opas emphasized the importance of addressing the root causes of PM2.5 pollution, which are primarily linked to vehicle emissions and industrial activities"

The AQI for Bangkok right now is 112. At Lovell school in Pattaya it is 153. Half of Pattaya is seashore, so little air pollution should come from the sea.... levels around Laem Chabang industrial are lower. Are there really more vehicles here than in Bangkok? Hmm air flow from field burning? You tell me

"... Ministry is moving towards renewable energy solutions, including the installation of solar panels and the future deployment of electric vehicles..." Such a pile of BS: why not simply say "We are going to do nothing"? California used to have abysmal smog & then got the political will to pass laws AND enforce them... Vehicle inspections and going after major polluters agricultural or industrial could make a difference. Gov is soooo pathetic and spineless. I guess saying "People get the governments they deserve" applies here

Agreed.....Greed. There is no political will to do anything. "Let them eat dust" as Marie Antoinette might have said from her ivory Petit Trianon.

The billions of visitors to Thailand that TAT and the Thai government want to attract are simply not coming to be gassed...unless they're having a gas.

-

1

1

-

-

On 1/8/2024 at 9:30 AM, sungod said:

'Impending Haze Crisis'

Its been with us a couple of weeks already.....

Yes, this "impending haze" just now @ 10.27 am AQI 176, down from 186 first thing.

-

2

2

-

-

2 hours ago, Presnock said:

we the resident here, I think they will eventually instruct us that we must have a Tax Number, and that to extend a stay in the country, we have to provide that tax number and money remitted into Thailand by a copy of one's bank book (s) and that local banks will need to provide names of resident aliens and then, we will need to also provide our income and any taxes paid to our home country. For me is is easy, just need to print out an additional page or two when I do my 1-year long stay extension. I have plenty of documentation from my US payers of my govt pension and the amount of taxes withheld by the government. I used to have to provide these same documents to immigration along with my Embassy letter which disappeared a few years ago.

Until they want it officially translated.

1 hour ago, Presnock said:well, since the ltr are supposedly under royal exemption, you shouldn't worry for 8 more years.

Tax exempt LTR under Royal Decree, until it's not.

-

5 hours ago, CharlieH said:

A SIMPLE GUIDE TO PERSONAL INCOME TAX IN THAILAND

8 January, 2024

Version 5

1. This guide has been compiled in an attempt to provide readers with the simplest possible over view of Personal Income Tax (PIT) in Thailand. The scope of this document is limited to PIT.

2. You may have heard that new tax laws came into effect on 1 January this year, in fact, that is not true! The old tax rules still exist and remain valid, albeit just one minor change to them was made in November last year. Previously, anyone who earned money overseas and remitted it to Thailand in a different tax year, received that money free of Thai tax. That loop hole in the Revenue Department (RD) tax code has been extensively exploited by wealthy Thai’s and is now closed, hence, any money earned overseas and remitted to Thailand in any year, is now liable to Thai tax. The purpose of the new rule is to reduce tax avoidance. Unfortunately, it now means that overseas funds transfers by foreigners living in Thailand, also have an increased risk of being taxed.

3. This guide is an overview of the core parts of the PIT system. It is not designed to be exhaustive and it doesn’t cover all aspects of PIT, nor is it intended to override anything produced by the Thai Revenue or specialist tax companies such as Sherrings or Mazzars. This guide also does not address all types of income or the rules relevant to people from every country. What this guide will provide is a starting point for readers to manage their own tax affairs and it will also provide most of the answers for those with simple tax affairs, especially the average pensioner.

4. There are also certain types of visa that fall outside of the RD tax code. The LTR visa for example received its tax exempt status by royal decree hence visa holders will not to be assessed for Thai tax and they are specifically excluded from this explanation.

5. Terminology: this document uses the word “assessable” often. Assessable in the context of this document means income that is liable to tax and must be included on a Thai tax return. Not all income is assessable, some is excluded from tax assessment by its very nature or because of the terms of a specific tax agreement.

6. Dual Tax Agreement/Double Tax Agreement (DTA): is an agreement between two countries that sets out which of the two countries has the right to tax specific types of income and all the associated rules. It’s purpose, in part, is to ensure that the same funds are not taxed twice and provides a means by which tax that is paid twice, can be recovered, how and from where. Note: If the taxpayer income is sourced in one country but the tax payer is resident in a second country, use of a DTA can result in increased tax being paid, if the second country has a higher rate of tax on the type of income in question, than the other.

7. If you stay in Thailand for more than a cumulative 180 days, between 1 January and 31 December each year, you will be considered to be Tax Resident in Thailand during that year, regardless of the type of visa you have. It doesn’t matter that you may be Tax Resident in your home country or elsewhere or that you pay tax in those countries, Thailand will still regard you as Tax Resident. Tax Residency and Immigration status (and the visa you hold) are different things. Tax residency is based solely on the number of days you spend in Thailand and where you are at midnight on each day.

8. Because you are Tax Resident, YOU must review your income each year to determine if it is regarded as assessable to tax in Thailand, nobody else will do this for you. If your income does not exceed 120,000 baht per year, you do not need to file a tax return (60,000 baht if your only income is bank interest paid to you by a bank in Thailand). If your income is over 120,000 baht per year, you must file a Thai tax return between 1 January and 31 March.

9. Your income in Thailand is defined as any money paid to you inside Thailand, as well as, any money you receive from overseas, both types are potentially assessable income for Tax Residents. There are many types of income that can be classed as assessable, the Thai RD lists some of them and is linked below, however, the list is not exhaustive:

https://sherrings.com/personal-income-tax-in-thailand.html

10. There are also classes or types of income that the RD does not regard as assessable and these are also linked below:

https://www.rd.go.th/english/37749.html

11. Income that is derived from within Thailand is fairly clear, if you work and have a job and you are a Tax Resident, your income is assessable for tax. Interest that is paid to you on Thai bank accounts is regarded as income, as is income from investments such as stocks and bonds within Thailand. You should note that if you are generating income by working while staying in Thailand, it is (and has always been) irrelevant where that money is paid and whether you bring the money into the country or keep it offshore. That money arises in Thailand hence it is taxable here.

12. It is not possible to give the same blanket rule to everyone to determine whether income is assessable or not because of the variable factors involved. Overseas income has to pass several tests to determine if it is assessable to Thai tax or not. It is still early days and all the rules are not yet clear. It has been said that tax residents who import funds from countries that have a DTA with Thailand, will not be effected. Exactly how that will work leaves many questions unanswered hence this document attempts to look at only the most popular types of income based on what is known at present. This document does not speculate as to what may happen in the future, other than in the segment at the end concerning likely future Immigration rules.

13. If we take the simplest type of income and say that you transfer personal savings from overseas to Thailand and those savings were earned before 1 January 2024, those funds are not assessable. But savings earned after that date are, hence the date when the income is earned is extremely important. A word of caution, you may be asked to provide proof that savings were earned before 1 January 2024.

14. Another common type of income is pensions, which can be complicated, depending on the type of pension and the country that it comes from. The country of origin is important because there are over 60 different types of Dual Tax Agreements, sometimes called Double Taxation Agreements (DTA’s), between Thailand and those 60+ countries and each one is different. As a general rule, most private or company pensions from most countries appear to be assessable here but YOU will need to confirm that yours is or is not. If that is true, private and company pension income IS assessable income in Thailand.

15. US Social Security payments, a form of pension paid to some older people, can only be taxed by the US under DTA rules and Thailand is forbidden from taxing them, this means those payments are NOT assessable income. UK State pension on the other hand is not covered by a DTA so it is assessable income in Thailand whilst UK Government or Civil Service pensions are not!

16. The proceeds from the sale of a capital item such as overseas property, where funds are remitted to Thailand, is one popular source of funds, the sale of some investment products such as stocks, shares and bonds is another. Those proceeds typically comprise two parts, capital and profit. If the capital was acquired before 1 January 2024, it is free of Thai tax. One way to separate capital and profit may bee to have an official valuation or statement that is dated 1 January 2024 since anything earned before that date, is not assessable. Also, if the profit has been the subject of a Capital Gains return in the home country, that also may be free of Thai tax but this cannot be guaranteed at this time, until things are made more clear and are once again subject to the terms of any DTA. YOU will need to review the DTA between Thailand and your home country to fully understand what particular clauses affect you.

17. It appears as though most property rental income that is remitted to Thailand is considered to be assessable income and is taxable here, unless of course it has been taxed in the home country and/or the DTA prohibits its taxation (which seems unlikely).

18. YOU are responsible for determining if your assessable income in Thailand exceeds the threshold and means you must file a tax return. That assessable income might comprise, pension payments, investment income, rental income or any of the other types of income listed in the link above. If you have assessable income of over 120,000 baht per year, you must file a tax return (60,000 baht if your sole source of assessable income is bank interest paid in Thailand).

19. Before you can file a tax return in Thailand, you need to acquire a Tax Identification Number or TIN from the RD offices in your area. You will need your passport, a valid and current visa or extension and in many areas, a Certificate of Residency from the Immigration Department.

20. Completing a tax return is a simple affair for most people, if you have difficulty, the Revenue Department staff are extremely helpful. Tax returns must be filed between 1 January and 30 March each year, if you file later than that, penalties will apply.

21. Thai tax is layered in bands and is payable based on the amount of assessable income that falls within each band and are shown and linked below:

Taxable Income per year(Baht) Tax rate

0 – 150,000 Exempt

150,000 – 300,000 5%

300,000 – 500,000 10%

500,000 – 750,000 15%

750,000 – 1,000,000 20%

1,000,000 – 2,000,000 25%

2,000,000 – 4,000,000 30%

Over 4,000,000 35%

https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Payroll/Personal-Income-Tax

22. The Thai tax system contains a series of Allowances, Deductions and Exemptions that will help you reduce your tax bill and they are very generous. It is easily possible for the average expat foreign retiree to reduce their taxable income by 500,000 baht or more each year. For example, a retiree aged 65 years of age, married and living here full time, supporting a Thai wife who has no income and doesn’t file tax return, is allowed the following:

a. Personal Allowance for self - 60,000

b. Personal Allowance for wife - 60,000

c. Over age 65 years exemption - 190,000

d. 50% of pension income received, up to 100k - 100,000

e. In addition, the first 150,000 of assessable income is zero rated and free of tax

23. Additional deductions and allowances exist for health or life insurance premiums paid in Thailand. A complete list of deductions, allowances and exemptions can be found here

https://www.rd.go.th/english/6045.html or from Sherrings below.

https://sherrings.com/personal-tax-deductions-allowances-thailand.html

24. The Thai Revenue tax filing system is online but is only available in Thai language at present. The tax forms are however available in English and they can be downloaded from the link below. CAUTION, the forms are updated every year and the 2023/24 forms for full year PIT are NOT yet available:

https://www.rd.go.th/english/63902.html

25. A simple sample completed tax form for a person aged over 65 years is shown below as a guide.

26. https://aseannow.com/topic/1312534-taxation-of-ex-pats-pensions-etc/?do=findComment&comment=18532562

27. Tax filing in Thailand is based on the honour system, it relies on you declaring all the right information every year and there are severe penalties for evading Thai tax. It would be foolish and a gross under estimation of RD capabilities to think that doing nothing and keeping a low profile means you should ignore Thai taxation. Very few sane people in the US and UK ignore the tax authorities who tend to have a long reach. It cannot be ruled out that at some point, a link may be established between tax filings and visa extensions. A law already exists that requires foreigners to apply for Tax Clearance Certificates before being allowed to depart the country but it is not being enforced currently. These things are possible because similar things have been adopted in several countries in the past, including the US.

28. There are several sources of detailed tax information and these web sites are linked below:

https://www.rd.go.th/english/6045.html

https://sherrings.com/personal-income-tax-in-thailand.html

https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Payroll/Personal-Income-Tax

*** END ***

Thanks to @Mike Lister for the contribution of this article.

Thank you for this. Whilst I do not doubt your intentions, and you qualify all of what you write under Clause 3:

Quote3. This guide is an overview of the core parts of the PIT system. It is not designed to be exhaustive and it doesn’t cover all aspects of PIT, nor is it intended to override anything produced by the Thai Revenue or specialist tax companies such as Sherrings or Mazzars. This guide also does not address all types of income or the rules relevant to people from every country. What this guide will provide is a starting point for readers to manage their own tax affairs and it will also provide most of the answers for those with simple tax affairs, especially the average pensioner.

it would be really really really helpful if RD could, after their promised "extensive discussions with stakeholders" issue something like this, and one of the tax companies you quote could refer to that. As far as I am aware none of these entities have done so. I realise you also acknowledge this. I have not yet hired a tax firm, but I am sure they are itching for business, which may be derived from this change in RD interpretation. Until they satisfy the foregoing, (a definitive guide), it would seem pointless, and costly.

I also realise that the law has not changed, just the interpretation, but it is unclear whether the changed interpretation can be implemented without a change in the law.

-

1

1

-

-

2 hours ago, Mike Lister said:

Loint return were phased out in 1992. :)

An excellent question that hasn't come up before, the answer is, I don't know! My strongest suspicion is that the 190k exemption can only be claimed once per tax return and that if both people want to claim it, they must file single returns. I will do some checking and try to come back to you with a definitive answer.

Thanks for raising a useful query.

In my case my partner and I have overseas joint accounts for everything. As our partnership is not recognised in Thailand, we will each file tax returns. As we're over 65, we will each have THB500K which is not taxable, (after allowances and zero rated sum).

How RD view co-mingled funds, on top of fungible capital accumulated over 40 years of partnership is beyond my ken. If you get a definitive answer on that, I'd welcome knowing it.

-

2

2

-

-

On 12/30/2023 at 6:31 PM, Doctor Tom said:

Take note; there are no pedestrian crossings in Thailand. They may be marked as such, some even have lights, but they are never safe. Like roundabouts, Thai's do not understand them .

1 hour ago, Artisi said:What's a zebra crossing, asking for a Thai friend 😉

Traffic lights are a year round Christmas decoration. Just a set of pretty lights in three colours.

-

Who did the "staging" for this photo? Lampshades in the wrong direction, (displayed differently in another photo); bed looks as though someone has just sat on it; a "throw" atop aptly named. Seems an unusual choice of room of his official residence to showcase.

Also, good choice to "live above the shop" and avoid worsening traffic by having a motorcade. How about improving traffic congestion whilst he at it?

Hardly a PR success.

-

2

2

-

-

- Popular Post

- Popular Post

12 minutes ago, The Cyclist said:My FCA opened when i was NR does not pay any interest.

I will be doing a round robin of my accounts next week to update passport details and I will be sure to let the banks know that I am now Resident for tax purposes and see what they have to say.

Perhaps the FCA will start to pay interest

Let me predict, (as it's New Year-ish): they wont have a clue.

-

1

1

-

1

1

-

2

2

-

- Popular Post

- Popular Post

4 minutes ago, Mike Lister said:Carrying this nonsense to its logical conclusion, if we absolutely must......so RD sees that person A, using card number X, bought an elephant in Thailand and asks if there were any other transactions also, maybe yes, maybe no. But since an elephant is a big ticket item and RD is concerned about financial impropriety and evasion, it asks Immi to run your name and birth date (both known at this stage) and Immi says, yep, we got a Mr A, born on that date and BTW, he has a long stay visa. Hmm says RD, I wonder, did he ever file a tax return.....whoa, he didn't, best get out the sherlock holmes kits, alert SWAT plus we'll need some rubber gloves.

And a re-enactment scene, with finger pointing.

-

3

3

-

16 hours ago, Etaoin Shrdlu said:

Why not give gays the right to be just as miserable as the rest of us?

Then we would have to be called "sads", (with apologies to Private Eye).

15 hours ago, mfd101 said:That would be logical, but TIT ... might require a further 10-year wait.

I'm torn between enjoying and dreading our arrival at the relevant office here in Prasat Surin and seeing the look of consternation on the faces of the clerks. "Thai only!"

That's exactly the detail that those of us in (UK) Civil Partnerships (or same sex marriages) want to know, but I suspect it will only apply to Thais with Thais or foreigners with Thais.

Pink Id card for foreigners

in Thai Visas, Residency, and Work Permits

Posted

I used my lawyer. Can't remember how much it cost. I was also applying for a Blue book, (I don't know why, as I'm not Thai), and a Yellow book. The whole process took about 2-3hrs, and I had to sign about 20-30 pages of what, I know not. My amphur is Thungmahamek, (Bangkok).

I could not have done either on my own, (B&Y books & ID).