LivinLOS

Advanced Member-

Posts

20475 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Everything posted by LivinLOS

-

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Provide a Thai tax number and or Thai tax return. Not hard. Almost all UK retirees resident here should not be paying taxes back to the UK on their pensions. The 'I pay my taxes back there' or 'its protected by my DTA' is miss informed and should be corrected when posted. That isnt how it 'should' be. How Thailand treats this is open to interpretation, they may accept it, it may have tax credits, or it may require claiming it back from the UK. Thats the level of detail we do not yet have. -

Health Ministry approves medical use of opium and magic mushrooms

LivinLOS replied to webfact's topic in Thailand News

Both of those are on many download sites and really deserve watching, both very powerful documentaries. -

Health Ministry approves medical use of opium and magic mushrooms

LivinLOS replied to webfact's topic in Thailand News

-

Health Ministry approves medical use of opium and magic mushrooms

LivinLOS replied to webfact's topic in Thailand News

e -

Health Ministry approves medical use of opium and magic mushrooms

LivinLOS replied to webfact's topic in Thailand News

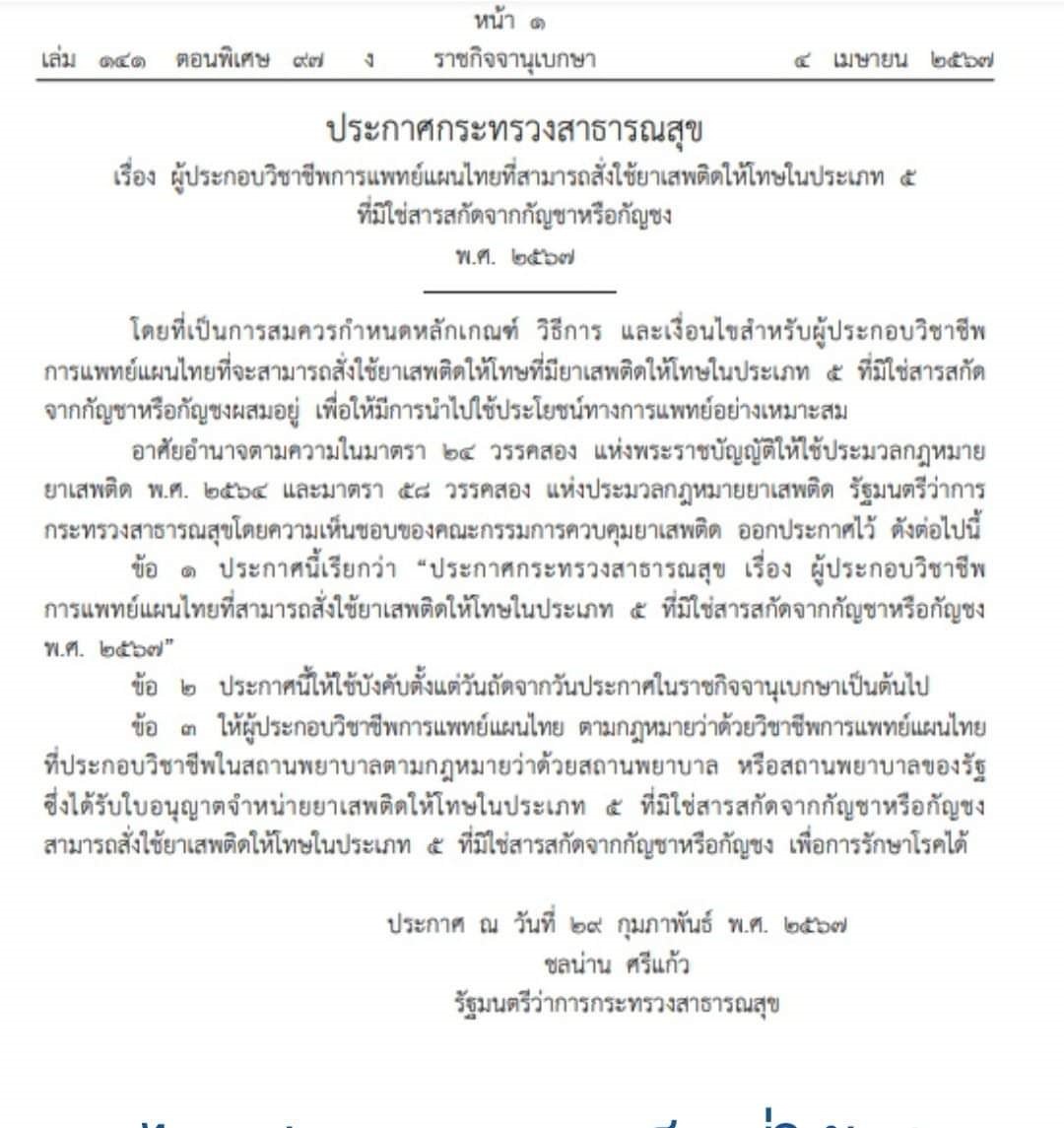

So just for a frame of reference, this was published 4th, I was alerted 6th and Mon the 8th I was at a local traditional medicine clinic to discuss with the owner (not Dr, the Dr was not there) as soon as it opened. To be fair, she was not knowledgable as to even what mushrooms do. She is a businesswoman who believes that cannabis flowers will be rescheduled later this year and has set up a clinic and supply infrastructure to be able to 'sell' cannabis medically when that happens. No issue with that but clearly her motivation is profit and not medical care. Within a minute or two of meeting she emphasized she 'didnt take drugs' which in many ways sums up the mindset of what medical cannabis or mushrooms are. We talked the law, and the issues, and I tried to discuss the risks and how psychedelic therapy is generally handled in the west. Each point of resistance was just brushed aside with a yes yes that is fine.. I tried to explain that generally a therapy like this is much more than simply giving the dose but should have a therapy component before and after 'yes yes my Dr can do that' 'oh really, so your Dr has experience taking psychedelics' 'Oh NO !!' 'hmmm ok.. So your Dr can speak English ?' 'little bit' Right so I can only imagine the kind of sensative therapy and cross cultural understanding there would be to handle a challanging psychedelic experience and then deal with the post experience integration !! From a DR that speaks 'nidnoi' english and has never taken them !! Secondly she appeared to have very little idea of even what mushrooms do !! When I asked why someone could be prescribed mushrooms her answer was 'if depressed or maybe can not sleep' !! (mushrooms for insomnia !!) when I asked what dosage she thought was right she said 'maybe a gram' the more I talked to her the more is appeared that she thought mushrooms were 'something like weed' a bit made you sleepy, a bit more made you more sleepy.. This is the level of understanding from the owner of a clinic that is supposed to adminsiter these therapies !! I am a STRONG believer in the power of properly adminsitered psychedelic therapy, but it has genuine risks of patient harm and needs a trained, educated and experienced sitter or guide and to achieve the most beneficial outcomes requires skilled therapists. I am seriously thinking of setting up a non profit to deal with guide training, I know western guides operating underground already here in Thailand and Thais some of whom have even been trained overseas by MAPS and in the caribbean. Someone has to put in work on this or the opportunity will be wasted when bad things happen. -

Health Ministry approves medical use of opium and magic mushrooms

LivinLOS replied to webfact's topic in Thailand News

I have spent 2 weeks dealing with the MoPH over this, I am probably 100 hours into fighting against zero understanding... Everyone is clueless. In fact many have outright denied the law is the law even after me giving it to them to read. The law was Published on the 4th April in the Royal gazette. I was alerted to it by a Herbal clinic owner I am working with on the 6th of April and I have since then put in perhaps 50 hours of work trying to get information from MoPH in bangkok / Chiang Mai, etc etc. The blunt fact is no one knows and many of the interactions have been borderline hostile simply for asking 'is this the law'. One person at the MoPH in Bangkok actually said after I showed them the law 'it is the law but we do not accept it', when I asked what they meant by that they just got angry and refused to continue. The pereception of mushrooms as a medicine is not there. On Tuesday this week I finally found someone in authority that knew what they were talking about, after being sent from hospital to hospital and office to office just getting insane looks. On this day I was referred to an appointment with the manager of the consumer protection dept at the MoPH in Chiang Mai, the only person above her in the CM hierachy is the regional director, it is her duty to control the processes around the Herbal Clinics and ensure that rules are followed. She took all the info, made some checks, and confirmed this is now the law, but was exasperated that this has been done without any staged roll out and preparation. Thai traditional medical clinics with a regsitered Herbalist Dr can now prescribe magic mushrooms. This has been rolled out with no education, training, and done so country wide for all herbalist clinics, if they have knowledge or not. At this time no one can explain 'where' the herbal clinics are supposed to source the mushrooms, if they can grow them themselves, or if they can be dispensed for offsite medication or only onsite consumption (the law is vague here). I have a meeting monday to address this but frankly no one has a clue (more on this in a monent). There are no guidelines or guidance for what grounds there are for prescription and zero understanding of theraputic use, preparation, set setting and integration. The risks in this style of launch are huge and this should not be handled as cannabis was in a 'let it happen and see what happens' the risk for patient harm is too great. I have already set up video meetings with MAPS in the states and am in comms with the Beckley foundation in the UK for assistance. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Had not heard of that scheme, will have to have a google and read. I recall my good friend of some years back actually sold his uk letting apartments in large part because of the continual tax obligations and reporting. But the point about pensions is the key part, the idea that somehow pensions are always UK source income and always taxed at source in the UK isnt correct. Most British citizens resident in Thailand will be able to qualify for 100% tax relief, via the P85 and NT code structure and pay no UK taxes on UK pensions (and as usual some niche cases will have to, Armed forces etc). -

Registering a .th domain without a company (or trademark)

LivinLOS replied to LivinLOS's topic in IT and Computers

Thanks, will try to grab an in.th later today. I actually want an or.th as am considering a non profit but I need to research that whole topic deeper as to how heavy the costs of such a venture may be. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Only income that comes from a fixed UK asset. Eg rental returns, forestry income, etc etc are always taxed at source as they arise from a UK based physical asset. UK employment depends on multile factors (location and residency at the time of the engagement, permanent establishment of the employer, etc but again is not 'always' UK (despite what the UK tax man tries to imply and make people believe) i have paid 100s of employee payrolls per week, 1000s of men a year, all UK employees, and the income tax was not paid in UK. Once a P85 is filed for non residence, you simply obtain an NT tax code and pensions (not armed forces or civil servants) are then not UK taxed. A successful application to HMRC would result in a change to your tax code, with an ‘NT’ Tax Code, applied as a non-resident. Your pension trustee would receive confirmation from HMRC of the change and income should be paid gross, without any tax deducted. https://www.forthcapital.com/articles/uk-pension-income-for-expats-where-do-you-pay-tax-and-what-is-an-nt-tax-code -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

First file P85.. Second get NT tax code (based on that fact). Then UK pensions are tax free.. UNLESS its an armed forces or senior civil servant pension. Pension income is NOT 'domestic source' income like rental returns etc, it is not arising from a fixed UK asset. How can I receive my UK pension overseas without paying tax in the UK? Non-UK residents can apply directly to HMRC to obtain an NT code. What is an NT code? The NT stands for “nil-tax” and means that an individual is exempt from paying income tax on that specific income. In the case of non-residents this is because they are liable for tax in another country and, as per existing double-tax agreements between their country of residence and the UK, they are exempt from tax in the UK. https://valiant-wealth.com/how-will-my-uk-pension-be-taxed-if-i-live-overseas/ -

I have a need for a Thai domain name, the in.th would be acceptable and is for individuals. Various info pages say you must provide an ID to prove address, I have yellow book, Pink ID and of course a driving license, held for decades. Can a non Thai citizen register a domain as a person this way ?? I appreciate the co.th domains need either a domestic company or a regsitered trademark here or overseas, I actually prefer not to use a co.th anyway. Anyone done this ? any feedback ?

-

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

No it is not.. I am unsure why people repeat and believe this, the information is easy to check online. https://www.gov.uk/state-pension-if-you-retire-abroad/tax-on-your-state-pension https://www.gov.uk/tax-uk-income-live-abroad When tax is not due or is already deducted Non-residents do not usually pay UK tax on: the State Pension interest from UK government securities (‘gilts’) If you live abroad and are employed in the UK, your tax is calculated automatically on the days you work in the UK. Income Tax is no longer automatically taken from interest on savings and investments. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Yes that should remain cear under the jan 1 2024 prior savings rules.. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Still needed but it becomes a 365 day report 😉 it becomes once per year if you dont travel. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

That may be the case for USA expats, thier DTA states it and I think from memory canada also. This is not the case for UK expats, and most EU countries whose DTAs I looked at, actually many scandivanian expats choose to pay taxes here at a lower rate than in thier home countries. In the case of the UK pensions only remain UK domestic source income for non residents on armed forces pensions and some civil servant pensions. The rest, both state and private pensions stop being UK taxable after a P85 filing. Paying taxes 'back home' is user error, not the correct use of the system, of course th UK doesnt exactly remind folks fo that and even incenivises not doing so (index linking, healthcare access etc). -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

For 4 years I filed zero returns, to the absolute bafflement of the revenue dept.. My reasons where I had bsuiness activity in UK and europe and was having to file in UK, Netherlands, and Ireland, I still do in 2 of those.. I needed be sure my home country filing was fully up to spec so that if demaned I could show it there, I had good earnings in each of those countries and claimed non residence there for tax remissions. To claim tax relief on large sums there but not have a home country tax return I could show was a much bigger risk than just forcing them to take the zero return. I admit it was odd, they appeared to never having seen anyone file 0 without Thai employment, work permit, and domestic source income. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Yes LTR visas are 0 rated for overseas income tax.. Exactly why I am transitioning to an LTR visa. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Because up to Jan 1st if they said thay all you had to reply was 'no this is savings from last tax year' as they cant look into your overseas bank t prove your liability, you had none. Now that changes, this year is pretty easy to argue the same, but as year by year goes by, the credibility of that argument becomes weaker.. In 2030 if you want to say you have lived off only savings, not investment returns for the last 6 years, proving that gets harder and harder.. Of course all this likely falls into the 'too hard' category.. But everyone now needs to be concious of it.. People using income, pension or otherwise for extensions are much more at early risk. They are the low hanging fruit on this. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Yes.. The issue revolves around what can be proven to be non-asseable and also how Thailand treats taxes paid where they should not have been. If nothing else this recent tweak of the rules has shown how few expats have a clue what they should do when they stop being resident of thier home countries and many have been paying taxes for years even decades for no reason at all. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

That will depend on if you 'should' pay tax in your homne country.. If you filed a P85 when you became non resident of the uk, you shouldnt be paying taxes there. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

Yeah pretty much.. Before they did not ask because a simple 'its last years savings' was the solution.. New they can ask and you need a better reason.. Theres still plenty of potential reasons, and a total lack of clarity about whch ones they may accept, how they view taxes paid elsewhere and tax credits, etc etc. But the possibility of needing to justify them is on the table, and if there is undeclared income in thier eyes, its 200% with the penalty. Guys who use the income method for extensions are signing a possible liability and handing it over, I cannot imagine that in a few years time a future government doesnt decide it just doesnt want that free tax revenue. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

You seem to be purposefully not understanding the issue. In the past inbound funds could always have been claimed to be prior years savings, and as Thailand had no ability to determine that or not it was all ignored. Since Jan 1 inbound funds no longer can be written off as simply offshore savings from past years, and hence all inbound funds are potentially taxable here unless we can show them to be one of the multiple reasons why not eg correctly taxed under a DTA, prior savings, etc etc etc etc Without the loophole they fall into default taxable unless justifed not taxable, with the loophole as anyone could claim anything was prior savings and untaxable they simply didnt ask. If they choose to implement this is anyones guess, my gut is it is far too hard a task for regional tax officrs to be skilled in understanding 67 DTAs, sources of income, what is domestic sourced income etc.. But tax clearanes for extensions of stay renewals ?? Things that add friction and cost money ?? maybe.. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

https://msnagroup.com/thai-personal-income-tax-penalty-and-surcharge/ Believe what you like, those are simply the facts -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

And this may now need to be proven.. That what has changed, the shift from not needing to prove anything, now becomes needing to establish it is NOT taxable by showing that it was prior savings, DTA covered, etc... There are plenty of reasons why an inbound transfer isnt taxable income, but now they may demand that it is proven that it is not taxable income, a task we have not in the past had to do. -

Foreigners and their overseas income: what next?

LivinLOS replied to webfact's topic in Thailand News

All inbound funds are 'potentially' income and may need to be justfied (DTA covered, prior tax paid, savings prior Jan 1, etc etc) to prove they are not. Before Jan 1 inbounds possibly were 'savings' under the old loophole and Revenue had no way to really dig into it, so never bothered. The onus on the burden of proof now changes, if they choose to enforce the rules stritctly.