LivinLOS

-

Posts

20483 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by LivinLOS

-

-

First 2 registrars I have attempted both claim I need a work permit. I have found ones which dont seem to require this but want 80 usd instead of 360 baht !!

Can anyone confirm if a work permit is a genuine requirement, when a yellow house book can be presented ??

Or can provide a registrar for reasonable money (1000b ??) that will offer an in.th domain to a non Thai with Pink ID, Yellow Book, etc. -

1 hour ago, Mike Lister said:

I'm sorry but what you wrote is not correct!

The rule change (or reinterpretation of the rules) has been made last year and is in effect from 1 January 2024 and everyone is obliged to adhere to it, Thais and foreigners. Everyone is obliged to follow those rules, there is absolutely no doubt whatsoever about that.

What is in question is two things:

1) the precise rules and processes that TRD will adopt for all types of income from all countries, that is what many of us are attempting to discover presently.

2) The degree to which the TRD will follow up and audit individuals for conformance to the new rules. This may not become fully apparent for a couple of years. The risk is that some people will adopt a wait and see attitude and when no major announcement is forthcoming they may be lulled into a false sense of security and believe the new rules have been scrapped when really they have been operationalised since 1 January 2024.

How you handle this rule change is you choice but it is not true and is very misleading to say that just because all the details are not known currently, it hasn't happened and will not happen. If this rule change is ever walked back, everyone will hear that news, quite unmistakably.

Isnt that saying exactly what I said ??

The rules are now technically in force, however we have no actual idea how those rules will really be enforced or implemented given the complex nature of overseas income streams, DTAs, past taxation liabilities, etc. In reality we do not know if any actual enforcement of the process at all will be attempted next year.

What specifically did I claim that you feel is not correct ? -

Yaba daba dont !!

-

2 hours ago, MartinBangkok said:

LivinLOS, are you in a state of denial or have you been asleep the last 10 months.

This is exactly what has happened already!

No we dont.

Until next year when the first of these tax returns will be due, we have no idea how intently the Thai Revenue will attempt to pursue non Thais over 2024 remittances.

We have no idea if..- they will demand proof that inbound remittances were prior saved before Jan 1.

- how they will treat provable offshore savings from Jan 1 2024 over the following years / drawdowns.

- what the levels of proof that this may be, the denial of comingled future assets, the chain of custody of funds implications.

- they will demand proof that inbound remittances have been tax paid elsewhere.

- they will accept that tax paid elsewhere (incorrectly) is allowed as a credit here.

- they demand that tax incorrectly paid elsewhere is reclaimed under DTA and remitted here.

- even the most basic of 'need to file' is debatable if a liability is uncertain, and almost all non Thais incomes would be in the uncertain category.

The potential for this to all fall into the 'too hard to administer' basket, when only 4m out of 67m Thais even pay income tax, especially at first, is IMO quite large. Over time, as the systems become more developed, I am sure filing will be more common and I am sure some expats will even opt to pay here as it can save them taxes in other places.

But pretending that this has happened already or that we know how the varous local revenues will seek to enforce this is simply false. Until next years filing deadlines, no one really knows what they will do in practice. Be prepared, have answers and a plan but dont be too panic'ed by it would be my position.-

1

1

-

1 hour ago, Luuk Chaai said:

...and who in that ministry owns land in the Golden Triangle ?

and come to think of it .. 2rai of land on my road just got sold to 2 young men who say they will be growing mushrooms..

and there is plenty of cow pie in the area

Cubensus mushrooms are grown in a controlled indoor environment, its a factory looking space not a garden.

-

7 hours ago, NaaKap said:

Exactly what I was thinking. The bluster for legalisation of cannibis came with the disclaimer that it was for medical use. Didn't realise Khao San Rd was a hospital.

But in that case it became descheduled so it had no controls at all. In this case they have redefined who can prescribe, namely the system of Thai Traditional Medicine and the registered Herbalist Dr's which is a totally different form of control.

The problem I have is that the people charged with handling this, seem utterly clueless in the responsibility they have been given. -

6 hours ago, Bday Prang said:

What are the "sitters and guides" for?

Primarily for harm reduction. People have challenging experiences, and in extreme cases those challenging experiences can mentally scar the person long term and create trauma. The goal of therputic work is to be able to process and deal with the things those challenging experiences bring up, and allow the person to change how they think about the issues they have often supressed. Establishing a safe trusting space and being a calming understanding presence through the experience is very often all that is needed to ensure that a small moment of panic doesnt spiral into a larger more damaging meltdown. Also by ensuring a safe uninterupted environment you reduce external triggers and stimulus which can cause that initial thought pattern. The goal of ensuring patient safety and maximising the potential positives of the experience is what 'guides and sitters' can do. Of course the more mental baggage a participant has that they are seeking to address, the more risk of those issues surfacing and being part of that challenging experience.

Current theorys on the mechanisms of how this works, via the dissolution of the default mode network and the neuroplasticity that psychedelic experiences appear to generate are less important personally than the fact that this does measurably seem to happen. The use of psychedelics as tools for self improvement, even on basic things like 'I needs to improve my diet / fitness / health' or for people trying to reduce drinking or smoking. Evidence is showing there is no better tool for habit modulation, but they do come with risk and that risk is what needs cautious management.

If Thailand goes the route it is apparently going, where mushrooms will be dispensed by Herbal Drs with zero knowledge or understanding, then patient harm and negative experiences will happen at a far greater ratio than they need to. Guidelines for beneficial use and guidance, as well as direct personal experience of what the patient may be going through is totally lacking in the Thai Traditional Medicine system that is now allowed to prescribe them. Thailand doesnt really have much indigenous or cultural use, there are not really Shamans to speak of like in S America where this is culturally understood. My experiences this last 2 weeks is the medical, psychiatric, and herbalist community have a near zero understand of what these do, others than 'mao' of some form. -

5 hours ago, topt said:

Thanks for the link -

Not as simple as you are alluding however

Provide a Thai tax number and or Thai tax return. Not hard.

Almost all UK retirees resident here should not be paying taxes back to the UK on their pensions. The 'I pay my taxes back there' or 'its protected by my DTA' is miss informed and should be corrected when posted. That isnt how it 'should' be.

How Thailand treats this is open to interpretation, they may accept it, it may have tax credits, or it may require claiming it back from the UK. Thats the level of detail we do not yet have.-

1

1

-

-

Both of those are on many download sites and really deserve watching, both very powerful documentaries.

-

-

-

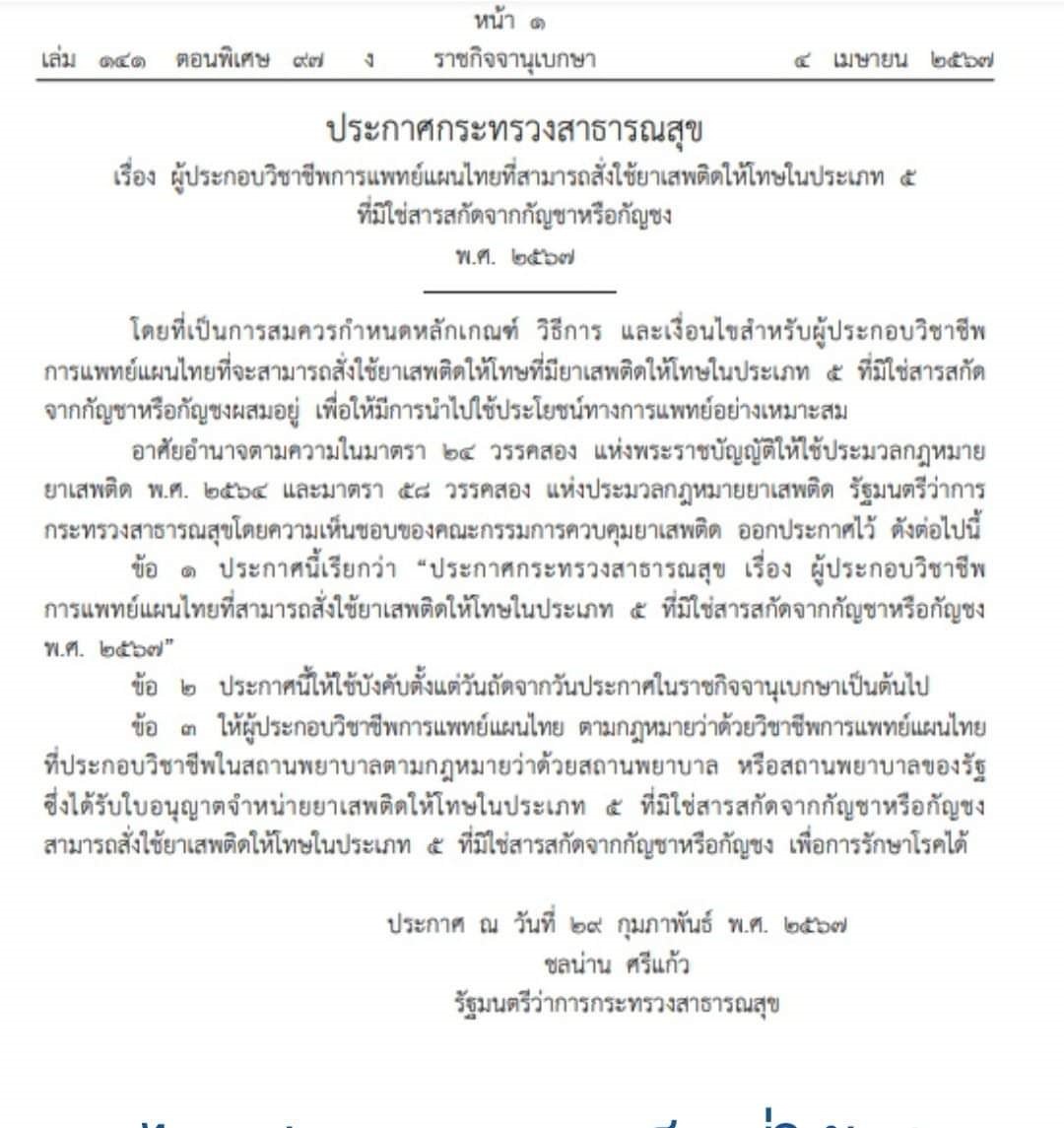

So just for a frame of reference, this was published 4th, I was alerted 6th and Mon the 8th I was at a local traditional medicine clinic to discuss with the owner (not Dr, the Dr was not there) as soon as it opened.

To be fair, she was not knowledgable as to even what mushrooms do. She is a businesswoman who believes that cannabis flowers will be rescheduled later this year and has set up a clinic and supply infrastructure to be able to 'sell' cannabis medically when that happens. No issue with that but clearly her motivation is profit and not medical care. Within a minute or two of meeting she emphasized she 'didnt take drugs' which in many ways sums up the mindset of what medical cannabis or mushrooms are.

We talked the law, and the issues, and I tried to discuss the risks and how psychedelic therapy is generally handled in the west. Each point of resistance was just brushed aside with a yes yes that is fine.. I tried to explain that generally a therapy like this is much more than simply giving the dose but should have a therapy component before and after

'yes yes my Dr can do that'

'oh really, so your Dr has experience taking psychedelics'

'Oh NO !!'

'hmmm ok.. So your Dr can speak English ?''little bit'

Right so I can only imagine the kind of sensative therapy and cross cultural understanding there would be to handle a challanging psychedelic experience and then deal with the post experience integration !! From a DR that speaks 'nidnoi' english and has never taken them !!

Secondly she appeared to have very little idea of even what mushrooms do !! When I asked why someone could be prescribed mushrooms her answer was 'if depressed or maybe can not sleep' !! (mushrooms for insomnia !!) when I asked what dosage she thought was right she said 'maybe a gram' the more I talked to her the more is appeared that she thought mushrooms were 'something like weed' a bit made you sleepy, a bit more made you more sleepy..

This is the level of understanding from the owner of a clinic that is supposed to adminsiter these therapies !! I am a STRONG believer in the power of properly adminsitered psychedelic therapy, but it has genuine risks of patient harm and needs a trained, educated and experienced sitter or guide and to achieve the most beneficial outcomes requires skilled therapists. I am seriously thinking of setting up a non profit to deal with guide training, I know western guides operating underground already here in Thailand and Thais some of whom have even been trained overseas by MAPS and in the caribbean. Someone has to put in work on this or the opportunity will be wasted when bad things happen.

-

I have spent 2 weeks dealing with the MoPH over this, I am probably 100 hours into fighting against zero understanding... Everyone is clueless. In fact many have outright denied the law is the law even after me giving it to them to read.

The law was Published on the 4th April in the Royal gazette. I was alerted to it by a Herbal clinic owner I am working with on the 6th of April and I have since then put in perhaps 50 hours of work trying to get information from MoPH in bangkok / Chiang Mai, etc etc. The blunt fact is no one knows and many of the interactions have been borderline hostile simply for asking 'is this the law'. One person at the MoPH in Bangkok actually said after I showed them the law 'it is the law but we do not accept it', when I asked what they meant by that they just got angry and refused to continue. The pereception of mushrooms as a medicine is not there.

On Tuesday this week I finally found someone in authority that knew what they were talking about, after being sent from hospital to hospital and office to office just getting insane looks. On this day I was referred to an appointment with the manager of the consumer protection dept at the MoPH in Chiang Mai, the only person above her in the CM hierachy is the regional director, it is her duty to control the processes around the Herbal Clinics and ensure that rules are followed. She took all the info, made some checks, and confirmed this is now the law, but was exasperated that this has been done without any staged roll out and preparation. Thai traditional medical clinics with a regsitered Herbalist Dr can now prescribe magic mushrooms. This has been rolled out with no education, training, and done so country wide for all herbalist clinics, if they have knowledge or not.

At this time no one can explain 'where' the herbal clinics are supposed to source the mushrooms, if they can grow them themselves, or if they can be dispensed for offsite medication or only onsite consumption (the law is vague here). I have a meeting monday to address this but frankly no one has a clue (more on this in a monent). There are no guidelines or guidance for what grounds there are for prescription and zero understanding of theraputic use, preparation, set setting and integration. The risks in this style of launch are huge and this should not be handled as cannabis was in a 'let it happen and see what happens' the risk for patient harm is too great.

I have already set up video meetings with MAPS in the states and am in comms with the Beckley foundation in the UK for assistance.

-

1

1

-

1

1

-

-

7 minutes ago, Mike Lister said:

Yes, OK, agreed. A minor but not pedantic point on this is that not all UK fixed assets are taxed at source, property rental income can be received gross of tax under the Overseas Landlord Scheme, mine is. All of which confirms yet again, how difficult it is to make a single statement about tax rules anywhere and that there are always exceptions.

Had not heard of that scheme, will have to have a google and read. I recall my good friend of some years back actually sold his uk letting apartments in large part because of the continual tax obligations and reporting.

But the point about pensions is the key part, the idea that somehow pensions are always UK source income and always taxed at source in the UK isnt correct. Most British citizens resident in Thailand will be able to qualify for 100% tax relief, via the P85 and NT code structure and pay no UK taxes on UK pensions (and as usual some niche cases will have to, Armed forces etc). -

Thanks, will try to grab an in.th later today.

I actually want an or.th as am considering a non profit but I need to research that whole topic deeper as to how heavy the costs of such a venture may be. -

On 4/5/2024 at 11:46 AM, Mike Lister said:

For UK citizens, income that arises in the UK is taxable in the UK. If that income falls within the Personal Allowance then it will be zero rated. But if the State Pension should exceed the PA, (a political bombshell for whoever decided to make that happen), it will be taxable in the UK, under existing rules.

Only income that comes from a fixed UK asset. Eg rental returns, forestry income, etc etc are always taxed at source as they arise from a UK based physical asset. UK employment depends on multile factors (location and residency at the time of the engagement, permanent establishment of the employer, etc but again is not 'always' UK (despite what the UK tax man tries to imply and make people believe) i have paid 100s of employee payrolls per week, 1000s of men a year, all UK employees, and the income tax was not paid in UK.

Once a P85 is filed for non residence, you simply obtain an NT tax code and pensions (not armed forces or civil servants) are then not UK taxed.

A successful application to HMRC would result in a change to your tax code, with an ‘NT’ Tax Code, applied as a non-resident. Your pension trustee would receive confirmation from HMRC of the change and income should be paid gross, without any tax deducted.

https://www.forthcapital.com/articles/uk-pension-income-for-expats-where-do-you-pay-tax-and-what-is-an-nt-tax-code

-

On 4/6/2024 at 5:39 PM, topt said:

I am surprised no one else has pulled you up on this as, unless I am misunderstanding what you are saying, potentially you are completely wrong......

Private pensions are taxable in the UK for a non resident irrespective of filing a P85. The only way you avoid tax on a private pension paid in the UK is if you take it offshore or the combined amount is less than the personal allowance. The state pension may be zero rated but is added to the total of income so effectively counts for your total tax base.

Any property rental amounts are also taxable and again a P85 has nothing to do with it.

You could start here - https://www.gov.uk/tax-uk-income-live-abroad

P85 detail - https://www.gov.uk/guidance/get-your-income-tax-right-if-youre-leaving-the-uk-p85

Please show me I am wrong........

First file P85.. Second get NT tax code (based on that fact).

Then UK pensions are tax free.. UNLESS its an armed forces or senior civil servant pension. Pension income is NOT 'domestic source' income like rental returns etc, it is not arising from a fixed UK asset.

How can I receive my UK pension overseas without paying tax in the UK?

Non-UK residents can apply directly to HMRC to obtain an NT code.

What is an NT code?

The NT stands for “nil-tax” and means that an individual is exempt from paying income tax on that specific income. In the case of non-residents this is because they are liable for tax in another country and, as per existing double-tax agreements between their country of residence and the UK, they are exempt from tax in the UK.

https://valiant-wealth.com/how-will-my-uk-pension-be-taxed-if-i-live-overseas/ -

I have a need for a Thai domain name, the in.th would be acceptable and is for individuals.

Various info pages say you must provide an ID to prove address, I have yellow book, Pink ID and of course a driving license, held for decades.

Can a non Thai citizen register a domain as a person this way ?? I appreciate the co.th domains need either a domestic company or a regsitered trademark here or overseas, I actually prefer not to use a co.th anyway.

Anyone done this ? any feedback ?

-

20 minutes ago, spambot said:

With the proviso - UK government state pension remain liable to tax in the UK no matter where you are resident.

No it is not.. I am unsure why people repeat and believe this, the information is easy to check online.

https://www.gov.uk/state-pension-if-you-retire-abroad/tax-on-your-state-pension

https://www.gov.uk/tax-uk-income-live-abroadWhen tax is not due or is already deducted

Non-residents do not usually pay UK tax on:

- the State Pension

- interest from UK government securities (‘gilts’)

If you live abroad and are employed in the UK, your tax is calculated automatically on the days you work in the UK.

Income Tax is no longer automatically taken from interest on savings and investments.

-

1 hour ago, spambot said:

Mnnn - Good info.

So for example with £175,000 inside a savings account on 31 Dec 2023 - Then remitting 65k Thb / month (Approx. £17,500 / yr) to a Thai Bank for Visa ext. This essentially provides 10yrs of remittance that is free from taxation - Am I understanding you correctly?

Yes that should remain cear under the jan 1 2024 prior savings rules.. -

5 minutes ago, Presnock said:

plus no 90-day reports either.

Still needed but it becomes a 365 day report 😉 it becomes once per year if you dont travel.

-

3 hours ago, JimGant said:

I'm just curious -- what are the sources of your remitted income to Thailand? If largely current year private pensions, then, yes, assessable income. But not assessable are govt pensions and social security, from current or past years

That may be the case for USA expats, thier DTA states it and I think from memory canada also.

This is not the case for UK expats, and most EU countries whose DTAs I looked at, actually many scandivanian expats choose to pay taxes here at a lower rate than in thier home countries.

In the case of the UK pensions only remain UK domestic source income for non residents on armed forces pensions and some civil servant pensions. The rest, both state and private pensions stop being UK taxable after a P85 filing. Paying taxes 'back home' is user error, not the correct use of the system, of course th UK doesnt exactly remind folks fo that and even incenivises not doing so (index linking, healthcare access etc). -

7 hours ago, jayboy said:

All employed foreigners in Thailand pay tax and always have done so and that is not up for debate.I speak as someone formerly in that category.The more pertinent question for this forum is how many retired expats without Thai generated income and resident more than 180 days have filed returns and paid tax - that is up to now.The answer is almost none though a tiny minority may have filed returns for reasons best known to themselves, and sometimes quite unnecessarily.The Thai Revenue Department in practice had no issues with that.The situation has changed now and though the practical aspects are still not fully clear we have a reasonable understanding of how matters will play out.

For 4 years I filed zero returns, to the absolute bafflement of the revenue dept..

My reasons where I had bsuiness activity in UK and europe and was having to file in UK, Netherlands, and Ireland, I still do in 2 of those.. I needed be sure my home country filing was fully up to spec so that if demaned I could show it there, I had good earnings in each of those countries and claimed non residence there for tax remissions. To claim tax relief on large sums there but not have a home country tax return I could show was a much bigger risk than just forcing them to take the zero return.

I admit it was odd, they appeared to never having seen anyone file 0 without Thai employment, work permit, and domestic source income. -

- Popular Post

- Popular Post

16 hours ago, Neeranam said:Why do long term visa holders get special treatment over Thais?

Are you sure about this?

Yes LTR visas are 0 rated for overseas income tax.. Exactly why I am transitioning to an LTR visa.-

3

3

Registering a .th domain without a company (or trademark)

in IT and Computers

Posted

'Check the actual legal situation'

The issue I am finding is, there doesnt appear to be actual clarity!! in.th is for individuals, there is no apparent restriction on the nationality of individuals.. Even the registrar who denied me is now humming and haa'ing on if a Pink ID / Yellow book suffices.. And they are incharge of the process !!

Once again the rules seem to be yes / no / maybe..

I already grabbed a .asia which can do.. But would prefer an in.th and and long term may even warrant an or.th but not there yet.