- Popular Post

TravelerEastWest

-

Posts

1498 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by TravelerEastWest

-

-

Thank you folks for the ideas.

The real estate question is interesting as I wonder if the BOI is interested in cashflow or only taxable income? Misty's post leads me to think cashflow is considered even if not taxable income - which is good

BOI staff are friendly and helpful but don't always think outside the box...

-

2 hours ago, Ben Zioner said:

I showed my yearly pension and matching bank account statements. Unlike Immigration BOI show some sensible flexibility. Now I was helped by the fact that they had dozens of identical cases (Pension + Health plan) shortly after I applied.

Ben Zioner

Thank you for your thoughtful response!

My friend is not yet receiving a pension, but has the passive income and age...

I am wondering what type of letter he should write to the BOI - I am not sure as I submitted Form 1040 so it was easy for me.

I did receive a message with someone who used a Thai CPA to write that a Thai return was not needed. Also he wrote a letter stating that his country did not require a tax return...

-

If someone is over 50, has health insurance in Thailand of over the correct amount, and more than $80,000 in annual interest income.

But is from Europe and not required to file a tax return anywhere - how do you correctly for the BOI show (in English) your annual income - without a tax return and is that allowed or is a tax return required?

-

22 hours ago, oldcpu said:

That was NOT a typing mistake. That was the selection of the WRONG description and it had me wondering if you knew the difference. ...

I am not asking you if I made a typing mistake in a hurry - i am telling you the fact that I made a mistake maybe you are new to Thailand or not a native speaker of English (use of "thou" tells me this most likely..) or you are much smarter than those who I talk to about visas here as visa renewal and reports etc are used interchangeably by most people. They are probably not technically correct but they are what people use.

I would strongly advise you to be careful about assuming you know what people said or intended. I think this forum has rules about making personal attacks such as yours. You may want to considering being polite and trusting what people say...

Good luck with your questions I will ignore you going forward and I hope you have the courtesy to do the same for me...

Again all the best ti you.

22 hours ago, oldcpu said:-

1

1

-

3

3

-

1

1

-

-

On 3/2/2024 at 6:32 PM, JimGant said:

Another cavalier comment. By the way, what's your nationality? I've kind of got it narrowed down....

I am an American I tried to help you - please ignore my comments going forward as you prefer not to listen... Good luck with your form...

There was no lack of concern for you, just the opposite I was trying to help, (maybe I don't know the same meaning of the word cavalier) apparently you don't want help and that was my mistake. I apologize for trying to help you it will not happen again.

-

1

1

-

1

1

-

1

1

-

-

4 hours ago, oldcpu said:

No. I am correcting a mistake. Cavalierly mistyping (stating "visa renewal" instead of "1 year report") may be a trivial matter for you, but it is not for others.

Correct it is a trivial matter because almost everyone quickly sees it is a typo just like some of us make spelling or grammar mistakes as English is not their first language or they are working full time...

Cavalierly was rudely and incorrectly used _ There was no lack of concern for others, just the opposite I was trying to help. And it was certainly not important as it is common knowledge that you don't renew your visa after one year but after five years (maybe) usually, therefore an obvious and clear typo next time I wont post as people such as yourself are somewhat challenging to deal with... Please do not comment on my posts going forward...

-

2

2

-

-

On 2/29/2024 at 1:40 PM, JimGant said:

I can just see me in the drive thru, with the clerk scratching his head and calling higher authority -- while ten cars behind me are warming up their horns... I've got a few months to decide about Star Visa. They're a lot closer to me than Imm, plus no parking problem or streets to cross. Beside, hey, I'm a Wealthy Pensioner -- why worry about 1000 baht 😉

On 2/29/2024 at 1:40 PM, JimGant said:I can just see me in the drive thru, with the clerk scratching his head and calling higher authority -- while ten cars behind me are warming up their horns... I've got a few months to decide about Star Visa. They're a lot closer to me than Imm, plus no parking problem or streets to cross. Beside, hey, I'm a Wealthy Pensioner -- why worry about 1000 baht 😉

Sometimes you need to read between the lines - use your intuition...

-

12 hours ago, Pib said:

Star Visa is one of only four "certified agencies (CA)" in Thailand that BoI has certified (i.e., blessed) to facilitate LTR applications. So maybe being a BoI CA gets Star's foot in the door at Chiang Mai immigration offices for LTR purposes...don't know...just guessing.

On 2/29/2024 at 1:31 PM, oldcpu said:Visa renewal ? His permission to stay renewal would be after 5 years, not 1 year. And a renewal (?) for another LTR would be after 10 years and not 1 year. ... I assume you mean his 1 year report?

Great news if he was able to do his 1 year report at CM without having to go to Bangkok (although I type that noting that for some of us Bangkok can be a fun visit at times - in particular my wife enjoys going there to shop and the 1-year report gives her a good excuse to arrange a Bangkok trip for the two of us - and a happy wife is a happy life 😄 ).

You know what I mean... I assume that you are being funny.Yes he did his one year reporting at the immigration office near the air[port.

For the agency's this is a new field - do your due diligence and be very skeptical I learned to be careful talking to all of the agencies and getting different answers going direct to the BOI was the best in the end..

-

On 2/26/2024 at 7:30 AM, JimGant said:

I doubt anybody working the drive through window has ever seen a TM 95.

I am fairly certain they have or at least know what it us now as a friend who lives in CM got his LTR visa a year ago and did his visa renewal at CM in person it was very easy.

I wonder about all of the services that have only recently been "certified"... my intuiton is that you would do a quick job yourself.

-

6 hours ago, JimGant said:

Contacted Star Visa, an LTR certified agent here in Chiang Mai, and asked about how they handled TM95 reporting. Their answer was, they can do the TM95 reporting at CM Immigration, i.e., no need for them to go to Bangkok. So, CM Imm has at least one Imm officer familiar with TM95s. But, I could probably spend the whole day wandering around looking for this individual. So, if nothing's resolved about mail in reporting come this July, guess I'll hire Star Visa, for 1000 baht. At least they know what door to knock on at Imm, plus they're a shorter drive than is Imm (tho' the post office is only a stones throw from my house). Oh well.

Easy to do update at CM Immigration in general as they have a drive through window - 1,000 baht is very expensive for filing a report...

-

Go for a local Thai CPA that speaks English ask them for references related to Thai taxation if that is what interest you.

If not find an American CPA not an EA with a questionable education... Or A UL CA etc.

Good luck!

-

22 minutes ago, Misty said:

You could be correct that the requirements are the same as for a work permit not attached to an HSP LTR visa, although the LTR unit said verbally there are no requirements.

I calculate a breakeven point between a normal tax schedule (PND91 - progressive rates) and the HSP tax schedule (PND95- flat 17%) at about Bt181,000 per month. If you earn below that, you'd pay less Thai tax using PND91 calculations. If you earn above that, you pay less Thai tax at the flat 17% rate. Not that that is taken into consideration for the HSP digital work permit, however.

LTR staff are probably correct...

Good idea to calculate the tax both ways!

-

1

1

-

-

7 hours ago, Misty said:

Does anyone know what the digital work permit salary requirements are for LTR-HSP visa holders?

For example, work permit holders with NonB visas have stated minimum salary requirements that vary by nationality.

I’m considering hiring an employee who qualifies for the LTR HSP visa. I’ve asked the LTR unit about what the digital work permit salary requirements are for HSP visa holders and been told verbally by a junior staff that “there are none.” I’ve tried to verify this in writing (emailed the LTR unit, looked for legal documentation), but have not received a response nor found anything online supporting it.

All I can find is that there are no 4 Thai employee requirements - nothing about salary requirements either way.

If there truly are no salary requirements, it would be good to know and would provide more flexibility. But if there are salary requirements, it would be better to find out now rather than later.

As always, I appreciate any insight that this forum can provide.

Form 46 was required for my WP LTR Pension so company income and salary immigration reviews teh work permit application - it was easy to do They didn't tell me the required salary but probably the normal requirements...

-

5 hours ago, SHA 2 BKK said:

Just tell the guard at the front of the Fast Track line they are your family. I’ve never had problem with us all going in together.

Thank you

-

1

1

-

-

For international flights when traveling with a Thai family member any special ways to stay together and move quickly?

-

Does the LTR visa speed up domestic flights?

-

1

1

-

-

I was at the BOI office and after I got my digital visa i asked about forms for teh annual report

1) Form 95 can be filed at any immigration office

2) 90 day reports can still be filed - not a problem

He wasn't sure about using the mail.

-

1

1

-

-

5 hours ago, Pib said:

Not at all sure what your post means...especially the ".....he said that one looks better...." part.

If he got a receipt it will show whether he got a 90 day or 365 day "next report date." If he did it online but maybe lost the receipt he can logon today and print out the receipt again. Like when I was still on a Non-O type visa (before getting my LTR visa) I used the online reporting system to do my 90 day address reports. Now I had low success with it because 60% of my report were rejected for unknown reasons but the ones that were approved include a receipt telling me it was approved and when my next report is due...and those receipts can be download/viewed long after they have come and gone....like I just viewed my 17 May 2022 report from almost 2 years ago.

Yea, maybe your friend was successful in doing an online report for this LTR 365 day address report but it goes against what immigration has said that LTR address reporting has "yet to come....but hopefully soon." Plus no one else has posted, at least in this thread, that they have successfully accomplished their LTR 365 day address report online.

My friend liked the one from this thread better than the one he filled out - I sent him an email with a copy of the one from this thread - not sure I think it was form 95?

Two possibilities:

1) The form he filled out won't work and they will tell him at some point - not a big problem.

or

2) He filled out the wrong form but they said mai pen rai and accepted it... Note it was not rejected.

i think number 2

-

8 hours ago, Misty said:

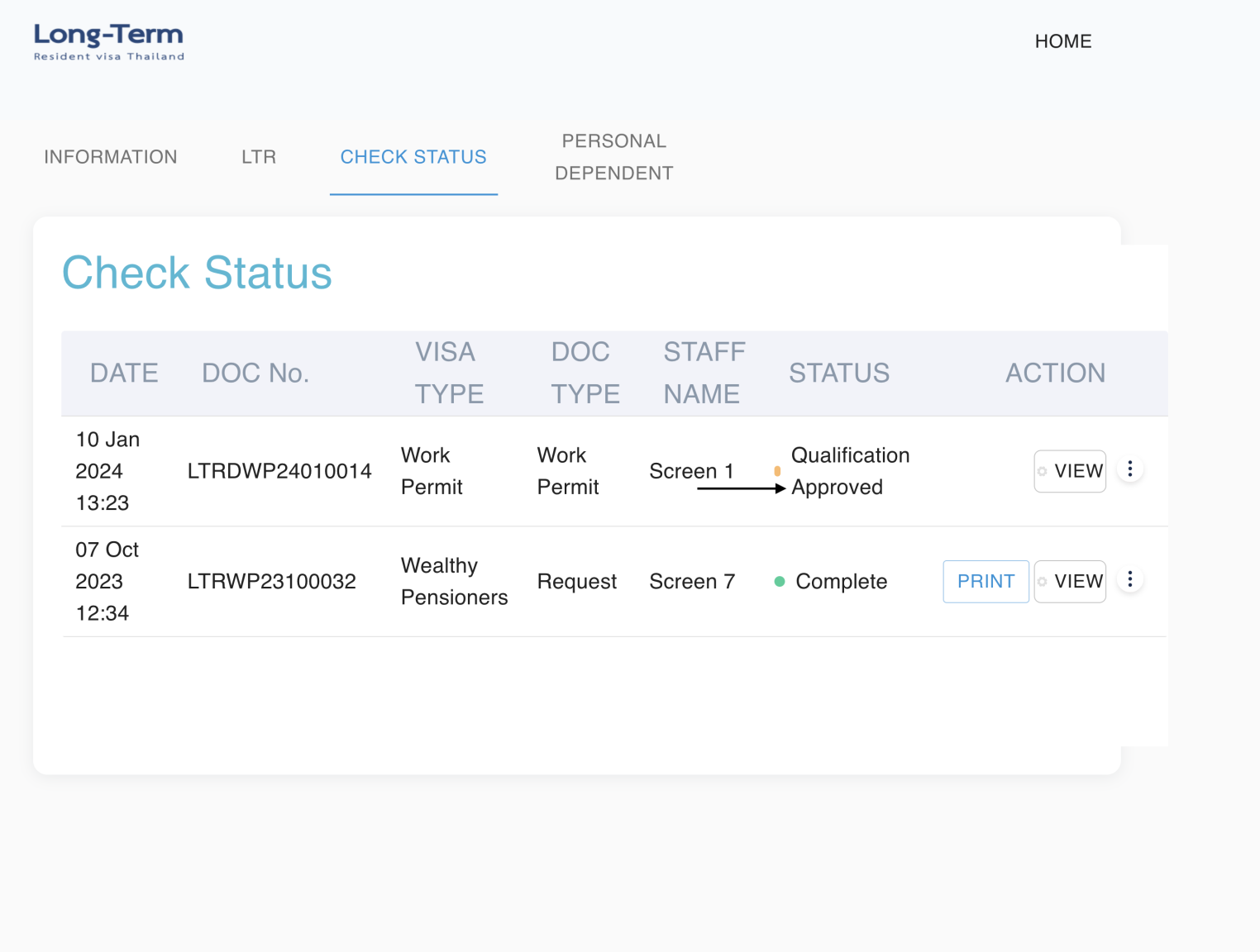

Yes, I found phone calls to the LTR unit to be invaluable, also in-person visits when all else failed. If you call, be prepared for long wait times, so have something to do or read while you wait. You'll probably first get the BOI switchboard and get put on hold. Ask for the LTR unit, and you'll probably get put on hold again. But once you get someone at the LTR unit, they'll be able to look up your case by the "DOC number" which if it's a digital work permit that you applied for this year, starts out "LTRDWP2401..." Hope it goes well and you get your appointment!

Misty

Thank you for your help - I have appointments available now! I am in Chiang Mai so I have to try for 11am unless I get up at 5am... for an early flight...

-

1

1

-

-

On 1/27/2024 at 4:18 PM, Pib said:

However, back on 11 Jan 2024 in this thread @TravelerEastWest said he had a friend who did his LTR 1 year address report online but when several of us questioned is the friend sure he got a receipt to report again in 1 year or maybe it was just 90 days TravelerEastWest said he would need to follow-up with his friend to double check. Unless I missed it, I haven't seen a response yet.

My friend actually didn't tell me if he got a receipt but after looking at an example from this thread of the one year form he said that one looks better...

-

On 1/27/2024 at 11:27 AM, Misty said:

Is there a red bell in the upper left side of your screen you can click on? Or otherwise, try clicking on the 3 vertical dots next to the "View" button in the screenshot above. If neither of those pull up the calendar to schedule a visit, my best suggestion is just call the LTR unit and ask.

Thank you Misty - yes three dots but nothing happens... I will email them - I didn't know that calling was an option...

-

-

30 minutes ago, Mike Lister said:

Please do not type in such a large type face, it gives the impression of shouting and is difficult to read.

My career and background are not the subject of this thread and personalization of them are very much off topic, as much as you may be curious and wish to know more.

I am aware of the 60% deduction for expenses. My wife runs a business and we file her taxes using that very generous deductions, which until fairly recently was even higher.

Thank you for telling me who I should and should not be trying to help and how but your advice is not required in this area. Now, I insist that the debate return to the topic and not stray further afield, any further off topic posts will be removed. Thanks.

On my monitor the type is not overly large - maybe something is off with my settings?I I shall have to consult with someone who is good with these things.

I do not shout in person or online ever - end of story. For some it is easier to read and you are the first person ever to suggest this.

By mentioning those four years and where you were employed you opened up questions; please do not blame others when you prefer not to speak about your tax background or lack thereof. I agree again this is your right. As a courtesy to you I won't mention the missing four years again as I don''t want you to be uncomfortable.

Confusing that you know about the general deduction yet feel such confidence is placed in the taxpayers again it seems to clearly not support your stated theory as does my practical but very limited experience in Thai tax life, but again you have a right to your opinions right or wrong. we have something in common - I found out about that deduction by accident from my wife's CPA.

As for removing posts that would be a bit much; removing posts should be reserved for bad language, violence, prohibited quoting - etc. if you are not comfortable with readers being curious your education and experience - which is 100% directly related to the topic as you brought it up...

Again I do think that you are kind and mean well. Thank you for your many hours trying to help people.

-

23 hours ago, Mike Lister said:

Firstly, if you look at the document we produced in the Simple Tax thread, and also read the second post, you will see that we are careful to ensure that everyone understands that the purpose of the document is to inform, not to advise. Nowhere does it even remotely suggest that I, or anyone connected with the thread, is a tax expert, in any country, nor will tax advice be given. In fact, we state categorically, at the outset, that we are not any of those things.

Secondly, you are American and having lived in the US for almost two decades, I am aware of the average American persons near total reliance on the likes of HR Block (or similar) to prepare even basic tax returns and of the tax preparation industry in your country. In the UK, we have nothing even comparable, we trust ourselves to be capable of understanding basic tax rules and performing basic math, which is why the UK tax authority allows us to do self assessment online, without the need to rely on the likes of an HR Block equivalent. In a nutshell, our cultures and approach to tax preparation are very different, as are our respective education systems. I should also point out the Thai Revenue Department also trusts its citizens because tax filing system has been online for several years and regular, every day Thai people, are entrusted to enter their own tax data and prepare their own tax returns. I suppose if you take the view that the average Western expats in Thailand is far less capable than the native population in Thailand, your suggestion that we all need Thai CPA's to file tax returns, might be valid!

Thirdly, I understand that Americans will always advocate the use of CPA's for tax preparation, which for tax affairs above anything other than the basic level, is probably a sound idea, especially in a foreign country. However, most reasonably well educated and equipped individuals who have filed taxes previously in their own country, are eminently capable of filing a simple tax return in Thailand. If of course they are uncomfortable with such things, there are plenty of CPA's around who will do the work for a fee, but that is not necessarily always the default case and starting point for everyone. If all else fails, I suppose expats could always ask the locals how to file a return since they seem not to need tax preparers!

Lastly, I am never going to give anyone tax advice, other than perhaps my wife, I'll happily cast an opinion and tell people what I think about individual aspects of tax, if asked, (because this is after all a social network forum that discusses tax), providing I know, but advice, no/ These threads are not in that business and if anyone things differently they should go back and reread carefully the things that have been said.

And lastly lastly, I don't mind that posters such as you and others post denigrating comments about their perceptions. The realities, however, are that in over 240 pages, over 6,300 posts discussing tax, that have endured for many bilious weeks, none of the participants have been able to stop debating the quality of air in a vacuum long enough, in a repetitive circular fashion, to produce anything even remotely useful to the average expat. I make no apologies that we have brought an end to that often gut wrenching exchange and produced something of value that ordainary people can understand. I understand that a handful of posters are annoyed at that but the thread has been a talking shop, a mutual ego stroking competition to see who is the biggest "expert" or most capable hypothetical thinker, for many weeks.

I hope that clears up some of the misperceptions you have very clearly been under

Hello Mike Lister,

Thank you for your thoughtful and friendly comments:

1) Your disclaimer will be ignored by some of your readers - evidence of that is by a recent poster who was very uncertain about what to do... you replied that you would be happy to help (sounds a lot like advice to readers). Note I am impressed with your kindness I think you are clearly a nice person who it would be fun to have a cup of coffee with...

2) Your comment on HR Block is actually an interesting one - they (and other firms like them) prepare many returns and typically do not employ CPAs or other qualified staff - what they do is recruit seasonal workers who they train for a few hours.

They are actually very much in your old field - finance those without experience in the American tax industry are unlikely to know this...

They make money - lots of money by making high interest loans for tax refunds. I do not know what percent of their customers would use them without the loans probably a very small number?

Not really sure what your mention of UK taxpayers shows but since I have never been to the UK (but would love to visit one day to walk in the Lake District and visit the V and A museum) I will not comment and take it as your thoughts...

In regards to education systems, I do know a bit about the UK education through accounts from friends who grew up and taught there. One thing comes to mind the early narrowing of subjects in high school compared to the American system with many electives. Like the sports world, there will be fans of both. And I do see advantages to both systems but prefer the American system. Both because the American system tends to be more fun (I know not a serious response) and because the American system tends to lead to thinking outside the box. Although Darwin and others in England are amazing!

The Thai Revenue department thinks a bit differently than you imagine (and all tax practitioners in Thailand know about these rules) - They do not always trust those with small businesses (such as street noodle sellers) they stand nearby and count sales and then tell the taxpayer how much to pay. Just an example but a real one told to me by a Revenue department district director. This shows the lack of trust in the skill set of the population.

That was a practical example, on a more theoretical level they know that bookkeeping can be difficult for those who are not trained in that skill so for some small businesses - they simply say - you have no need to keep track of your expenses at all - not all, as it is not practical- instead, they give you a percent of revenues - such as 60% as an automatic deduction. If you haver the slightest doubt of what I am saying ask a Thai tax professional on either side of the street a CPA of Revenue department auditor.

You will never see such a kind practice by the US IRS - never... I have no idea what is allowed in the UK maybe you can tell us?

I am still very curious about your 4 years at Deloitte which is a fantastic firm and very large - were you in the tax department as you hinted at or a totally unrelated area? I ask as if you were a tax guy I very much need to give you a great deal of respect as four years in their tax department would mean you know great deal about the tax world.

If you have no real-world tax experience or a recent tax law education - you should not be offering to help elderly forum members - I get it that you have a good heart but again unless someone has experience and or education in the field it is perhaps not really being kind...

As for your mention of the average Expat's skills in Thailand I really don't know; but in general due to a lack of language skills yes, they are at a disadvantage.

At home, someone who is a good reader but not skilled in taxation can read about a new tax law and be alerted to research it or pay for advice - in Thailand that could be difficult.

Thai CPAs are very inexpensive and something you may know is the fact that tax returns prepared by CPAs have a very low probability of audit compared to those done by individuals. You may or may not know this - did you mention this fact in your guide and did you know this? All CPAs know this.

Thinking aloud - if someone enjoys doing complex crossword puzzles and playing chess etc. doing your Thai tax return yourself may be an interesting challenge? Just a random thought I could easily be wrong.

I understand that you truly believe in your positions and I compliment you on your kind intentions.

Softly, gently, and politely I don't agree with your opinion of your advice and theories - but I am eagerly awaiting your response to my question about the nature of your four years at Deloitte.

-

1

1

-

Plant-based meat popularity fuels new ventures in Thailand

in Thailand News

Posted

Actually the answer is simple and you might have guessed many people love to eat meat but they feel that it is not good for their health so plant based products taht tase similar to meat are a stepping stone to a whole food plant based diet.

I could be wrong but step by step more and more studies seem to support a plant based diet.

As for profits company's like to give people want they want and make lots of profits... very normal...